Interest rates are rising at an accelerated clip. This leads me to question how long the asset bubbles can last. Currently we are in the midst of a sector rotation. Technology and biotech stocks have been underperforming and financials, energy, and industrials have been increasing. The logic behind the sector rotation does not hold. The narrative is expensive stocks like technology and biotech stocks have their valuations cut during periods of rising interest rates. The problem with that narrative is almost all stocks are expensive. The Shiller PE has only been substantially higher in the 1929 and 1990s bubbles.

One example of an expensive industrial stock is Caterpillar. Today Caterpillar lowered expectations for earnings in 2017. It said EPS estimates of $3.25 were too high. This means Caterpillar stock trades at over 30 times next year’s earnings. The stock did not sell-off today even on that terrible news because of the sector rotation caused by bullishness surrounding Trump’s stimulus.

Besides the equity market, there has also been a bubble built up in autos and housing. Their burst will coincide with a market crash which will only cause the debts Trump plans to pile up to increase even more. As you can see from the chart below, housing prices are even higher than they were in 2006 at the peak. There has been over a 20% rise in housing prices since the recovery started as low interest rates fueled a second bubble. Home prices have increased at an inflation adjusted pace of 5.9% per year since 2012 even as the labor participation rate has remained stubbornly low and millennials struggle to reach the income levels of the previous generation.

Mortgage applications are falling as interest rates recently started increasing. Applications last week fell 9.4% week over week and fell 0.5% year over year. Refinance volume declined 16% week over week and 3% year over year. The chart below shows this decline in refinance activity. Activity has fallen below the seasonal norm signaling the newfound weakness.

If housing prices only rose at such a fast clip because of low interest rates, there will be a burst if they rise higher. It’s amazing how financial stocks have skyrocketed higher because of Trump’s election. Investors are focusing on deregulation and increasing net interest margins while ignoring the bubble pricking that higher interest rates will bring. The chart below shows the decline in mortgage applications in relation to homebuilder stocks. They too are ignoring the weakness and rallying despite it.

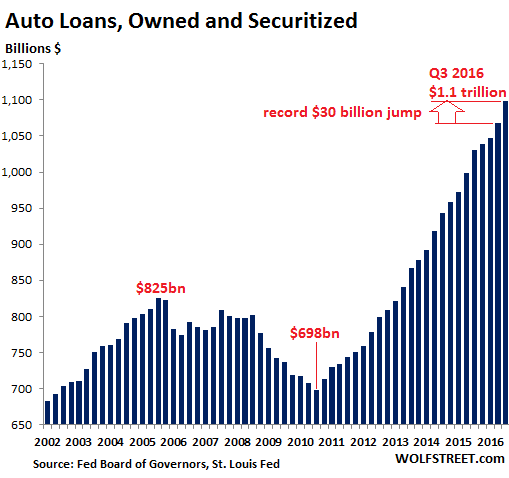

Auto loans have also experienced bubble growth because of low interest rates. As you can see from the chart below, the current $1.1 trillion in auto loans has risen beyond the last economic peak. Auto finance companies have originated 75% of the subprime loans. Whenever it’s not banks originating loans I get nervous. We have seen Signet get into trouble recently for its delinquent loans rising. Signet makes loans for its jewelry. When a business makes loans to fund purchases of its products, there is a bias towards giving out loans to those who can’t afford to pay them back. At the end of the cycle, when it’s tough to find new customers, more loans are usually awarded to those who are the least capable of paying them back. Even with the record $30 billion jump in loans given out in Q3, there was a plateauing of auto sales in the same period. This signals more deals were made with those who can’t afford the loans, just to keep the status quo.

The chart below shows what I have been discussing. It breaks down the credit scores of those taking out auto loans. The only loans that matter are subprime loans because they are the ones which will go delinquent at an increasing rate in a recession. As you can see, loans with a FICO score of less than 620 have reached higher levels than the last peak. The highest credit score loans barely declined during the 2008 financial crash, but it took until 2012 for the weakest borrowers to start getting loans at an increasing rate. In the past few quarters, the weakest borrowers have seen the fastest growth as auto finance companies lower their standards to meet their tough year over year comparisons.

As you can see from the chart below, the weakest borrowers have already seen their delinquencies increase. Auto finance companies must be desperate to hit their numbers if they are willing to accelerate their lending to those with the lowest FICO scores even as that same group is seeing its default rate accelerate higher. This default rate is only about a half of one percent off the peak of the 2008 crisis. I think this next peak will hit higher than last cycle because the bubble is bigger and default rate is already heightened even though we have yet to enter an official recession.

Conclusion

The past few months have been a rising rate environment. If this continues, it can pop the stock, real estate, and auto loan bubble. Banks stocks are rallying even as mortgage applications decline. They are ignoring the possibility of a second housing bubble bursting due to rising interest rates even though housing prices have risen at an unsustainable rate. The past few days have been a sector rotation out of technology and biotech and into industrial, energy, and financials. The entire market needs to sell-off to cleanse the overvaluation which is rampant due to excessive speculation.

Recent Comments