Clarifications

Before I get into the discussion in this article, I want to point out an error I have made. I have compared GDP growth to S&P revenue growth, but that’s a mistake because it’s not an ‘apples to apples’ comparison. S&P revenue growth is in nominal terms while GDP growth is in real terms. The nominal year over year GDP growth in Q1 was 4.08%. The 6.84% year over year revenue growth looks much closer to that number than the 1.2% annualized real GDP growth rate. To recap, the growth in international sales is what was able to push revenue growth higher than GDP growth. Profits grew faster than revenues as margins improved; the sectors with the most improvement were the financials, tech, and energy.

Another aspect which I have been thinking about is the bifurcation between returns on capital expenditures which are low and the near record operating margins which were at 9.84% in Q1 for the S&P 500. The low return on capital expenditures is why corporations have a record $1.5 trillion in cash on their balance sheets and will only grow capex by 2.57% in 2017 according to Citi’s estimates. One of the reasons firms have low returns on capex is because of high competition. It’s important to recognize this metric because some bulls claim competition being lowered is why margins are near their record high. Margins aren’t as full-proof as the bulls make it sound like they are.

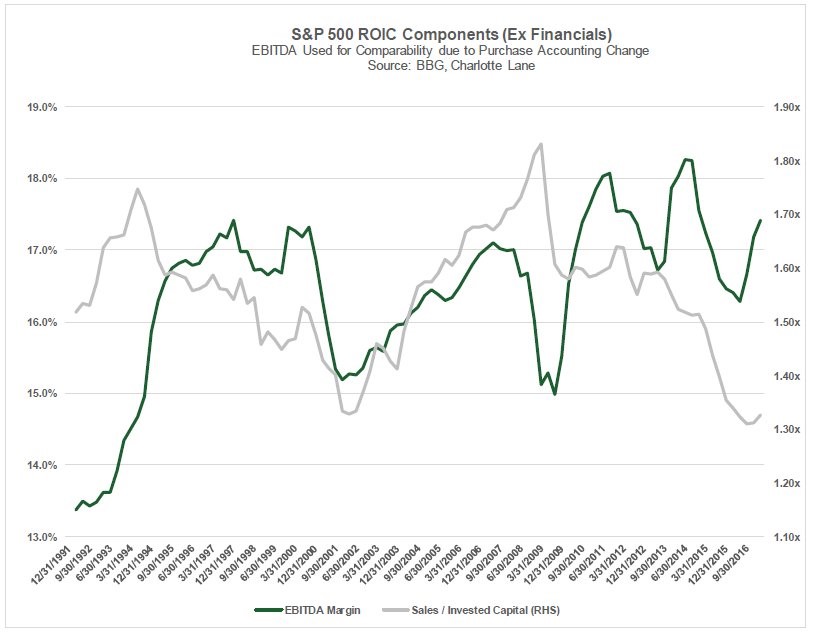

As you can see from the chart below, EBITDA margins peaked in 2014 when trailing-12 month earnings peaked. The two mid-cycle declines in EBITDA margins were about half the size of the declines in the previous two recessions. The inconsistency and length of this recovery is part of what makes it unique. The other part being the extraordinary central bank policies which led to record low interest rates in 2016. The grey line shows the sales divided by invested capital. The ratio has gone lower than the low seen after the early 2000s recession. It’s not profitable to reinvest cash into businesses which is why cash hoards are so high.

Republicans blame high taxes and regulations, while Democrats want to tax corporations higher and use the tax code to force them to invest. The reality is structural weakness in the economy caused by regulations, low interest rates, and weak demographic trends cause this ROIC weakness. Low interest rates mean capital is easy to acquire for start-ups. Start-ups having unlimited capital to get into new industries has led to firms acquiring small firms to grow revenues instead of making investments on their own. Some start-ups get worried about their ability to compete with large businesses because of a lack of capital, but now is a great time compete because of the risk-taking appetite of venture capital.

I know of a small restaurant chain looking to go public even though it has no profits. The fact that we’re in an ‘anything goes’ environment and large firms are acquiring the best small firms are why small caps are seeing margins decline. The high valuations seen in the Russell 2000 supports this claim. The Russell 2000’s trailing twelve-month P/E is 82.36. Part of the reason for that high valuation is because of weakness in energy. The increase in the sales to invested capital ratio during the 2008 recession doesn’t imply that the economy was good because the amount of investment and sales fell. It just happened to be than invested capital fell faster than sales.

ECB Quantitative Easing

The European Central Bank issued new information on what’s in its asset purchases. The contents of the purchases are much more informative than the Fed’s because the ECB buys corporate bonds, while the Fed only buys mortgages and treasuries. We effectively got an audit of the ECB. 12% of corporate bonds purchased had negative yields showing how artificial negative corporate bonds are. The only reason why private investors buy negative yielding bonds is because they know the ECB will be there with them buying the bonds. If the ECB pulled back from this market, the 8.9% of securities which have negative yields which are on its balance sheet would collapse in price as yields would rise to normal levels.

The purchases of high quality corporate bonds with negative yields is probably the least egregious aspect of this QE. The most worrisome part is shown in the charts below. As you can see, many of the bonds purchased haven’t been rated. None of the bonds listed are junk, but some of the unrated bonds may be junk if they were rated. The ECB buying junk bonds effectively props up zombie companies because many of the companies wouldn’t be able to afford the free market interest payments which would be higher. The entire European economy is in a zombie state. Allowing failures to prosper is a long term drain on productivity growth as ineffective firms get capital they don’t deserve.

The chart below shows the amount of bonds purchased in the primary market and the amount in the secondary or public market. If you’re curious, CSPP stands for Corporate Sector Purchase Program. This means 15% of purchases were made directly from companies as the ECB is giving lifelines to firms which may not have gotten money otherwise. The ECB may have decided to purchase lower rated bonds because the high rated bonds are becoming scarce. Negative rates imply high scarcity. We are one step away from the ECB giving money to private citizens to start businesses because the public market is being swamped by purchases. There may not be many securities left to buy by the time the ECB is done with its $60 billion per month program in December. Some of the purchases are from American firms like Caterpillar, Schlumberger, and Whirlpool as the ECB loses control of the market. There is simply no way the ECB can reverse this program without collapsing the bond market. It is at the point of no return.

Recent Comments