Volatility Leaves Us In A Precarious Yet Wildly Opportunistic Position

Stocks end the week flat as markets try to decipher the mixed economic data and "earnings recession" from companies. Unusual options activity in the Volatility Index presents a opportunity for us. Watch this crucial weekend video newsletter to find out how to take advantage of the current market environment...

Redbook Sales Solid, MBA Applications, & Pending Home Sales

Redbook Sales - Same Store Sales Growth Moderates Redbook sales year over year same store sales growth rate of 5.4% last week supported the strong consumer sentiment reading. Growth fell to 5.2% this week which is still above the 4.6% growth of 2 weeks ago. The deceleration from 9.3% in December has stalled for now.…

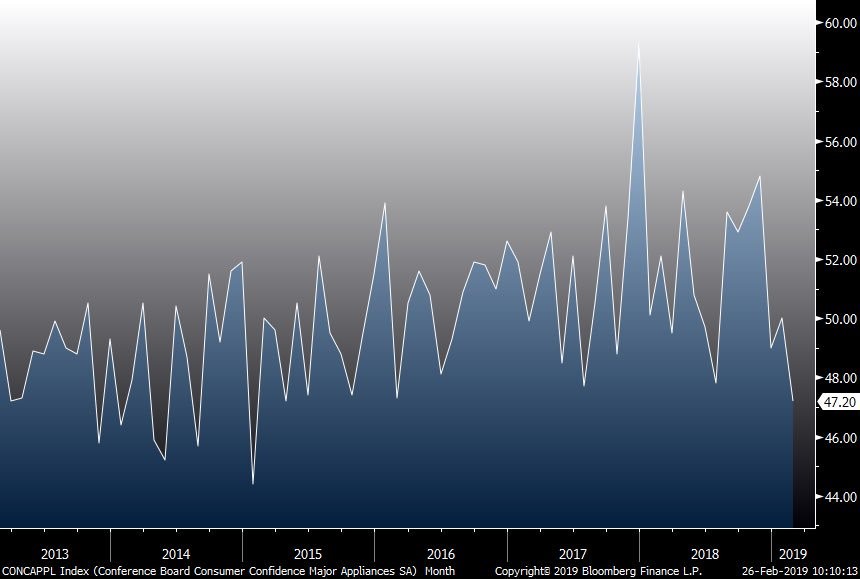

Consumer Expectations Soar On Rising Stock Market

Consumer Expectations - Confidence Rises The stock market is usually thought of as a reflection of the future economy. However, through the reflexivity theory, the stock market can cause changes to the economy. Volatility paired with the trade war and the government shutdown to take down consumer confidence and other soft data reports. Noteworthy due…

Key Levels We're Trading in Financial Stocks

What option volatility breakout trades are setting up right now in the XLF and key financial stocks such as Goldman Sachs and JP Morgan? Corey highlights the critical pivot levels, current IV levels, and future expected move levels to create trades to play for a future range and volatility expansion event in this key sector…

Bad Earnings Reports Cause Individual Stock Crashes After Hours

Bad Earnings Reports - Mixed Wednesday Action The market was mostly flat on Wednesday. S&P 500 fell 5 basis points, the Nasdaq rose 7 basis points, and the Russell 2000 was up 0.23%. Biggest action was in the after hours session as many tech stocks fell. During the normal trading session, the worst 2 sectors…

QT - Fed to End It Sometime Between Late 2019 & Late 2020

QT - Mixed Dallas Manufacturing Fed Report Before getting into QT or Quantitative Tightening, let's review the Philly Fed. Relatively speaking, the Dallas Fed report was solid because the Philly Fed report was negative and the Markit flash PMI fell. The production index was down 4.4 points to 10.1 and the general business activity index…

Here's what Big Movement in the Bonds Means

If you only look at how the stock indexes performed today you'd think nothing happened in today's session. To the contrary, there was a big move in bonds that everyone needs to be aware of. Watch this video now for this crucial update on the bond market and trading opportunities you can still take this…

Weak Housing Market & Weak Home Depot Earnings

Weak Housing Market - Small Caps Underperform On Tuesday, the stock market took a slight breather as the S&P 500 fell 8 basis points, the Nasdaq fell 7 basis points, and the Russell 2000 fell 0.71%. The VIX rose for the 2nd straight day as it increased 2.15% to 15.17. Maybe the spike on Monday was…

Stock Prices & Economy Don’t Compute

Stock Prices - What Is Priced In? The biggest question investors need to answer is “what is priced in?” The current market is particularly perplexing because of the extreme rally despite the global economic weakness. The S&P 500 has been above its 10 day moving average for 35 days. That's the longest streak in over…

Tech Stocks in Play Right Now

As we move into March, let's take a moment to highlight which of our leading technology stocks, along with the QQQ and XLK ETFs, are in play right now. Corey walks you through the daily chart and possible volatility/option plays in candidates such as AMZN, NFLX, IBM, FB, and a completed recent trade (from last…

Recent Comments