Jobless Claims Decrease - Another Rally On Thursday

Jobless Claims Decrease - This has been a solid 3 day run for stocks as the S&P 500 is up 2.65% since the low on Monday afternoon. Because the correction wasn’t large to begin with, the market is close to recovering its losses. I don’t think the stock market will zoom past its record high. But I also don’t see this as a triple top moment where the cycle is over.

Is it possible to not be extremely bearish or bullish here? I lean to the bearish side because of the weak economic reports. But I also see how the April retail sales and industrial production reports could have been blips. I can see a scenario where Q2 GDP growth is below 2%. But if the end of the quarter shows improvement, it won’t matter what GDP growth ends up at.

Nasdaq increased 0.97% and Russell 2000 increased 0.58%. VIX fell 7% right back down to 15.29. It went on a nice run after I said it could move up. I think it will bottom around 13 in the next few days. CNN fear and greed index increased 4 points to 39 which is fear.

It’s amazing to see any index at fear with the S&P 500 only down 2.34% from its record high. About half the correction has been regained. At the peak, I felt there was extreme greed.

Sectors & Bond Market

Jobless Claims Decrease - Every sector was up on Thursday, even the utilities which increased 0.58%. Top 3 sectors were materials, financials, and consumer discretionary which increased 1.34%, 1.1%, and 1%. 10 year yield increased 4 basis points on Thursday. But on Friday morning it fell 2 basis points to 2.38%.

It’s extremely low because of the weak economic data and global suppression of yields. It’s only 4 basis points above its 52 week low. The 10 year German bond yield is at -11 basis points. It started the year at 17 basis points.

2 year yield has kept below the 10 year yield as it is at 2.18%. It is just 4 basis points above its 52 week low. It is screaming at the top of its lungs that there will be a rate cut in the next 6 months. There is a 13.3% chance the Fed cuts rates in June.

All year I have been saying the Fed won’t cut rates, but I could see the Fed having a more dovish tone in its June 19th statement. The June meeting has a summary of economic projections. So we will get to dig into the specifics of the expectations for the economy and rates.

Maybe as a form of dovishness, it will get rid of the guidance for a hike next year. It’s very easy to do this because if the economy strengthens, it can always bring it back because it is in a while. The only issue is some speculators could fear the end of the cycle because the Fed is done with rate hikes.

Reality is a slightly more dovish Fed could save this cycle. The dovishness in December saved the stock market, allowing financial conditions to improve again. There is now a 75.3% chance the Fed cuts rates in 2019. That’s pretty high when you consider the Fed hasn’t hinted at a possible cut in its statements yet.

Jobless Claims Decrease - Return To Form

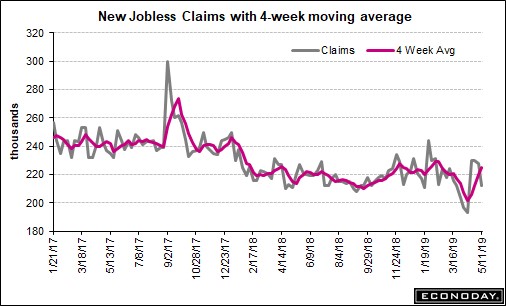

Finally, after three weeks of weak jobless claims data, the report in the week of May 11th showed new initial claims fell from 228,000 to 212,000. It was below estimates for 219,000. This decline is just in time for the BLS sample which should be next week. I was almost getting worried about this report. Easter shouldn’t affect data for 3 weeks.

Even with the decline, as you can see from the chart below, the 4 week moving average increased from 220,250 to 225,000. Continuing claims fell 28,000 and the 4 week average increased slightly to 1.688 million.

Housing Starts & Permits Both Beat Estimates

Jobless Claims Decrease - Both housing starts and permits beat estimates in April, but I hesitate to say this was a fantastic report because both had yearly declines. Starts were solid and permits showed signs of life, but weren’t great in the single family category. Starts were 1.235 million which beat estimates for 1.2 million and were much higher than last month’s reading of 1.168 million.

Permits were 1.296 million which beat estimates for 1.29 million and last month’s reading of 1.288 million. This report caused the Atlanta Fed GDP Nowcast’s estimate for Q2 real residential investment growth to increase from -5.4% to -3.6%. This reading has been negative for 5 straight quarters. I have been calling for a rebound for a few months. If the May and June reports build off this one, positive growth is possible.

Yearly starts and permits growth was -2.5% and -5%. That’s why I’m not extremely excited by the beats. Single family starts were up 4.5% monthly and multi family starts were up 6.2%. On the other hand, as you can see in the chart below, single family permits fell 4.2%.

Multi-family permits were up 8.9%. The West was strong as permits were up 5.3% monthly, but they did fall 2.3% yearly. The South was weak as monthly permits were down 1.2% and yearly permits fell 10.7%. Permits are a leading indicator for the housing market, so the results don’t paint a great picture for the rest of the year even with the overall sequential improvement.

Jobless Claims Decrease - Conclusion

The decline in jobless claims is a positive for the stock market in the midst of mostly weak economic reports which have the GDP Nowcast only expecting 1.2% growth in Q2. I wouldn’t be surprised if the BLS report shows over 150,000 jobs created in May.

Investors expect the Fed to lean more dovish in its next statement. Starts and permits beat estimates, but the yearly declines show this is far from a full recovery despite the drop in mortgage rates.

Recent Comments