Huge Rally In Small Caps

Even though the stock market has rallied in the past few weeks, there hasn’t been pure optimism about COVID-19 getting better until Monday. That’s because the work from home stocks such as Amazon and Microsoft along with the bubble stocks like Zoom and Shopify have been leading the charge. These coompanies are so big, they can drive the entire index higher. Top 5 companies are about 21% of the S&P 500.

When you add in some of the smaller players such as the cloud companies, there’s a huge swath of the market driving the index high. Counter to that, the energy companies which have dragged the index lower this year have shrunk as a percentage of it. Many are penny stocks which aren’t in the major indexes other than the Russell 2000. Similarly, retailers have become single digit stocks. Macy’s was just removed from the S&P 500.

If you’re buying Amazon stock because it’s one of the beneficiaries of the new economy, then you’re not really an optimist. You’re not betting on an economic rebound because COVID-19 will be contained. That’s not to say that Amazon won’t do well when things go back to normal. That’s not why many of the recent buyers acquired it. Shopify is up 54% year to date because of the temporary movement towards online shopping for small and medium sized businesses.

When these work from home stocks fall and the brick and mortar retail stocks rally, there is true optimism about the situation getting back to normal. Energy sector rallied even though oil prices crashed. That shows the much-improved sentiment on when the economy will reopen. Texas is planning to allow movie theaters to open in May 1st. Big chains won’t open until late June, but this is an important step for the economy.

Details Of Monday’s Action

The stock market entered the weak overbought, but stocks rallied nicely, with small caps exploding higher. S&P 500 was up 1.47% which means it’s only down 2.09% in the past year. That’s amazing considering the complete shutdown of the economy. Everyone seems to be bearish because of valuations, but the index continues to shoot higher. This was a new high for the recovery rally as the S&P 500 is up 28.68% from its bottom on March 23rd. Personally, I think the market has come too far too fast. Fact that the economy is in shambles is preventing euphoria.

However, usually there isn’t this much of a disconnect between prices and the economy. Stocks forecast the economy, but there’s too much uncertainty for the potential gains you are getting by going long. CNN fear and greed index rose 5 points to 43 which is the very top end of the fear category. If stocks rally on Tuesday, the index will be out of the fear category for the first time since February when the bear market started.

Nasdaq was only up 1.11% because the work from home and big tech stocks had a bad day. Amazon stock fell 1.42%. Bulls should actually root for it to decline. Shopify stock fell 2.27%. On the other hand, Bed Bath and Beyond stock rose 22.56% because it had an 85% boost in online sales.

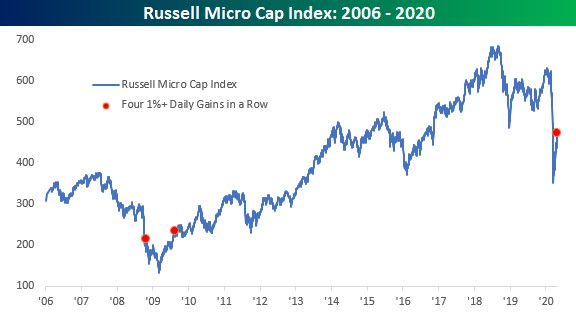

It was a good day in general for retail. Kohl’s was up 17.7% and PVH was up 15.2%. AMC stock was up 10.16%. You want to own the movie theaters if you expect the economy to get back to normal this summer. Russell 2000 was up 3.96%. As you can see from the chart below, the Russell Micro cap index has increased 1% or more 4 days in a row for the 3rd time since 2006. Another spike on Tuesday would be unprecedented. It was up 4.14% on Monday.

Volatility has died in April as predicted. VIX fell 2.64 to 33.29. It’s no longer outlandishly high for the situation we are in. Every sector was up on Monday. Best sectors were the financials and materials which rose 3.61% and 2.64%. Energy was up 2.1% even though oil prices cratered. On Monday, WTI fell $4.16 to $12.78 and Brent fell 6.76% to $19.99. Furthermore, WTI futures fell $1.63 on Tuesday morning to $11.15 and Brent fell 3.9% to $19.21.

As you can see from the chart below, all of the shale plays require much higher oil to drill new wells. They even require higher oil prices to cover existing wells which means there have been a lot of shut ins. This chart shows oil is at $18, but it’s actually at $11. Because shale is the marginal producer of oil, we know that oil prices will spike in the next few quarters.

When demand comes back, supply won’t be able to meet it because the market needs shale. There is a huge glut in oil that needs to be worked though, so we won’t see a recovery in shale production for at least a few months. You can track the glut of oil by reviewing the tanker stocks.

Scorpio Tanker was up 6.56% on Monday for a gain of 79% since April 3rd. Nordic American Tanker was up 23.08% on Monday which means it’s up 106% since April 8th. These are hugely speculative stocks I wouldn’t buy. As soon as this rare glut goes away in a few months, these stocks will crash and burn.

Conclusion

It sounds weird to say that investors finally turned positive on Monday because April has been a great month for stocks. However, it’s true because the brick and mortar retailers rallied and the online retailers fell. Brick and mortar can only do well if the shutdowns are over. They are slowly being rescinded as states like Texas, Alaska, and Georgia are starting to open.

Even New York stated on May 15th construction and manufacturing would begin upstate. Governor Cuomo said when hospitalizations fall for 2 straight weeks, they will look to open up. In NYC, daily new hospitalizations peaked on April 6th.

1 Comment

James Phipps

April 30, 2020Ref: "When demand comes back, supply won’t be able to meet it because the market needs shale. There is a huge glut in oil that needs to be worked though, so we won’t see a recovery in shale production for at least a few months. You can track the glut of oil by reviewing the tanker stocks. " I track the glut in oil buy watching KMI and EPD. But I agree with this write up. Of course it doesn't matter if I agree or disagree. But I do appreciate the article.