Stocks Rally - President Trump Lifts Tariffs On Canada & Mexico

Before getting into what caused the stocks rally, let's review what's going on in the trade war. In a tweet on Sunday, President Trump stated he would be lifting the steel and aluminum tariffs of 25% and 10% on Canada and Mexico.

In turn, their tariffs on American agricultural products were lifted. This will make it easier for the trade deal between the 3 countries to be ratified. There will no longer be quotas or limits on imported metals.

On Monday, US Steel stock fell with the market as it was down 2.26%. It rose with the market on Tuesday as it increased 4.49%. This move to eliminate tariffs shows how smoothly negotiations are going with Canada and Mexico. Those tariffs were the first tariffs President Trump put in place.

Those tariffs being removed give investors hope that a deal will be made with China. The deal with China will be tougher to achieve though because of China’s intellectual property theft. President Trump wants to get a deal done before the 2020 election. The problem is Chinese leaders know he is pressured to get a deal done. This has made them unwilling to give in on much. The closer we get to November 2020, the more intense negotiations will get.

90 Day General Export License For Huawei

Stocks Rally - One of the reasons given for the Tuesday rally in stocks, which I will get to next, was the 90 day exemption which allows Huawei to support its products. I don’t see how this is good news for negotiations. It’s necessary to help American firms who rely on Huawei’s equipment for important services. However, it doesn’t mean Trump is suddenly going easy on Huawei. The firm still can’t buy American parts. This is still a highly restrictive action.

I think the tech stocks that do business with Huawei had a relief rally because they fell so sharply on Monday. However, the fundamentals haven’t changed. Specifically, Qualcomm stock rose 1.47%, Intel rose 2.07%, and Micron rose 2.95%. The semiconductor ETF SOXX increased 2.05%.

As you can see from the chart below, semiconductor exports to China are taking a big hit because of the trade war. The 90 day window for Huawei isn’t close to news that can turn this around.

Stocks Rally - Big Oversold Rally On Tuesday

Tuesday was a solid day for stocks. S&P 500 rose 0.85%, Nasdaq rose, 1.08%, and Russell 2000 increased 1.33%. VIX fell 8.34% to 14.95 and CNN fear and greed index was steady at 34 which is fear.

The stock market can have big rallies during this correction phase where most economic reports are weak and there isn’t a trade deal with China. However, the market won’t reach a new record high until the data changes or there is a trade deal. Because the tariffs have gotten so large, those two variables will be highly correlated in the next few months.

Stocks Rally - I expect retail sales in June to be hurt by the tariffs. Q2 can’t afford to take much more negative news as estimates are already low.

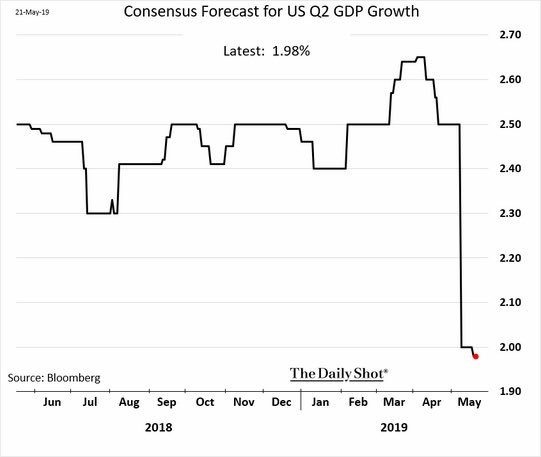

As you can see from the chart below, the consensus for Q2 growth has cratered from over 2.6% last month to just 1.98%. Odds of Q2 growth being below 2% have increased in the past couple weeks. Average estimate in the CNBC rapid recap is for just 1.8% growth. The Atlanta Fed Nowcast, which sees 1.2% growth, will be updated on Friday. It has been awhile since this Nowcast foresaw negative growth.

Every sector rallied on Tuesday except consumer staples which fell 0.31%.

Stocks Rally - Consumer discretionary sector increased 0.57% despite the weak retail earnings reports I will get to in the next section. The 3 best sectors were tech, materials, and industrials, which rallied 1.2%, 1.51%, and 1.18%.

Apple rallied 1.92% even though it faces big risks from the trade war. I see more volatility in the near term for this stock, sector, and the market before the situation is sorted out.

Tuesday Retail Disaster

Stocks Rally - 3 retailers reported bad quarters on Tuesday. This supports the narrative that the consumer is weak despite the 15 year high in the University of Michigan expectations index. Nordstrom reported 23 cents in EPS and $3.44 billion in revenues which both missed estimates for 43 cents and $3.57 billion. This sent the stock crashing 9.25% after hours. The firm blamed executional misses.

It’s nice to see a firm take responsibility for its misfortune. The firm expects 2019 net sales to be flat to down 2% rather than positive 1% to 2% which it previously projected. Sales from its full-price department stores fell 5.1% while sales at its off-price store Nordstrom Rack only fell 0.6%. The consumer traded down.

Kohl’s also missed estimates on the bottom line, but beat on the top line bottom as EPS was 61 cents and revenues were $4.09 billion. Estimates were for 68 cents and $3.94 billion. Same store sales growth was -3.4% which missed estimates for -0.2%. The firm blamed the cooler and wetter start to spring. It called its issues “temporary.” Its stock cratered 12.34% on Tuesday.

J.C. Penny has been relegated to a penny stock as it has been poorly positioned for years. Its stock fell 6.96% on Tuesday as the firm met revenue estimates of $2.56 billion, but lost 46 cents instead of 38 cents per share. Its same store sales fell 5.5% instead of 4.2%.

Stocks Rally - Conclusion

The stock market rallied Tuesday because it was oversold. To be clear, I’m not calling for a bear market. I’m simply positioned for weakness because of poor economic reports and the uncertainty over trade with China. There is no evidence of progress on trade despite the 90 day window where some companies can do business with Huawei.

While the trade war can end with a tweet, neither President Trump nor Chinese leaders are in a position where I see them doing a 180 degree turn and suddenly negotiating a deal. Chinese leaders have been headed in the wrong direction ever since Trump announced the latest round of tariffs.

Recent Comments