Low Wage Workers Getting Another Raise

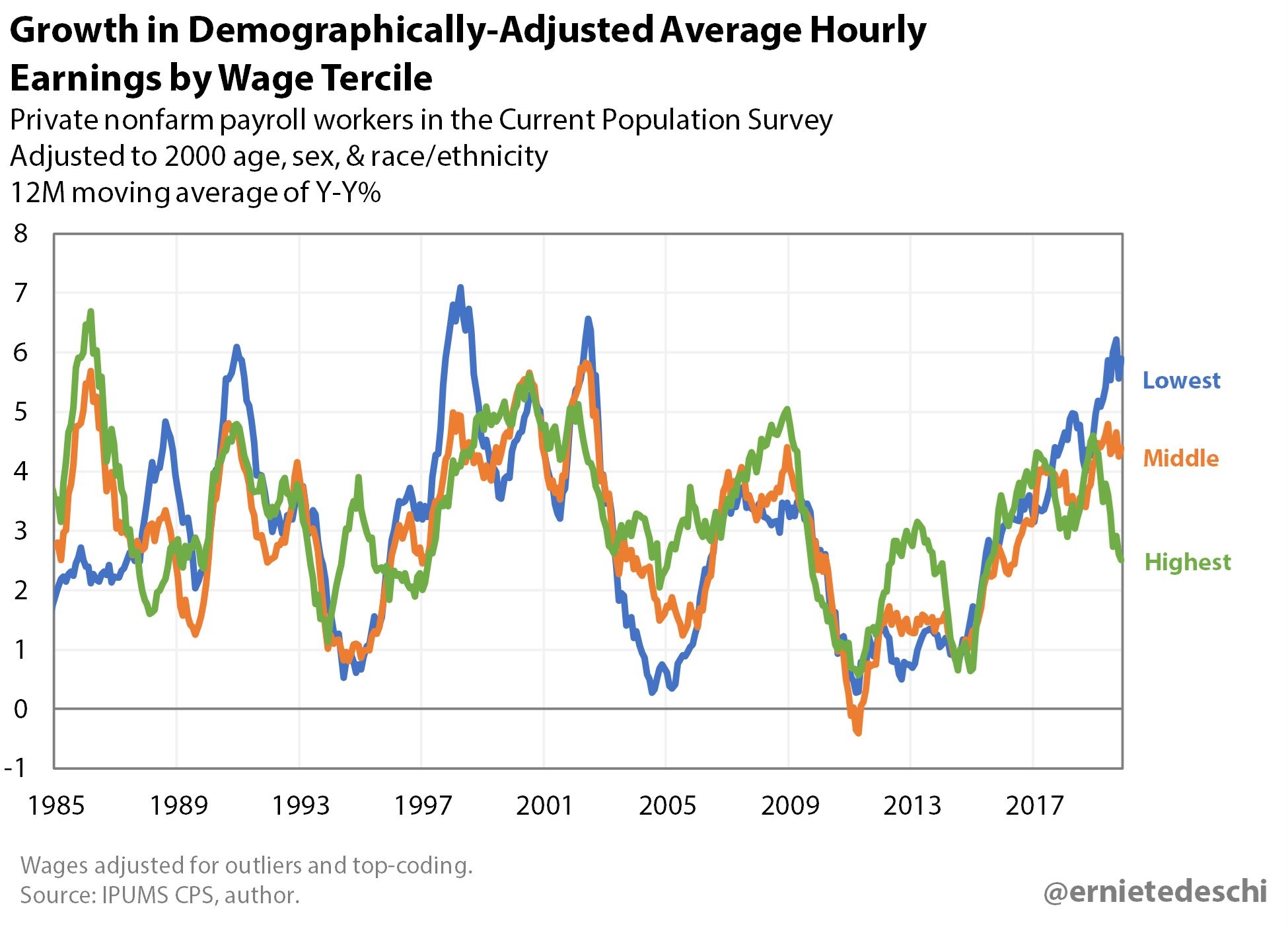

A big negative for workers in 2020 will be the rise in headline inflation because of the increase in oil prices. In the next few months, comps will get tougher, but oil prices will likely rise this year. Fundamentals of the labor market look great for middle and low wage earners. The chart below shows wage growth for each third of workers; it is adjusted for age, sex, and race.

As you can see, usually low income wage growth outperforms at the end of the cycle and it occurs for a brief time. This time, low income wage growth might outperform for an extended period because the cycle has been long and is showing no signs of ending. Furthermore, there have been a slew of minimum wage hikes. That has been a significant factor in boosting wage growth for the low end of the labor market.

21 states and 26 cities and counties raised their minimum wage at the start of 2020. 17 of the cities and counties raised the wage to $15 or higher. In addition to this initial burst at the start of the year, there will also be minimum wage hikes later in the year. 4 states will raise their minimum wage throughout the year. 23 cities and counties will do so. 15 of them will be at or above $15.

California and New York raised their minimum wage. That’s important because of their size. Specifically, California raised its minimum wage for large and small employers by $1. They were increased to $13 and $12 respectively.

Large firms in NYC have the same ($15) minimum wage as last year, but the wage for small firms was up $1.50 to $15. It’s logical that minimum wages are higher in areas with a higher cost of living. That’s why it’s not necessarily problematic that the national minimum wage has stayed at $7.25 since 2009. It’s only an issue in states that haven’t raised their minimum wage.

If you’re curious, $7.25 in 2009 is the equivalent of $8.69 in 2020. Inflation is often used to figure out how much to raise the minimum wage. Highest minimum wage for all employer sizes is $16.05 in Sunnyvale and Mountain View which are cities in California. For large employers, Seattle has a minimum wage of $16.39. High minimum wages suppress job growth which isn’t an issue now because there are more openings than hires.

Job Cuts Fall In December

In the week of December 28th, jobless claims fell 2,000 to 222,000. They have normalized after the spike in early December which occurred because of the late Thanksgiving. That spike caused the 4 week average to increase to the highest level since January 2018. 4 week average will decline next week once the spike is excluded from the average.

Job cuts in December fell from 44,569 to 32,843. That’s a 25.2% decline from last year. Now we have data from the full year. There were 592,556 job cut announcements in 2019 which is 10% above last year. That’s the most since 2015. 2011 had the most cuts this cycle. There could have been more cuts in 2019 if Q4 2018 replaced Q4 2019.

In other words, the 4 quarter stretch of elevated cuts didn’t perfectly fit in one year. 10.49% of cuts were related to bankruptcies. This was caused by retail bankruptcies even though retail job cuts actually fell from 98,563 to 77,475. Percentage of job cuts related the bankruptcies was the highest since at least 2005. Previous high since then was in 2005 in which 6.92% of cuts were related to bankruptcies.

Biggest increase in cuts was in tech which ironically had the best performance out of any sector in the S&P 500. This sector had a lot of multiple expansion. Cuts were up from 14,230 to 64,166. California had the most cuts as they were up from 97,163 to 100,506. Tech cuts definitely played a role in this increase. Looking at the regions, the Northeast had a 6.4% decline in cuts. Midwest was down 0.1%. West and Southeast were up 21.9% to 32.6%. The biggest increase was in Virginia which went from 12,106 to 25,804.

There were 789,781 seasonal job cut announcements. Amazon and Target had the most as they were 200,000 and 133,000. Walmart had none. Number of hiring announcements was up from 15,999 to 26,313 in December and up from 1,018,428 to 1,207,751 in 2019.

Chicago Business Barometer

As you can see from the chart below, in December, the Chicago Business Barometer rose from 46.3 to 48.9 which was the highest since August. This index makes it look like the economy is improving more than it is because the GM strike this fall (September and October) suppressed the index.

That being said, this was a solid report compared to November which wasn’t impacted by the strike. Specifically, the production index was up 4.9 points to 47.2. New orders fell 0.3 to 49.1. Inventories index was up 4.4 points to 47.4. Employment index fell slightly to 47.4, but the index was up 11.1% in Q4.

Supplier deliveries was the only index above 50 as it increased 5.1 points to 55.4. Prices index was up 9.2% to 58.4 which is the highest level since August. This supports the growing trend of increasing inflation. The Fed probably won’t cut rates in 2020 with inflation rising. The special question in this report was what percentage of firms’ 2020 capital budget will be spent on labor productivity. 50% will spend less than 5% on this. 26.2% will spend more than 5% of their capital budget. Finally, 23.8% will spend more than 10%. This survey has a fat right tail.

Conclusion

Wage growth for low income workers should be strong in 2020 partially because of the minimum wage hikes. Jobless claims were low again in the latest report. Job cuts were also low as the 2019 increase was mainly because of Q1. Chicago Business Barometer increased from November, but it’s still below 50.

Recent Comments