Leading Indicators - Record High

The August Conference Board leading indicators were up 0.4% month over month which missed the consensus for 0.5% growth. The July Conference Board leading index was revised to show 0.7% growth instead of 0.6% growth.

Even though the leading index is supposed to lead the economy, they are laggards in the sense of that the data in the index was already known. The leading indicators were lead higher by the strong ISM manufacturing orders.

On that point, it’s fair to say the leading indicators are biased to the upside since the ISM manufacturing report didn’t accurately portray the manufacturing economy in August.

The manufacturing sector actually lost jobs according to the initial BLS report. It wasn’t as strong as the PMI suggested.

Credit, interest rates, consumer expectations, and stock market metrics were also all strong. It’s not like the economy is cratering. There’s a fine line between exceptional growth and decent growth, but it’s worth recognizing. Building permits and existing homes sales were the weak parts of this index.

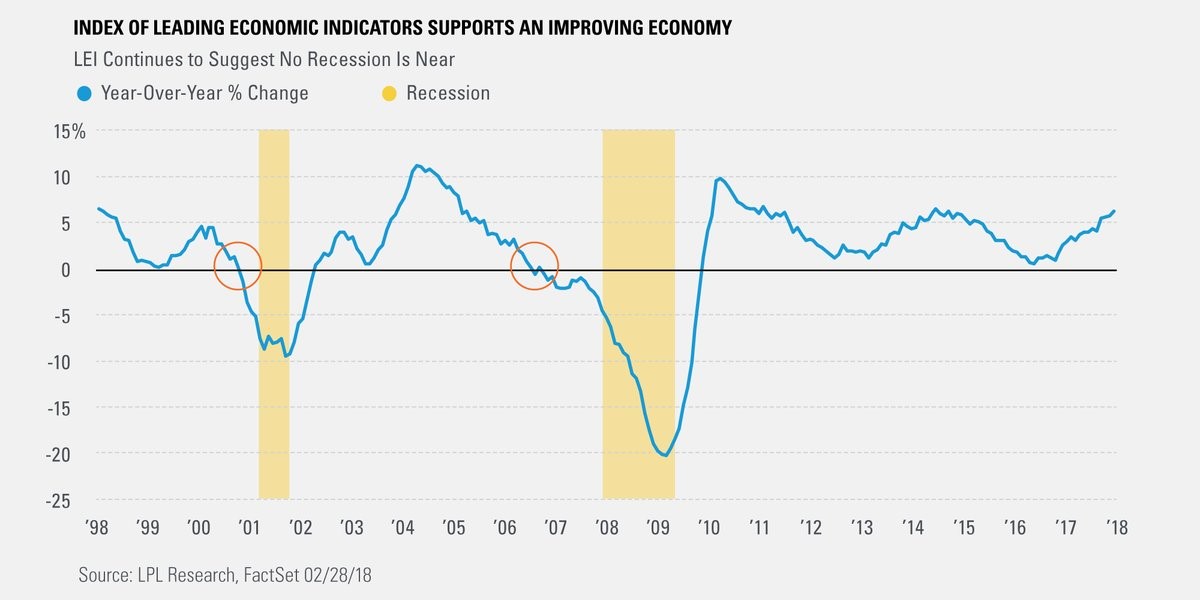

As you can see from the chart below, when the leading index is at a record high it means a recession isn’t coming in the intermediate term. As you can see, it fell off its record high 20 months before the last recession.

To be clear, this data is far from a guarantee. It’s only as good as the metrics which make it up. Since the stock market isn’t a perfect measurement of the future economy, this stat isn’t perfect either.

Secondly, you can’t use the stock market’s year over year performance to predict future returns. Stocks go up until they don’t. There’s no insight there.

Leading Indicators - Housing Starts Beat Estimates & Permits Miss

The seasonally adjusted August housing starts were 1.282 million which beat estimates for 1.24 million. They also beat the July starts which were revised from 1.168 million to 1.174 million.

They beat the high end of the estimate range which was 1.253 million as this volatile statistic had a 9.2% increase. Multi family starts were at a 406,000 rate which is a year over year increase of 38% and month over month growth of 29%.

Single family housing starts were up 1.9% month over month to 876,000. This was a 0.2% decline from last year.

Permits missed estimates for 1.303 million as they were 1.229 million. They even missed the lowest estimate for 1.26 million. July’s permits were revised down from 1.311 million to 1.303 million.

Permits were down 5.5% year over year as multi family permits were down 17.7%. Single family permits were down 6.1% month over month and 2.1% year over year. Permits are a leading indicator of the housing market, so this isn’t a good sign.

Finally, single family completions were up 11.6% and multi family completions fell 18.5% to 290,000.

Leading Indicators - Philly Fed Index Beats Estimates

The overall September Philly Fed index beat estimates after a weak August report. This made me wonder if the manufacturing sector was slumping.

Manufacturing growth was moderate. Meaning, growth in August was somewhere in between the pessimistic Philly Fed report and the optimistic Empire Fed reading.

As you can see in the chart below, September was a reversal as the Empire Fed report weakened and the Philly Fed index strengthened. The Philly Fed index went from 11.9 to 22.9 as it beat the consensus of 19.6 and the highest estimate which was 21.1.

The underlying metrics were very strong as the new orders index went from 9.9 to 21.4. Interestingly, the inventories index fell from 15.4 to -3.5, the delivery times index increased from 6.4 to 11.1, and the unfilled orders index increased from 5.6 to 12.6.

Even with this problem in the supply chain, the inflation metrics took a nosedive for the first time in months.

The prices paid index fell from 55 to 39.6 and the prices received index fell from 33.2 to 19.6. The regional Fed reports have been showing extreme inflation all year.

This decline is in line with the deceleration in the CPI and PPI reports. I’m interested to see the PCE report because that’s what the Fed follows the closest. I still think the Fed will raise rates even if PCE inflation falls.

However, the Fed will need to give a detailed explanation as to why it’s raising rates while inflation declines just like it did in 2017.

The biggest differences this year are that rates are going up 1% instead of 0.75% and the Fed is closer to positive real rates.

Leading Indicators - After 2018, policy will no longer be accommodative.

The chart below is interesting because it shows the z-score of stocks and the Philly Fed 6 month forecast index have diverged. Besides early 2017, this is the largest divergence since mid 2010.

There’s no question stocks are overbought as they are at their all-time high. However, the 6 month forecast isn’t exactly weak, so I disagree with the implication of this chart. I’m bearish on stocks, but not because the 6 month forecast index went from 38.8 to 36.3. That’s still a decently positive result.

The new orders index fell from 38.1 to 34.1 and the capital expenditures index also fell as it went from 27.1 to 26.7. The inflation stats also fell as the prices paid index fell from 60.2 to 49.6 and the prices received index fell from 58.9 to 44.2.

Leading Indicators - Conclusion

Cycle high hourly earnings growth and cycle low jobless claims (claims fell 3,000 to 201,000) suggest the Fed should raise rates. However, now the Philly Fed index is singing the same tune as CPI and PPI. This suggests the Fed doesn’t need to raise rates because prices aren’t running hot.

Interestingly, even with Hurricane Florence hitting North Carolina, its jobless claims weren’t estimated. While the damage was severe, there might not be as large of an impact on the economy as Hurricane Harvey. The Fed is sticking with hourly wage growth by raising rates 4 times in 2018.

Recent Comments