Extremely Positive Fund Manager Positioning

Extremely Positive Sentiment Interestingly, the stock market fell very slightly on Thursday. But that has no impact on the extremely speculative run the market has been on for the past few weeks. It was very exciting to finally get the NAAIM exposure index because we knew it would get above 90 which is a strong…

Best 50 Day Period In Market History

Extreme Euphoria Recently, it seemed like this had the potential to be a historic market where it gets extremely overbought like in January 2018. History has been made as the S&P 500 has increased 37.7% in the past 50 days, making this the best 50 day period ever. Previous best period was in 2009 when…

Massive ADP Private Sector Jobs Report Beat

Weirdly Impressive ADP Report May ADP report was terrible when using normal calculations, but spectacular compared to expectations. This may have been the biggest beat ever, because other than last month, no estimate would ever be this negative. Specifically, the April reading was revised from 20.236 million job losses to 19.557 million losses. The chart…

Consumer Doing Better Than Last Week?

Consumer Improving? Maybe Currently, the bottom of this cycle in Redbook same store sales growth was the lowest reading ever. It’s rarely negative. That makes sense because the consumer is usually growing and prices are usually increasing. In the week of May 30th, Redbook same store sales growth fell from -5.5% to -7.2%. That’s not…

Stock Market Reminiscent Of February?

Extreme Optimism Continues Surprisingly, the stock market rallied on Monday even though it’s extremely overbought and there are riots in the streets. We are close to a correction. A tense situation on the streets is escalating and stocks are due for a correction anyway. This reminds me of February where markets completely ignored COVID-19. We…

German Restaurant Bookings Are Back To Normal

Moment Is Here The moment is finally here. A country fully recovered from COVID-19. Yes, it’s Germany, but this is still important. It’s a potential leading indicator for America. To be clear, Germany had less of an impact from coronavirus than America did. Germany had 103 deaths per 1 million people and America had 321…

Jaded Investors Can’t See Stocks Ever Falling

Jaded Investors Investors who follow the fundamentals have become jaded. You can tell because there were discussions on FinTwit about how the stock market would rise after the weekend protests and riots. These investors are wrong to suggest the fundamentals don’t matter and they have recency bias. We are faced with an extremely overbought market…

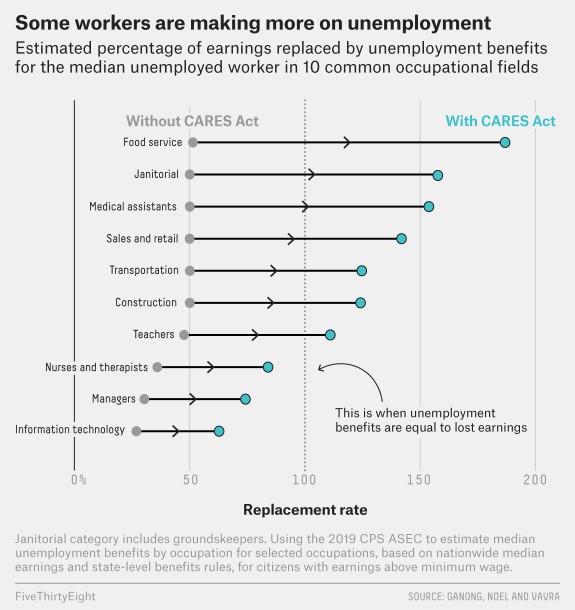

Economy Skirted A Depression, But Risk Is Still Here

Worst PCE Report Ever By A Mile April PCE report was the worst PCE report ever. It gives us the details on how bad the economy would have been if the government didn’t give out extra unemployment benefits. It also shows how horrible it likely was for people who didn’t get benefits or got them…

U.S. Stocks Rally In The Face Of 3 Risks

Euphoria Takes A Quick Breather With the decline on Thursday and the selloff on Friday morning, it looked like markets were calming down after a big explosion. Then, madness occurred. President Trump gave a quick speech on Hong Kong which caused stocks to briefly selloff and then explode higher. This was a relief rally because…

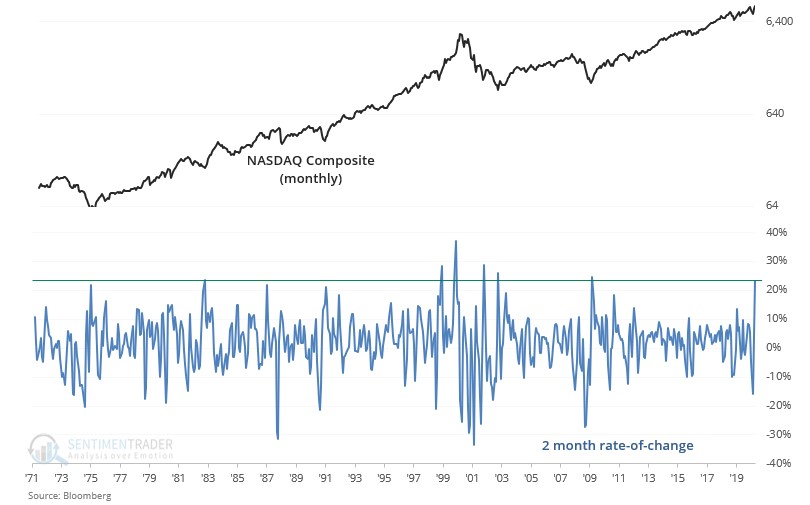

Rate Of Change Analysis Says Buy!

Earnings Growth Estimates Stop Falling This article will be all about rate of change analysis. The stock market loves when the economy and earnings go from terrible to less bad. Since this was the worst recession in modern history, we are getting a lot of that. As you can see from the table below, Q2…

Recent Comments