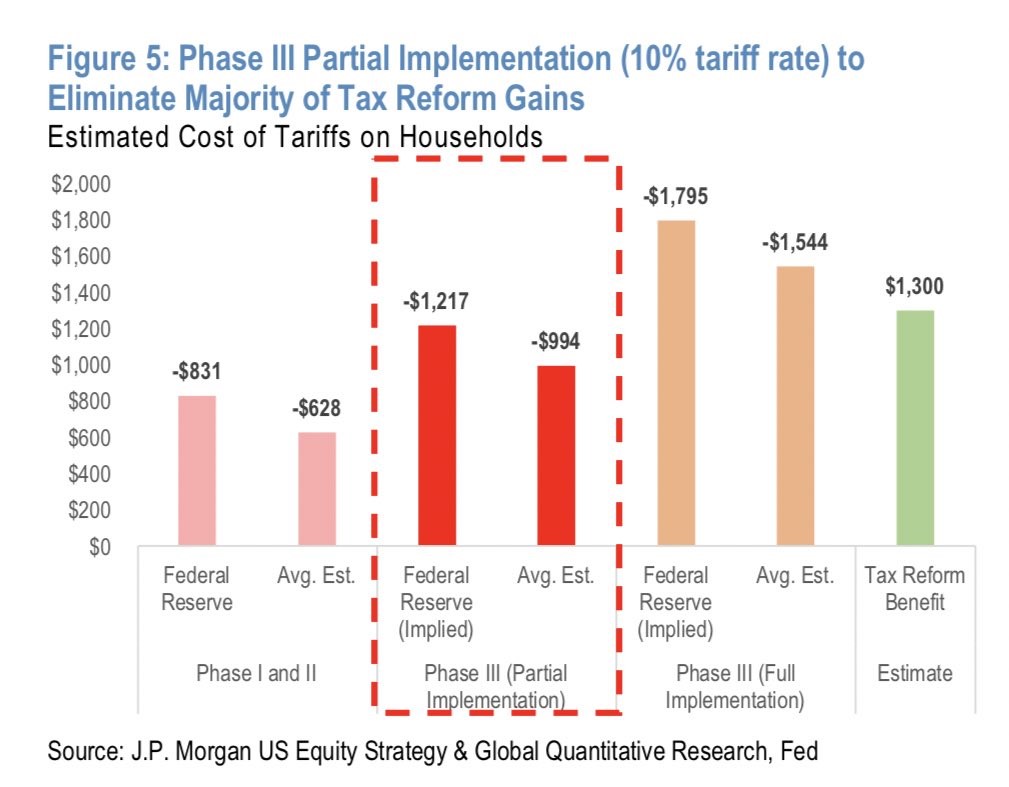

Tariffs To Hurt Consumers More Than The Tax Cuts Helped Them

Redbook Sales Growth Redbook same store sales growth in the week of August 17th was 4.9% which was a jump from 4.4%. This means August’s retail sales growth is tracking at a slightly lower, but still strong pace, as compared to July. This is prime shopping time for the back to school season. Each week’s data…

Trade Weighted Dollar Hits A Record High

Stock Market Ends 3 Day Winning Streak The stock market ended its 3 day winning streak as the S&P 500 fell 0.79% on Tuesday. In the past few corrections we have seen a sharp downturn, a smaller sharp upturn, then a retest of the low, and then a gradual rally until the market hits new…

Recessionary Warning - The Yield Curve Is The Only One

Yield Curve Only Indicator Showing Recession Before you get scared of the yield curve predicting a recession, look at the other indicators. If it wasn’t for the trade war, it’s possible the manufacturing sector wouldn’t be contracting. Without the trade war, it would be clear to most there’s little risk of a U.S. recession in…

Overblown Recession Fears As Stocks Continue To Recover

Stocks Reverse Recession Worries The only economic report that came out on Monday was quarterly e-commerce retail sales. It showed similar results to the July retail sales report. The category is on fire as quarterly growth improved from 3.6% to 4.2% in Q2. Yearly growth was 13.3%; e-commerce grew 0.2% to 10.7% of total retail…

Recession Fears Spike (Probably Too Much)

Recessionary Fears Catapult Higher Every stock market correction prices in some recession fears. It’s normal to expect an uptick in expectations for a recession after declines. The larger the decline, the more fear ramps up. A prime example was late last year when stocks fell 20%. This latest correction is different because the 10-2 year…

Volatile Week Ends With Stocks Gains

Stocks End The Week On A Positive Note The S&P 500 was up 1.44% on Friday, but it still closed down 1.03% for the week. The chart below shows the volatile action and the reversals throughout the week. The 2.93% decline on Wednesday sunk stocks for the week. The S&P 500 is down 4.53% from…

Manufacturing Sector - Now Contracting

Model Of ISM Manufacturing PMI Based on the rate of change of the recent manufacturing data, it’s clear manufacturing is falling into a contractionary phase. This won’t be one or 2 weak readings. It will be a manufacturing recession like 2015-2016. However, that call won’t generate alpha because it is the consensus at this point.…

Treasury Curve Now Calls for 39% Chance Of A Recession

Windshield Wiper Thursday The stock market was like a windshield wiper on Thursday because it moved back and forth. Even though the action wasn’t as sharp as we’ve seen in previous days, it was significant, because if the market would have closed at the low of the day, it would have made a new correction…

Consumers Won’t Let the Economy Fall Into A Recession

Another Manufacturing Slowdown Without An Economic Recession July monthly reading for sales growth was fantastic. However, the industrial production report was weak. It appears in the 2nd half of 2019 heading into early 2020, there will be another manufacturing recession, but consumption growth will be solid. That would make this situation like 2015-2016. There are 2…

Yield Curve Inversion Sends Stocks Careening Lower

Major Market Carnage As Yield Curve Inverts As expected, stocks fell sharply after the 10-2 year yield spread inverted briefly. This was its first inversion since August 2007 which was 12 years ago. The Wednesday trading session became historic because the U.S. 30 year treasury yield fell to a record low and the German 10…

Recent Comments