Slight Pullback On Monday

The stock market fell modestly on Monday after its big rally on Friday which was caused by the great jobs report. And, the market was pushed lower by Apple’s 1.4% decline. S&P 500 fell 0.32%. Apple is one of the trade sensitive stocks.

Obviously, there are other news events that can move the stock, but this time it was trade. China’s assistant commerce minister stated the nation hopes to make a deal with America “as soon as possible.” Plus, on Friday Larry Kudlow stated both sides were “close” to making a deal. But President Trump is willing to “walk away” if he doesn’t like the deal. Stocks may have fallen because the December 15th deadline is approaching.

We need to see real action, not nice statements or else the new tariffs will go into effect. Deadline is this Sunday. That’s in just 5 days. Besides the deadline and the 2020 election, China’s need for U.S. agricultural products could spur a deal soon. Pork prices rose 110% in November. Prices of beef, mutton, chicken, duck, and eggs rose between 11.8% and 28.7%.

Review Of Monday’s Trading Session

Nasdaq fell 0.4% and the Russell 2000 fell 0.26%. Small caps don’t include Apple or other international stocks that will be affected by a worsening trade war. That could be why it outperformed slightly. VIX was up 2.24 which put it above 15 again. It’s now at 15.86 which isn’t high. CNN fear and greed index fell 2 points to 68 which is greed.

Only 3 sectors that rose were consumer discretionary, real estate, and consumer staples. They were up 7, 14, and 15 basis points. Worst sectors were the utilities and healthcare which fell 0.49% and 0.68%. 10 year yield hasn’t moved much in the past few days as it’s at 1.81%. The 2 year yield is at 1.61%.

Decline in healthcare gives me a chance to update you on the 2020 Democratic primary election. Latest news is that there haven’t been any polls in the past few days. That’s important because it means Yang and Gabbard haven’t gotten a chance to get the 1 debate qualifying poll they need. I don’t think either will win, but there’s a big difference between having 6 and 8 candidates on stage.

If Bloomberg gains in the polls and doesn’t accept donations, he can limit the debate field which will increase the speaking time of each candidate. The deadline to make the December 19th debate is December 12th.

As of now, we only have the Harvard Harris poll from Friday which showed Biden up by 13 points on Sanders. There were also polls showing President Trump beats all the Democrats in Arizona. Personally, I’m mainly focused on the primary first because that determines the likelihood of Trump winning. The primary starts in February, while the general election is in 11 months.

Wall Street Isn’t Bullish On 2020

Wall Street always thinks the stock market is going to move higher because it needs people to stay invested. Obviously, stocks don’t always go up, but there’s no benefit to predicting a decline. If you predict a decline and it doesn’t happen, then you were wrong and scared away investors. That’s a huge risk.

It makes far more sense to make a cautious price target on the S&P 500 and invest accordingly to survive the potential decline you see coming. This sets up the projections for 2020.

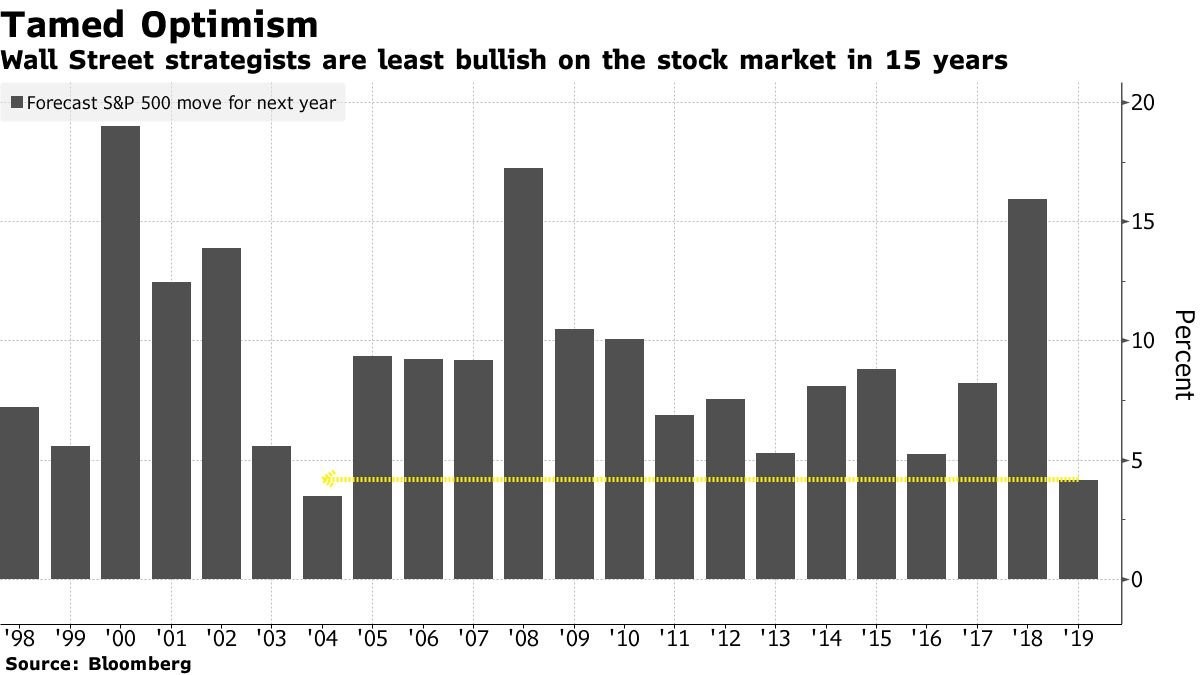

As you can see from the chart above, Wall Street sees a 4.3% gain occurring in 2020. That doesn’t sound traumatic, but for a group that never projects declines, that’s very bearish. The chart shows Wall Street is the least bullish on stocks since 2004. If you look further, Wall Street is the 2nd least bullish since at least 1998. The average price target doesn’t have a bad track record.

Projections for 2019 were very optimistic even as stocks cratered at the end of 2018. That ended up being correct. Projections were tepid in 1999 for 2000 which was accurate as the tech bubble peaked in 2000. Estimates in 2008 for 2009 were very optimistic which worked out as stocks bottomed in March 2009.

Mid-Single Digit Gains In 2020 Like Wall Street?

It’s very easy to see why Wall Street is bearish. Heading into the year stocks were cheap because they fell in 2018 while earnings growth was very strong because of the tax cut. This year, stocks have rallied sharply while earnings growth has been low because of the tough comps, declining margins, and the economic slowdown.

If you think multiple expansion won’t occur, there’s no reason to be very bullish as earnings growth should be in the mid to high single digits. That’s where all of the gains should come from.

Investors have already priced in the cyclical acceleration, so it’s tough to see why multiples would rise. Traditionally, you might expect stocks to rise as the acceleration gets going, but they already have. Wall Street’s version of being bearish on stocks is calling for a 4.3% decline.

However, I actually think that’s around how stocks will perform next year, barring any big changes in stocks by the end of the year. If stocks don’t move in the next 3 weeks, I think they will increase 4% to 6% next year.

Conclusion

Stocks fell slightly on Monday. That doesn’t change the fact that they have mostly priced in the coming economic expansion which could mitigate the gains next year. Wall Street only sees a 4.3% rise in the S&P 500 in 2020. I see an increase between 4% and 6%.

There weren’t any new qualifying polls for the Democratic debate in the next few days. Gabbard says she won’t go even if she qualifies, but she said she wouldn’t go to the last one and she went once she made the cut.

1 Comment

Kevin Morgan

December 11, 2019Multiple expansion will likely occur, and there are powerful demographic reasons the secular bull market to continue strongly in 2020 and beyond (Millennials are entering their prime 15 years of economic impact). Many (about 10?) different analogue studies by Ciovacco Capital consistently tell the same story: extremely high probability of significant market advance over the next two years, minimum. Elliott wave analysis tells the same story: major bull market advance in play, continuing from the cycle 4 wave low in Dec of 2018. So...just a few comments about a different perspective. But it's always price action that counts...