I think the best description of this current cycle is ‘this time is different.’ I’m not implying that the stock market will rally indefinitely and that a recession will never happen. I’m saying that most of the indicators I look at which have had a great track record have been wrong. The most pivotal one I look at which is waving a red flag is C&I loans. C&I lending peaked in November 2016, yet there hasn’t been a recession this year and there is no immediate sign of one coming. The Q2 GDP Now forecast is showing 4.1% growth. I’m not saying that growth rate will be achieved, but negative growth is out of the question. To be fair, C&I lending did rebound in April, but it’s still off the peak.

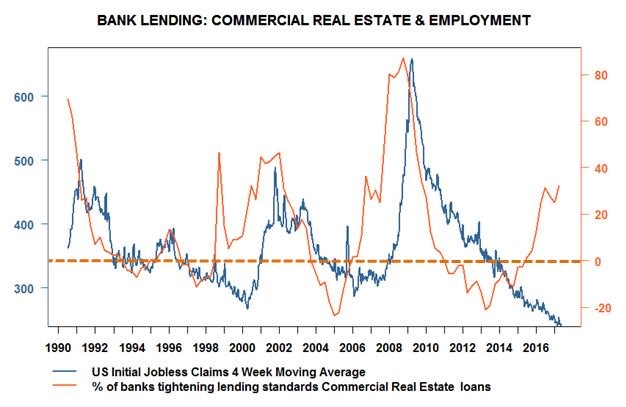

This is the mindset I approach the chart below with. It shows bank lending to commercial real estate versus employment. The orange line shows the percentage of banks which are tightening/loosening lending their standards. The latest figure on the chart shows that over 30% more banks are tightening standards than loosening standards. Whenever the line goes from negative to positive, there is about a two-year lag before jobless claims start to increase. Jobless claims have a direct and tight correlation with the stock market. When they increase, stocks fall. The two-year lag time implies that jobless claims will start to increase this year. So far, the increase has not occurred. I wouldn’t be surprised if this lead time is extended because this cycle is unlike the prior four because of excessive central bank intervention.

One of the emerging trends I’ve highlighted this year which can boost stocks higher is the reversal of the declines in buybacks. Buybacks have declined because of the earnings recession. Usually earnings recessions coincide with market crashes and recessions, but this time both were avoided. Q1 earnings were great, which means buybacks will start to increase again in 2017 after two straight years of declines. With earnings expected to pass their trailing twelve-month peak later this year, I would expect buybacks to make new record highs in 2018. The information on buybacks is delayed, so the latest update I have is from Q4. I will discuss Q1’s total when it’s released.

Personally, I think buybacks are bad for businesses because a heightened stock price is only a good thing if revenues are growing. Buybacks boost the stock price, but don’t help the underlying business. Taking the risk of investing in disruptive technologies boosts revenues and improves productivity. Buybacks are like painting the outside of a house a pretty color while the inside is dilapidated.

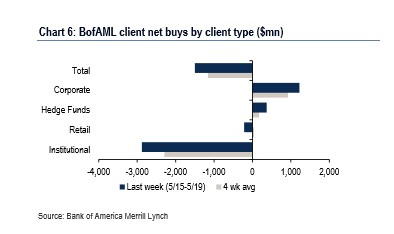

While the long-term economy and businesses suffer from buybacks which usually buy the most stock at the top of the cycle, if you’re investing with a time horizon of a few years instead of a few decades, buyback’s effect on stock prices matter a great deal. The chart below shows the breakdown of the buyers and sellers by Bank of America client type. As you can see, corporate buybacks were the number one buyers of stocks in the past week and the past four weeks on average. Corporations bought the dip in stocks. This chart is slightly confusing because, while it makes sense that there was net selling last week because the market was down, it’s surprising to see net selling over the 4-week average because stocks were up 1.59% during that period. This must reflect the fact that Bank of America’s clients were more bearish than the average investor.

One group of investors who are buying stocks are quant funds. As you can see from the chart below, quant funds’ gross notional equity exposure has gone up steadily since it started being tracked by Credit Suisse in 2012. To be clear, this chart reflects the increase in the size of funds over time along with the net changes in the aggregate investments by those funds. The quants have had a tough time finding profitable trades amidst the low volatility. It’s tough to make money in a unique manner when the number of stocks has declined and the stock market has barely moved. This has encouraged quants to pile into the same strategies. When trades become over crowded, volatility can spike when they decide to exit at all at once if they’re spooked. Quant funds control $500 billion. As you can see, much of that is long the stock market.

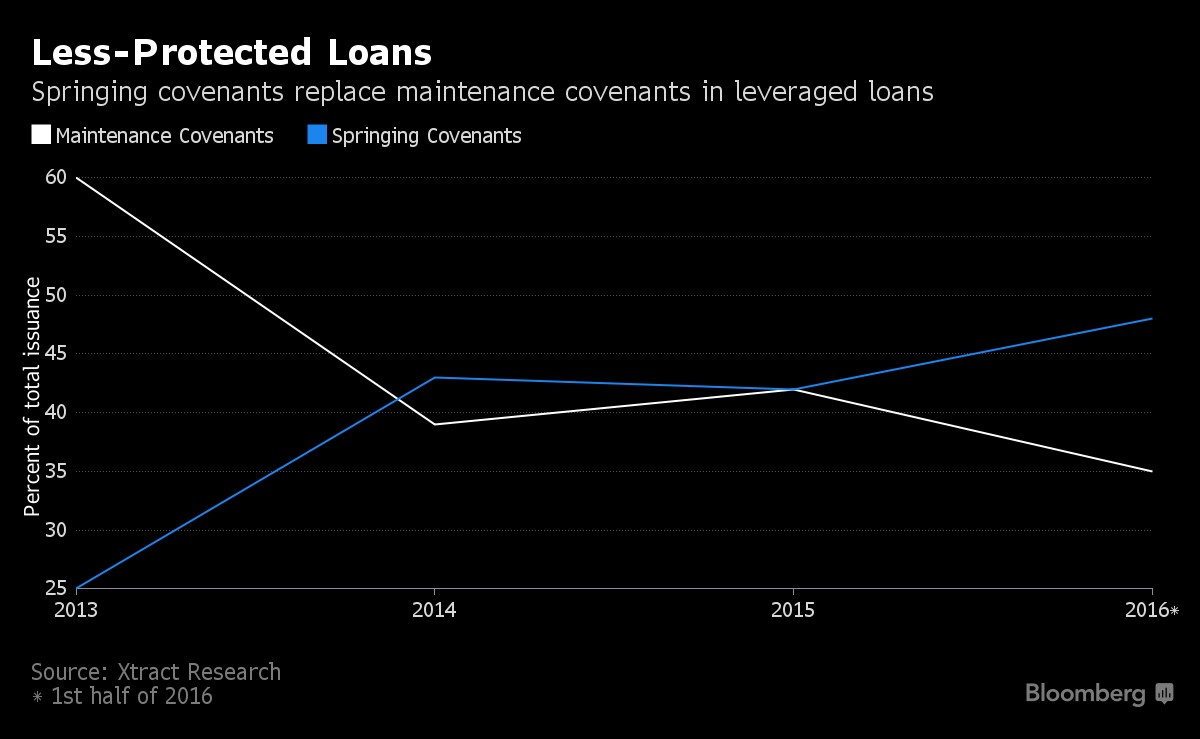

One of the themes in most of my articles has been that when the economy turns, the next recession and subsequent market selloff will be worse than in 2008. The principle concern I have is that corporate leverage is the highest ever. The leveraged loan market is also more toxic as you can see from the chart below. Covenant lite loans as percent of total loan issuances went from 25% in 2007 to 75% in 2016. These loans offer little protections to lenders and little obligation to explain when things go wrong.

Using an analogy to consumer loans, a loan that has restrictions is like a mortgage. Banks do research into the value of the home and the ability of the buyer to pay off the loan. With credit cards, lenders don’t do any research into what the person is buying. Because of this, credit card loans have higher interest rates than mortgages. Covenant lite loans have higher interest rates than loans with restrictions.

In a world where investors are hungry for yield, they are hungry to buy these loans without knowing the risk. This is like playing Russian Roulette. It seems like a disaster waiting to happen. Now that firms have realized how much demand there is for these loans, they can take more risk than ever before. Investors who have never dipped their toe into this product before this cycle will be in a world of hurt when the cycle turns.

To wrap up this point about levered loans, there has also been movement towards loans with springing covenants and away from loans with maintenance covenants. Springing loans are loans which have covenants which are only tested after a certain amount of the revolver is drawn. This is like a credit card firm starting to get concerned after a borrower misses a payment. After the revolver is heavily drawn and after a customer misses a payment, the situation becomes dire. Smart lenders would try to prevent revolvers from being drawn too high unless there is a financially responsible reason to do so.

Recent Comments