Hawkish Hike - The Fed Raises Rates And Lowers Guidance Slightly

Fed raised the Fed funds rate 25 basis points and the IOER by 20 basis points. Fed funds rate’s range increased from 2%-2.25% to 2.25%-2.5%. Guidance for rate hikes in 2019 fell from 3 to 2. I projected the Fed would hike rates and that guidance would be for 2 or 1 hike in 2019. I stated the Fed might not hike at all in 2019 if the economy continues to weaken.

It was easy to see that Fed guidance was going to fall to at least 2 hikes. Only one member needed to change his mind to lower the median projection.

This was a hawkish hike even though the Fed lowered its guidance for hikes because the market expected 0 hikes in 2019. Everyone seems to know the Fed constantly changes its guidance.

Yet few seem to realize the terrible track record the Fed funds futures market has with predicting policy outside of the next meeting.

Keep in mind, the odds of a hike at this meeting were slightly too low because of the 20 basis point IOER hike. Specific percentage doesn’t matter too much. The takeaway is the market expected a hike, but it wasn’t a lock like the past few hikes.

Hawkish Hike - Review Of The FOMC Statement

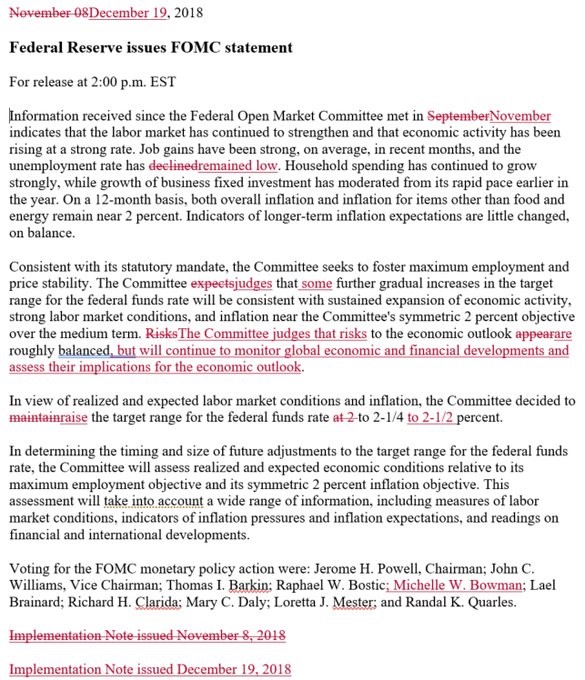

The image below shows the FOMC statement. I’ll review the changes to it here.

The overall takeaway is the Fed didn’t change much. This is a consistent with the previous statements with Powell as chairperson. Some investors expected the Fed to react to the stock market’s volatility.

This guidance didn’t change that much, and the statement didn’t assuage market fears. To be fair, it’s not the Fed’s job to push stocks higher.

Fed’s goal is to have moderate inflation and low unemployment. Fed has currently achieved those goals as core inflation is near 2% and the unemployment rate is 3.7%.

Prior to the past few years, many economists didn’t think it was possible for there to be such low unemployment and inflation simultaneously. They thought a tight labor market begets higher inflation.

Hawkish Hike - The Goldilocks scenario has lived on, however.

Rate hikes could be an unforced error which ends this scenario, but no one knows for sure which hike will hurt the economy enough to weaken the labor market significantly.

Specifically, the Fed stated the unemployment rate “remained low” instead of saying it “declined.” That’s a factual change.

The next alteration was where the Fed changed the sentence that said “The Committee expects that further gradual increases in the target range” will occur.

Now it says “The Committee judges that some further gradual increases in the target range” will occur. I don’t think there’s any difference between ‘expects’ and ‘judges.’ Adding the word ‘some’ shows that the Fed is suggesting there will only be a few more hikes. That’s consistent with the guidance for 2 more hikes instead of 3 in 2019.

The most important part of this sentence isn’t the changes made. It’s what stayed the same.

Fed still sees gradual rate hikes even though the market doesn’t expect any more this cycle. This market has begun to expect a cut in 2020 which is far away from the Fed’s dot plot.

Hawkish Hike - Fed didn’t flinch in the face of a volatile stock market.

You can tell Janet Yellen would have flinched because she now sees systemic issues. Earlier this month she stated, “I think things have improved, but then I think there are gigantic holes in the system.”

She wouldn’t have favored a rate hike in December. Powell is running a different Fed as he adheres more to his guidance and less to the stock market.

A final change in the statement was the largest one. The November statement was, “Risks to the economic outlook appear roughly balanced.” Under Powell, the Fed has shortened statements, but this change added a clause.

The new sentence is “The Committee judges that risks to the economic outlook are roughly balanced, but will continue to monitor global economic and financial developments and asses their implications for the economic outlook.”

This change means the Fed will look for further evidence of economic weakness. If the weakness occurs, policy will change. Fed reacting to economic weakness isn’t news. But the fact that it is saying this suggests the tacit acknowledgement that there has been some weakness.

Hawkish Hike - Fed’s Expectations

The table below shows the changes the Fed made to its projections for the Fed funds rate, GDP, unemployment, PCE inflation, and core PCE inflation. Yellow highlights show the changes. 2019 GDP growth is now expected to be 2.3% instead of 2.5%. Fed is cautiously following the consensus.

Growth will be lower than that if this slowdown continues. Fed now expects the unemployment rate to start increasing in 2020. It’s highly unlikely that the rate gradually increases. During recessions, it increases sharply.

Both the estimates for core PCE and PCE inflation fell slightly. Lower oil prices will crater headline inflation in the near term.

If the Fed thinks inflation will be near its goal in the next couple years, it shouldn’t hike rates much more. As I mentioned, the Fed took away one of the hikes in 2019. It also took away one hike in 2020 and one in the longer run.

These targets aren’t very important; I’m not even convinced the Fed will follow through on its 2019 guidance. The 2020 target is even further away from the Fed funds rate than the 2019 target.

To be clear, the market expects 0 hikes in 2019 and almost one cut in 2020. Fed expects 2 hikes in 2019 and 1 more in 2020. The market is almost 1% away from the Fed in 2020.

1 Comment

Jeff Perkins

December 25, 2018Great report also. Extremely informative and reasonable summation. Thanks Theo Team.