June Markit PMI - Is This A Slowdown?

Before getting into June Markit PMI let's discuss some overall mixed market signals. During most slowdowns, opinions are varied because the data isn’t consistent. Some economists are wondering why the Fed is about to cut rates and others think the economy is headed for a recession.

If you review all the data instead of cherry picking whatever supports your thesis, you can see this is a mixed bag. Also keep in mind, predictions on Fed policy, the economy, and the stock market aren’t all reliant on the same factors. For example, earnings data helps determine where stocks are headed, but it doesn’t tell us about Fed policy or the economy. They are all related, but not 100% correlated.

Fed is cutting rates because of worries about trade and because inflation is low. Stocks are rallying partially because investors think a trade deal will be made. Some are also increasing because of solid earnings. The first 8 companies to report Q2 2019 results have had an average of 19.18% EPS growth. That’s much better than the previous quarter’s average of 13.21%.

To be clear, earnings are helped by a strong economy, but they don’t always need one. We saw this first hand in Q1 when EPS growth was above 5% and final sales growth was the weakest in 6 years. Currently, Q2 GDP growth is expected to be 1.9%. The trade war is hurting some soft data economic reports such as the Empire Fed manufacturing general business conditions index.

Another Bad Flash PMI

June Markit PMI - May Flash Markit PMI was shockingly terrible which led investors to discount it slightly until we saw the final result. Final result was almost identical to the initial reading. This told us this slowdown is real, at least according to Markit data. This time the weakness isn’t as shocking.

Sequential decline wasn’t as bad, but the PMIs inched closer to 50 which signals no growth. Specifically, the composite output index was down from 50.9 to 50.6 which is a 40 month low. Services index was down from 50.9 to 50.7 which is also a 40 month low. I wasn’t expecting the weakness in services as much as I was expecting the weakness in manufacturing. Nothing is holding the composite up. It can easily fall into contraction territory this summer.

As you can see from the chart below, the manufacturing PMI fell from 50.5 to 50.1 which is a 117 month low. In other words, this is a cycle low.

Even though the Empire Fed general business conditions index was a historical surprise, even it didn’t show manufacturing being worse than the manufacturing recession from 2015-2016. May industrial production report showed manufacturing isn’t slowing close to as much it was in that recession. Finally, the Markit manufacturing output index fell from 50.7 to 50.2 which is the worst reading in 37 months.

To any of the bulls looking at the initial earnings data wondering why the Fed is about to cut rates in July, here is your answer.

June Markit PMI shows the economy is barley growing.

June Markit PMI - Employment survey showed the weakest growth since April 2017. Business optimism was the weakest since July 2012. Surprisingly, inflationary pressures increased from May, but they were still much weaker than they were at the start of the year.

In the Markit comment section, the Chief Business Economist stated the 3 PMIs in the quarter are consistent with just 1.4% GDP growth. That’s slightly weaker than the consensus. Recession fears will grow if that’s the result.

This report is also consistent with 140,000 jobs created in June. The guess of 150,000 for May was too high as there were only 75,000 jobs added. However, I think that will be revised slightly higher. According to Markit, the average expected jobs added per month in Q2 was 150,000 and 200,000 in Q1.

Finally, tariffs made prices increase. Two-thirds of all manufacturers stated some or all of their raw material cost increases were caused by tariffs. Just as Oxford Economics predicted, the price increases from tariffs are being offset by economic weakness.

Another Decline In ECRI Growth

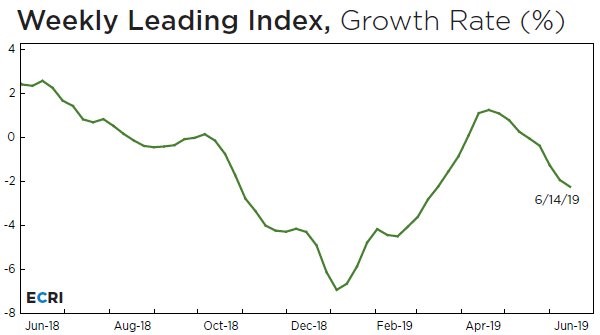

June Markit PMI - Investors expected the ECRI leading index to be helped by the stock market’s rally this month. That was correct as the index has increased in back to back weeks. It was up slightly from 144.4 to 144.6.

However, in both of those weeks, the index’s growth rate fell. As you can see from the chart below, in the week of June 14th the growth rate fell from -2% to -2.3%. That won’t happen in the next few weeks as the comps will get much easier. It’s still disheartening to see weakness. The economy still isn’t out of the slowdown predicted by this index in December and January. If this growth rate is accurate, growth will recover slightly in Q4, but fall in Q1 2020.

Coincident index showed growth in May fell from 2.3% to 2%. I am curious to see how low this index falls. In 2016 it bottomed at about 1% growth. It still has far to go to show that this slowdown is worse than the last one. I know that the Markit PMI was from June. But even its May reading was more pessimistic than this ECRI reading.

That’s why it’s important to look at multiple summaries of the economy before forming an opinion. We know this is a slowdown, but there are varying measurements of how bad it is.

June Markit PMI - Conclusion

First 8 S&P 500 companies had extremely high EPS growth. But that doesn’t necessarily mean this will be a great earnings season. Nor does it mean the economy is solid enough to avoid rate cuts.

The June Markit PMI tells a much different story as it is consistent with 1.4% GDP growth. Both the ECRI leading and coincident indexes saw their growth decline. Leading index suggests Q1 2020 won’t be strong and the coincident index tells us growth slowed in May. But this slowdown isn’t as bad as the one from 2015-2016 yet.

Recent Comments