NRF Optimistic About Holiday Spending

Consumer Is A Mystery Undoubtedly, this is the hardest holiday shopping season to predict ever. Normally, retail sales are hard to predict, but usually it’s not difficult to get within a couple of percentage points of the result. This current season is an order of magnitude tougher. As a hypothetical, if someone predicted 3.5% growth…

Options 101: Options Dividend Risk and How to Avoid It

Dividends Meet Options If you’ve made an option trade, you’ve probably seen the disclaimer warning of potential dividend risk. Most probably gloss over that information and never consider how their option trades could be impacted. However, we got flooded with emails last week asking questions about this type of risk, which was a great to…

Plug Power Inc Surges on Charged Option Activity

PLUG Unusual Option Activity Report It hasn’t been a week since Plug Power Inc (NASDAQ: PLUG) dropped around 8%. The reason for the decline was on news of a $750 million share offering. However, that was then, and this is now. The share price surged 10.3% on Monday as Baron’s discussed the PLUG as a…

I’m Yellen Sell the Strong, Buy the Weak

Let's take a look at what's been strong and what's been weak on a year to date basis. These sectors and specific stocks have been surprising. Here's where we see opportunity in the reminder of this shortened week…

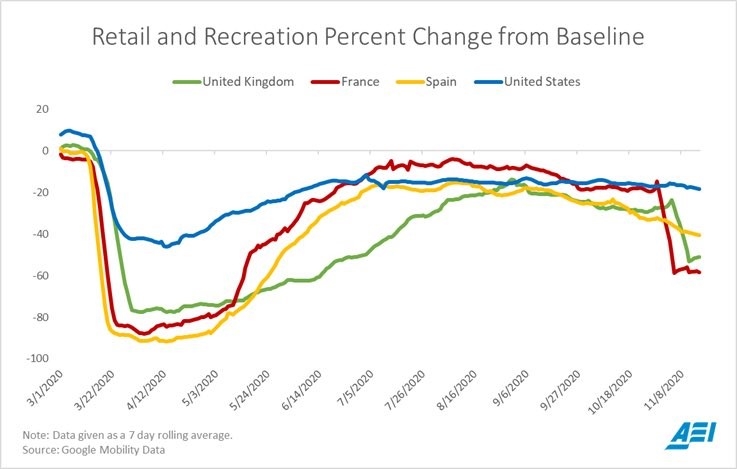

Stay At Home Wins Again

Work From Home Trade Is Back Large caps fell and small caps rose slightly on Friday which isn’t what you would normally associate with the work from home trade doing well because tech dominates large caps and banks dominate small caps. However, that’s what happened. It’s a very tough trade to make because 5 U.S.…

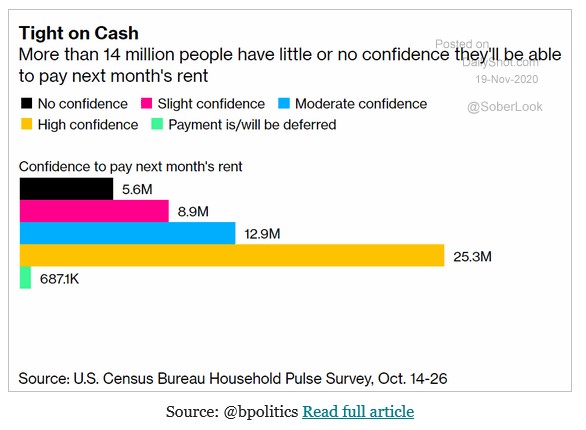

Economy Could Take Major Hit To Start 2021 Due To This

No Rent Payments This current economy is rough for renters and great for single family home buyers. As you can see from the chart below, 14.5 million people either have no or slight confidence that they will have enough for rent next month. This survey was done from mid to late October. Imagine how much…

Near All-Time Highs and Mountain of Liquidity Risk

Fundamentally Flawed-—Treasury ends emergency lending programs. Fed responds with disappointment.—Renewed economic pressure with lockdowns—unemployment benefits running out—double dip recession risks rise Traders Concentrate Liquidity-—what is concentrated liquidity?---retail sparking Algos—Rock the boat SPX Expected Move--last week-- 82.39 (expected move)--next week-- 67.39

Euphoria Back At Late August Levels

Stocks Increase Modestly Despite the news of worse economic restrictions and record high hospitalizations and cases, the stock market rose on Thursday which signals once again that the stock market is looking past the virus for greener pastures. S&P 500 was up 39 basis points and the VIX was down 0.73 to 23.11. We are…

Existing Home Sales Go Vertical - Jobless Claims Increase

Housing Stays Strong Housing data was strong again this week as you’d expect. November housing market index rose 5 points to 90. Present conditions index was 96 which is about as high as it can get. Expectations index was up 1 point to 89 and the traffic index was up 3 points to 77. There…

Markets Drive through the Middle of the Road ahead of Thanksgiving

In tonight's video update, Corey highlights the successful sell-swing that took place in the market this week but notes we're right back where we started in the middle of a wide range. What does it mean and what are key stocks such as Facebook (FB), Microsoft (MSFT) Apple (AAPL) and others hinting? Find out in…

Recent Comments