Absolute Madness At Grocery Stores

Sales at grocery stores and companies that sell products and services that help people work from home are experiencing hyperbolic demand. Their products and services are like an inverse chart of the Dow in the past month. This is like if the entire country was about to experience a snowstorm that meteorologists were predicting could leave people stuck inside for weeks. It’s tough to measure the intermediate term impact on grocery stores because people will be eating at home more.

In other words, people bought more groceries than usual, but they will eat more of them. After the shutdowns end, we could see people spending more money eating out, but it’s tough to say. Will people be excited to leave the house after being stuck inside for a few weeks or will they be nervous about germs?

Redbook same store sales report quantifies the situation. Yearly same store sales growth in the week of March 21st rose from 8.5% to 9.1%. That’s incredible growth in a period where you’d expect there to be major declines. The chart below shows the difference between discount sales growth and department store sales growth hit a record high of about 20%. There will likely never again be a period like this where discount stores outperform by this much.

Also, the chart shows consumer staples stocks versus consumer discretionary stocks. It implies consumer staples stocks should outperform consumer discretionary stocks. Personally, I couldn’t disagree with this more. Amazon and Netflix are in the consumer discretionary sector. But they benefit from people staying at home and ordering more goods online.

While I’m not necessarily bearish on staples, I’ll take it on a case by case basis. That being said, many consumer discretionary stocks will outperform staples in a ‘risk on’ environment.

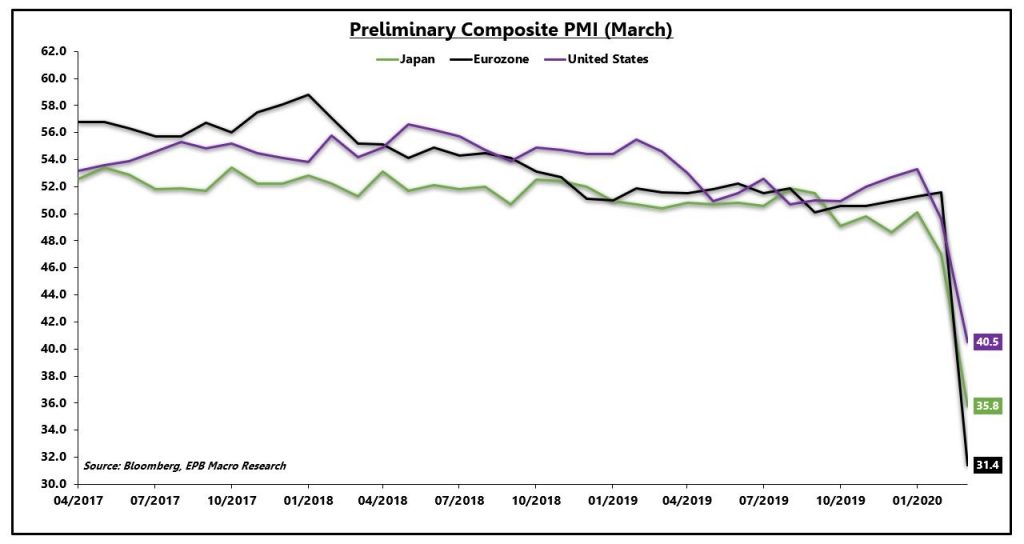

Big Decline In Preliminary Markit PMIs

March preliminary Markit PMI was a mess like everyone expected. Final reading will likely be worse. We already know it will be worse because there have been even more shutdowns since the start of the month. It would be impossible for the last week of March to have as many businesses open as were open in the first week of the month. On March 1st, restaurant bookings were up 2% yearly.

Now they are down 100%. Some restaurants might reopen by the end of the month, but we won’t see any yearly growth. Monthly growth in April will be great. It’s easy to compare sales to a period which barely had any sales.

As you can see from the chart below, the flash composite index fell from 49.6 to 40.5 which is a new series low. However, being a new series low isn’t a big deal because this index has never seen a recession. It started in October 2009. Since we know this is a recession already, it doesn’t tell us much because we are trying to gauge how deep it will be.

It's surprising that America is doing better than Japan. In fact, Japan has been the least hit by COVID-19 compared to other developed nations. It’s no surprise Europe is in disaster mode because Italy has been dealing with this for a few weeks prior to America. Spain has been catching up with America in the past week or so.

Services business activity index fell from 49.4 to 39.1 which is also a new series low. It's not surprising that the service sector is doing worse than manufacturing because it is people oriented. Manufacturing PMI fell from 50.7 to 49.2 (127 month low) which is a very small decline when you consider the massive decline in oil prices.

Mining production will likely get hit very hard in March and April as every oil company scales back capex. Manufacturing index troughed near 30 during the financial crisis. Finally, the manufacturing output index fell from 50.7 to 47.6 which was also a 127 month low. Sentiment among all companies was generally optimistic that business would improve in the next year. Business confidence was the lowest ever though.

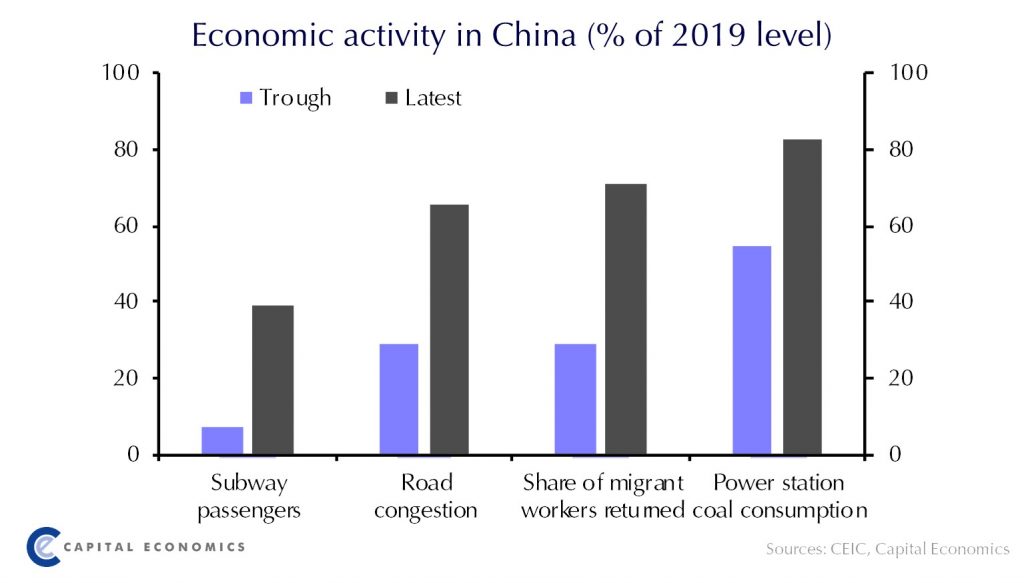

China Is In Fine Shape

China is recovering quickly. As you can see from the chart below, subway passengers, road congestion, share of migrant workers returned, and power station consumption have all gotten closer to their 2019 averages. We could see China be back to normal by Q3. This is good news for America’s prospects in May and June.

We should see a bottom in America in March or April. Bad news is America’s hardest hit area is New York City which is more important to America than Wuhan is to China. Wuhan is re-opening on April 8th. Hopefully, New York City reopens quicker than Wuhan as a 2.5-month shutdown would do a lot of damage to the local economy.

As you can see from the chart below, the Chinese stock market has outperformed emerging markets by the most in 2 decades. It’s not as if the Chinese market is in a bubble. It’s just not cratering like other emerging markets. From March 5th to March 23th, the Shanghai Composite index fell 13.4% which is great in this environment. It was down just 3.15% from its trough on February 3rd.

If you include Tuesday’s 2.34% gain, it’s only down 0.9% from the trough and 11.4% from March 5th. China is doing well because COVID-19 is the most contained there. The situation is contained in Japan and South Korea, but they are developed markets. This chart looks at developing ones.

Conclusion

Grocery store sales are doing amazingly. Discount stores are dramatically outperforming department stores. Luxury items are probably not selling well. PMIs all fell. It's surprising that the US manufacturing PMI didn’t crash since oil prices crashed.

Economic activity is rebounding nicely in China. This explains why the Chinese stock market is doing so well versus the other emerging markets. If China can recover from this in a couple months, America will surely recover by the end of the spring or the early summer. Personally, I think we will be in better shape to deal with COVID-19 if it comes back in the fall.

Recent Comments