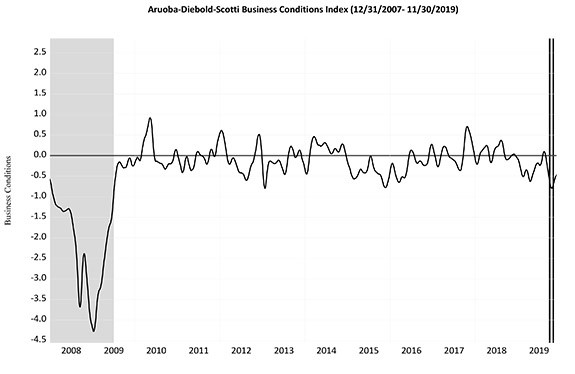

Recession Odds Decline

According to the Aruoba-Diebold-Scotti business conditions index, odds of a recession have declined recently. However, the most recent data in this report is always the least reliable. It gets updated after the fact when new data comes out. For example, the November industrial production report hasn’t come out yet. When it does, the November readings (which have already come out) will be revised.

With that understood, it’s valuable to know that the index bottomed at -0.794 on October 20th. Since that data is far in the past, it’s likely to be accurate. Only data revisions will impact October’s numbers (not new reports). All the monthly hard data from October is out now.

It didn’t round the reading that closely because anything below -0.8 is recessionary. Obviously, if this index slightly falls below -0.8, it doesn’t guarantee a recession, but the odds of one increase as it falls. Odds of a recession got into the low 30s (percent) at the trough.

Construction Growth Misses Estimates

October construction spending report showed higher yearly growth, but missed monthly growth estimates. That’s because it had an easier yearly comp. Specifically, monthly growth was -0.8% which missed estimates by 1.2%. That’s a major miss. It missed estimates even though September growth was revised from 0.5% to -0.3%.

As you can see from the chart below, yearly growth improved from -1.4% to 1.1% which was the first positive growth reading since October 2018. In Q4 2018, the housing market took a big tumble. Yearly growth comp went from 4.4% to 1.5%. Meaning, the 2 year growth stack fell from 3% to 2.6% in October. Next month’s comp is -1.5% which means positive yearly growth is very likely to continue.

Growth has been dragged down by residential construction. Residential construction growth has been below overall construction growth since July 2018. Residential growth troughed in February at -11.5%. Growth was 0.5% in October which was the first positive yearly growth reading since August 2018.

However, the 2 year growth stack was -2%. This wasn’t a perfect report. If you’re curious, non-residential construction yearly growth was 1.4%. It obviously outperformed the total to make up for residential weakness.

Even though the housing market has shown signs of life in the past few months, it makes sense that residential construction growth has been weak because home price growth has fallen this year. Even in the latest reading where it increased slightly, the 2 year stack was negative.

Also, in late 2018 there was a glut in housing which suppressed construction. That has been worked off this year. I expect price growth to improve. 2 year growth stacks will improve leading to positive 2 year growth stacks in residential construction. This should occur in Q1 2020.

ADP Report Misses Estimates

October ADP private sector jobs report was revised to show there were 140,000 jobs added instead of 125,000. The November report missed estimates and fell mostly because of very small firms. It showed 67,000 jobs created which missed estimates for 156,000.

As you can see from the chart below, this reading was nowhere near any of the estimates. Even the weakest estimate was too optimistic. It would terrible if the BLS report shows similar results as private sector job creation is expected to be 168,000. This ADP report lowered BLS expectations by 2,000 which isn’t much.

Stocks love when there is low, but solid job creation. Investors want positive job creation, but don’t want the economy to overheat. It would be fine if it missed estimates slightly, but 67,000 would be too cold. It would cause a selloff.

Of the 67,000 jobs created in November, 11,000 were from small firms, 29,000 were from midsized firms, and 27,000 were from large firms. There was a great divergence between other small and very small firms. Very small firms lost 15,000 jobs and other small firms added 25,000 jobs. In 5 of the past 7 monthly reports, very small firms have lost jobs.

This is the weakest period since late 2010 when the economy was just exiting the 2007-09 recession. Yearly growth in very small firm employment was 0.1%; that’s the weakest growth since February 2011. 9,000 of the job losses were in the service sector and 6,000 were in the goods producing sector.

In all business sizes, the service sector added 85,000 jobs and the goods providing sector lost 18,000 jobs. Like usual, the education and healthcare industry led the charge as it added 39,000 jobs. Natural resources & mining, construction, and manufacturing each lost 6,000 jobs.

In November, the leisure and hospitality industry only added 18,000 jobs. In the past few months, some economists have been concerned this low paying industry has been too large of a percentage of total job creation. Professional and business industries have been relatively weak in the past few months. Yearly job creation growth was 2.1%. Besides the previous month, this was the lowest growth rate since November 2017. Growth for this cycle was the lowest in late 2016 when it toughed at 1.6%.

Jobless Claims Crater Even Further

Possibly because of the timing of Thanksgiving, seasonally adjusted jobless claims fell from 213,000 to 203,000 in the week of November 30th. That’s a decline of 25,000 in 2 weeks. The 4 week average fell from 219,750 to 217,750.

It will quickly fall in the next 2 weeks if the weekly reading stays this low. This was the 3rd lowest weekly reading of the cycle. As you can see from the chart below, non-seasonally adjusted claims fell over 100,000 year over year for the first time since 2013. It's obviously because of the timing of Thanksgiving.

Conclusion

Odds of a recession fell probably because of the steep decline in jobless claims. This will help the leading indicators report. Construction growth was weak because of weak housing price growth. Private sector job creation was weak. Very small firms lost jobs for the 5th time in 7 months. Stocks will fall if the BLS report is as weak as the ADP report.

Recent Comments