Hugely Positive Day For Stocks

Friday’s action really stuck it to the bears and made them feel terrible. S&P 500 hit a new record high as it increased 0.97%. Stocks have had an amazing year and even the returns since the peak in January 2018 aren’t looking bad.

S&P 500 up 6.75% from that peak. It is up 22.34% year to date and 11.92% in the last year. MSCI ACWI (all country world index) increased 1.02%. Which now puts it just 1 point from its record high (it’s at 76.54). Nasdaq finally surpassed its July 26th record high as it increased 1.13%.

Expect A Pullback Due to Extreme Greed

Now the only major index left to hit a record high is the Russell 2000. It’s still down 8.7% from its record high in August 2018. However, it was up 1.72% on Friday. VIX fell 0.92 to just 12.3. I think now is an amazing time to buy some protection for the short term. It’s potentially looking like the economy will trough in 2H 2019. Many investors are not bearish in the intermediate term. However, many are a bit bearish in the short term.

CNN fear and greed index increased 8 points to 80 which is extreme greed. It can’t get much higher than it is now. This is the highest reading since it touched 80 in January 2018. It's likely the AAII sentiment survey will show there is an above average percentage of bulls in the next survey. I can’t imagine sentiment looking weak. Especially with phase 1 of the trade deal close to being done. And the Nasdaq and S&P 500 both at record highs.

We also don’t need to worry about Q3 earnings season as it is mostly over. So far 356 S&P 500 firms have reported earnings. 75% have beaten EPS estimates and 60% have beaten sales estimates. Non-GAAP EPS growth is 3.58% and sales growth is 4.11%.

It has been a decent quarter in terms of the negative impact on Q4 estimates. Whenever the economy turns, either in Q4 or Q1, we could see huge earnings beats. Q4 GDP growth estimates are extremely weak, so a turnaround then might be out of the cards.

Industrials Ramp 2.21%

With the huge rally, it’s no surprise the only 2 down sectors were utilities and real estate which fell 0.21% and 0.28%. Consumer staples was flat. 2 best sectors were energy and industrials which rose 2.51% and 2.21%. Industrials likely rallied because of the improvements in the manufacturing PMIs. They weren’t great PMIs, but they increased sequentially. That’s an early sign of a potential recovery.

If you wait until the ISM PMI is above 50, you will miss a great percentage of the rally. Also keep in mind that markets cause PMIs to increase. With the latest optimism in markets, I am confident the ISM PMI will get above 50 soon. Financials increased 1.42% explaining the big increase in the Russell 2000.

Healthcare Loses Steam On Warren’s Announcement

Healthcare sector increased only 0.17%. Early in the session it came very close to hitting its record closing high if it stuck with the gains. That ETF is at 94.87 which is just 1 point from its record high. It probably should have rallied because Warren fell in the latest Iowa poll. She went from 28% to 22%. Mayor Pete fell 2 points to 18%. It’s basically a 4-way tie as Biden is at 17% and Sanders is at 19%.

This sector might have given up most of its morning rally because Warren announced the details of her Medicare for All plan. While that’s a negative headline, I don’t see that as bearish because. We already knew she supported this. It’s tough to say what this means for her chances. It definitely puts a target on her back in the debates. Competitors like Biden and Mayor Pete will criticize her plan.

Phase 1 Of Trade Deal Near Completion

Phase 1 of the trade deal with China is almost done. President Trump stated phase 1 of the deal includes 60% of the long term agreement. Chinese Ministry of Commerce stated, there were “serious and constructive” discussions on “core” trade points.

The two sides also discussed arrangements for the next round of talks. Announcement of phase 1 of the deal was going to occur in Chile, but there were protests that prevented that. If the 2 sides just need to find a location, negotiations are in great shape. Obviously, we are still waiting for the details of this deal. That will tell us how serious it is. The market already likes it though as it doesn’t seem concerned about the trade war anymore.

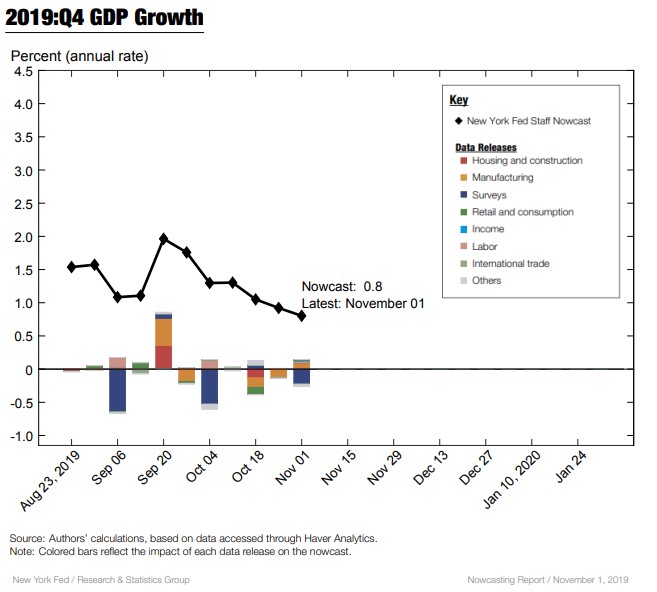

Q4 GDP Estimates Are Very Weak

St. Louis Fed hasn’t come out with a Q4 Nowcast yet. It’s the least accurate anyway. Atlanta Fed Nowcast is very low as it fell from 1.5% to 1.1%. Monthly jobs report, the ISM manufacturing report, and the construction spending report caused the estimates for real personal consumption expenditures growth to fall. It fell from 2.3% to 2.2%. An estimates for real gross private domestic investment growth fell from -0.7% to -2.5%.

NY Fed’s Q3 estimate ended at 1.93% which means it was accurate. Q4 Nowcast hopefully won’t be accurate as it is terrible. As you can see from the chart above, it fell from 0.92% to 0.8% which is its lowest estimate all year. If growth ends up this low, it will be the weakest growth in 4 years.

This would be a huge score for the bears which have been rampaged by the rally recently. It fell 12 basis points because if the ISM PMI. PMI caused it to fall 23 basis points. That’s more than the entire decline. It’s interesting because the ISM PMI called for 1.6% GDP growth. That's double the NY Fed’s projection.

Recent Comments