Small Business Confidence Improves Despite May Correction & Chinese Tariffs

Small Business Confidence - Redbook Same Store Sales Growth Slows Before getting into Small Business Confidence, let's review the Redbook. We go into every GDP report with the assumption that the consumer will drive GDP. Consumption drives about 2/3rds of economic growth. However, consumption growth was weak in Q1, but headline growth was strong. It’s…

S&P 500 2% From Its Record High

S&P 500 - Another Rally, But Why? The S&P 500 stock market rallied again on Monday as my bearishness in the past couple trading days has been misguided. I’m open to the possibility that this will be like 2016 when the economy turned around after a tough slowdown, but I don’t see evidence of that…

2% Chance The Economy Is In A Recession

2% Chance - Unemployment Indicator Shows No Recession There is only a 2% Chance that the economy is currently in a recession. One common recession indicator is the bottom in the unemployment rate. It’s not a terrible concept, but it’s unrefined. It was recently proven to be a misleading indicator. Some bears got excited by the 4 month…

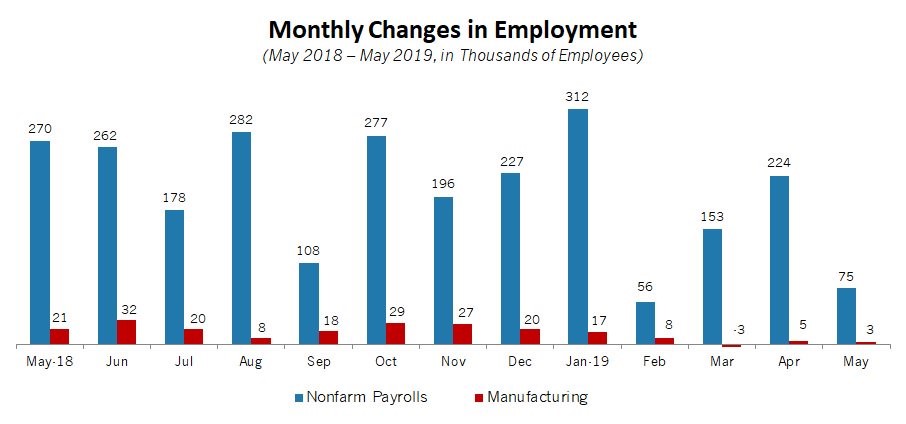

Disappointing May Jobs Report

Disappointing May Employment We saw a Disappointing May Jobs Report come out this week. Job creation in May missed estimates by a lot. Job creation in April and March was revised lower, making this a bad report. May job creation was slightly lower than I expected, but was still better than the ADP report. It…

Stocks Soar On Mexican Trade Deal & Rate Cut Hopes

Stocks Soar - The Perfect Day For Stocks Stocks soar and Friday was the perfect day. The jobs report was weak enough to allow the Fed to cut rates. But not weak enough to make investors seriously consider the possibility of a recession. Furthermore, President Trump made a trade deal with Mexico, preventing the tariffs…

Mexican Trade Deal Potential Creates Stock Market Rally

Mexican Trade Deal - Winning Streak Hits 4 Days On the hopes of a Mexican Trade Deal, the stock market rallied again on Thursday. Which wasn’t what I expected to occur. The market can go against you at any time if there is trade news. It’s debatable if the news on the Mexican negotiations even was…

Weak ADP Report - Signal The Labor Market is Turning?

Weak ADP Report - Big May ADP Miss Let's review the Weak ADP report for May. It was a disaster as it missed estimates by the most since December 2008. There were 271,000 jobs created in March and only 27,000 jobs created in April. That missed estimates by 158,000. Normally, I would dismiss this report because…

WTI Oil Down 18.6% In Past 10 Days

WTI Oil Down - This Is Still A Correction Before we talk about how the WTI Oil Down is affecting the market, let's first review the market. The stock market rallied on Wednesday. With this rally, much of the correction has been rescinded. It was never deep to begin with. The same recession risks are still out…

Recession Indicators - 3 Types

Recession Indicators - Big Burst In Motor Vehicle Sales Before getting into Recession Indicators, let's review motor vehicle sales. There was a big burst in motor vehicle sales in May. This will help the Q2 GDP report significantly if it doesn’t get revised lower. It increases the likelihood we will see 2% GDP growth. Auto sales…

Oversold Rally - Stocks Have Their 2nd Best Day Of 2019

Oversold Rally Should Be Short-lived Looks like the Oversold Rally this week is sending stocks higher. Personally, I think stocks rallied sharply on Tuesday because they were oversold. I don’t think Powell’s comments, which I will get to later, had much to do with the rally. Stocks were oversold in the near-term. That’s why I…

Recent Comments