I said Bitcoin could get over $1,000 in January because of the intense momentum it has. The parabolic momentum has cascaded the price to near its record high. The current price is $1,103 and the all-time high was $1,242 set on November 29th, 2013. At one point today it was up about 18% year to date. Bitcoin had been the best performing currency in each of the past two years, but the rally is now accelerating to a pace which is unmanageable. This is the climax of multi-year rally which will soon end in a large correction. Whenever the price of an asset rises this quickly there will be temptation to sell and take profits. If you bought bitcoin at $400 12 months ago, you have almost tripled your money. Even if you do believe like I do that bitcoin will be much higher in the long term, it’s still scary to hold on at this breakneck speed. Eventually sellers will overwhelm buyers and greed will turn to fear. I expect the correction to take place after it sets a new record.

The main news event surrounding bitcoin is the price. This is better than a news item about a hacking event like Mount Gox or new regulations. The news of bitcoin’s rally is good because it encourages more people to do research on bitcoin. The claim that bitcoin was a temporary bubble that would fade out of existence has now been proven to be a myth.

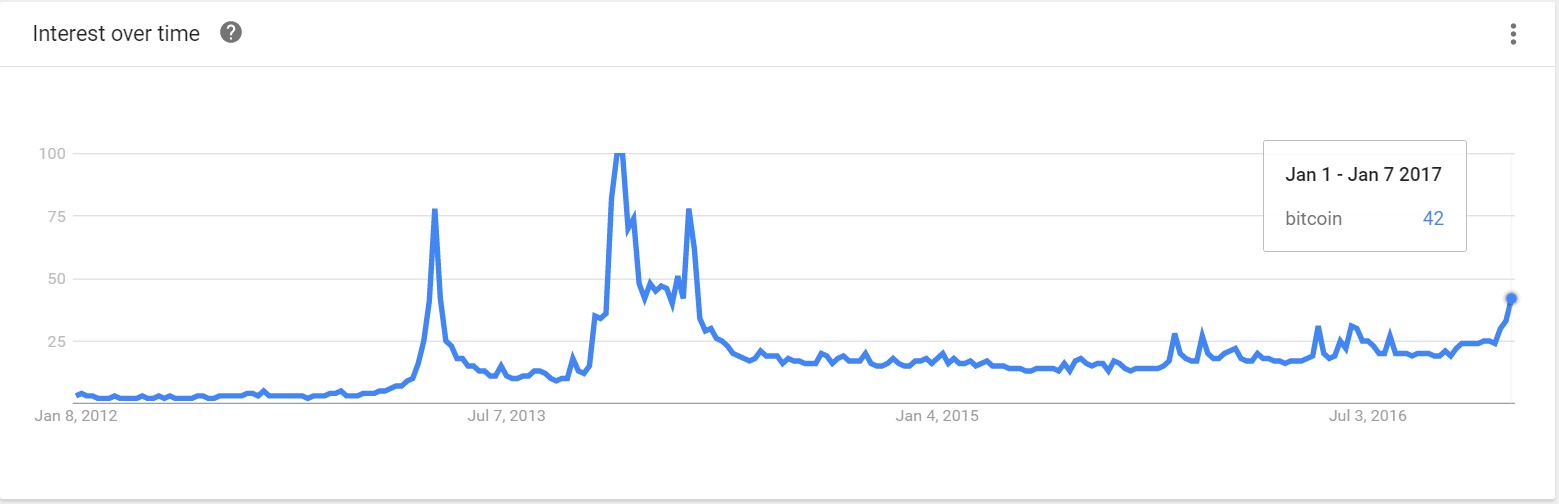

As you can see from the Google Trends data, the interest in bitcoin has almost doubled in the past three weeks. When bitcoin reaches an all-time high, it will get even more coverage which I believe will make its search engine rankings challenge the highs made in 2013. Once that happens, I think the final burst in the price will occur as Americans try to profit off of the optimism. The negative part of this story is that bitcoin’s price volatility encourages speculators to get involved instead of long-term users. Speculators will lose interest if the price stops rising, so it doesn’t improve the fundamentals of bitcoin. It actually hurts the fundamentals because speculators are the source of the selling pressure that causes the volatility and makes potential ordinary users skeptical of adopting it.

The reason why I said bitcoin prices reaching new all-time highs could encourage American users to join the fray is because Chinese demand has been the main source of this rally. Because China doesn’t have Google, it explains why the bitcoin price is near a new record high without being near the record high on Google Trends.

China is the place where demand is coming from because of the capital outflows from the country. China’s foreign exchange reserves fell 8% in the first 11 months of 2016 to $3.05 trillion. The yuan is at the lowest value versus the dollar since 2008. The reason bitcoin is the recipient of the capital outflows from China is because it is the best way to bypass capital controls in China. Capital controls have a Streisand effect meaning they encourage the outflows they are trying to stop. Capital controls are a signal that the economy is unsound. If the economy was healthy, there would be no need for them. Bitcoin is the current way to get around them, but eventually the PBOC will attempt to stop this end around. That could leave China in a worse place then it started in because access to bitcoin will be removed. Hopefully, the Chinese will understand the potential of bitcoin in the midst of their speculative craze, but I don’t have highs hopes for that.

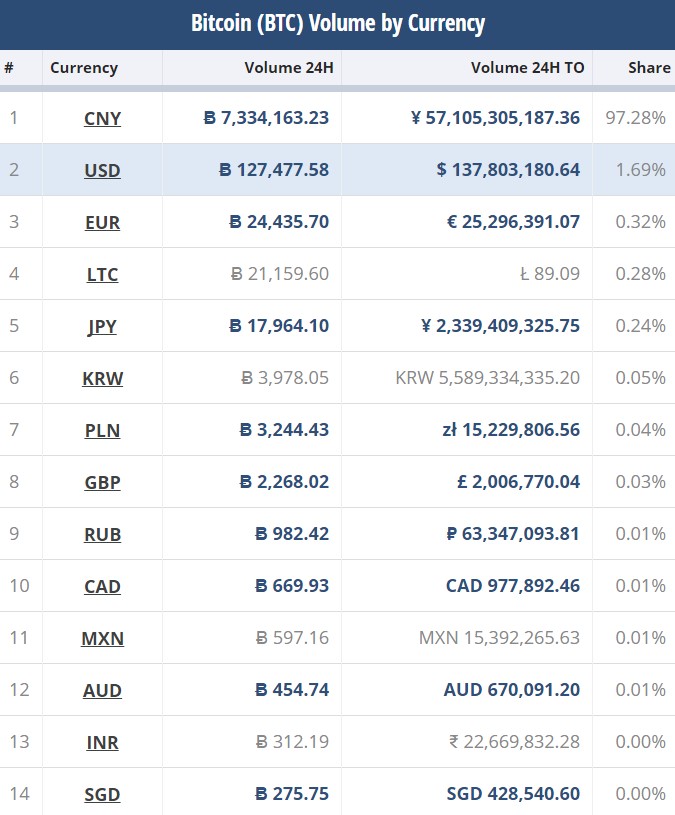

According to Cryptocompare, in the first 24 hours of the new year over 5 million bitcoins were bought in Chinese yuan which equals $3.8 billion. In the same time period 53,000 bitcoins were bought in America. While this may have been a particularly weak time for American purchases because it was a holiday, the percentage of Chinese buyers has consistently been high signaling it is the main driver of the recent price appreciation. The chart below shows the past 24 hours of volume from the top 14 currencies buying bitcoin. China makes up over 97% of the trading volume which isn’t sustainable. The fact that economic issues in one country can cause that country to dominate bitcoin trading shows the small size of bitcoin.

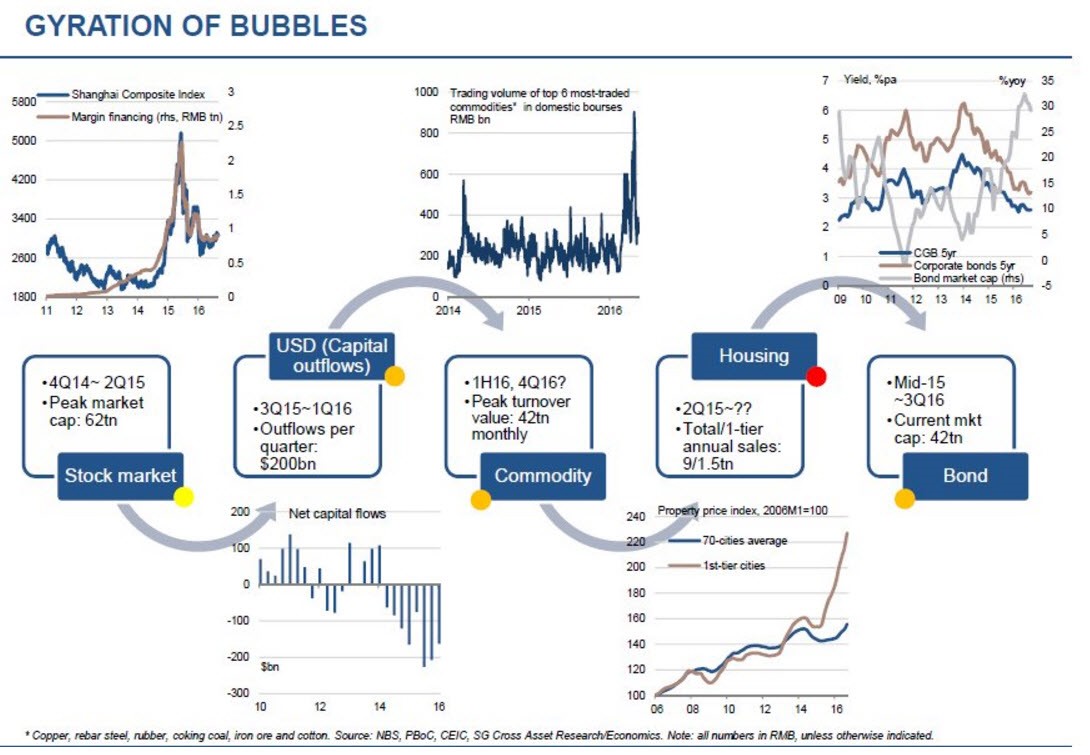

Hopefully the PBOC won’t be able to fully crack down on Chinese demand for bitcoin. However, even if they don’t, I expect this speculative bubble to eventually burst just like all bubbles do. The chart below shows the recent history of Chinese speculative bubbles. The Chinese people tend to take high risk and the Chinese government, being communist, acts to stamp out various bubbles. A lack of free markets and speculative behavior is a recipe for disastrous bubble formation. I consider these bubbles to be disasters because they hurt end users. They hurt users of the commodities when the price gets too high. They hurt Chinese people who want to buy a house because property values get too expensive. They will hurt bitcoin when the price falls and ignorant people blame the blockchain technology for the fall. Bitcoin has been deemed dead many times. A price crash would be fodder for more of these ‘bitcoin is dead’ stories.

Looking at the macro picture, the yuan is experiencing outflows because of the strong dollar which is strengthening because of interest rate hikes. Therefore, bitcoin goes up when the Fed raises rates. This is the exact opposite of what happens to gold. This would mean owning gold and bitcoin could be a great way to hedge against interest rate changes. I am expecting the Fed not to raise rates as the Trump inflation increases don’t meet expectations. This would make me bearish on bitcoin prices in the short-term. In the long-term, I remain bullish on bitcoin as a store of value because the currency is unlikely to ever have the number of bitcoins outstanding rise above 21 million.

Conclusion

The price of bitcoin is increasing because of Chinese demand as it is a great outlet for capital trying to escape the yuan’s devaluation. This isn’t a sustainable rally. However, I don’t expect the correction to knock the price down below the prior low as the long-term trend towards bitcoin adoption remains in-tact. Any long-term holder will step into the market and buy bitcoin if the price falls near the $500 level. That’s where I plan to take advantage of the decline if it happens.

Recent Comments