October New Home Sales - Amazon Takes Everything

Before we get into October new home sales, let's review the overall market action over the past few days.

Amazing is gaining an increasingly large piece of the retail pie. It is nabbing a huge percentage of retail growth.

As you can see from the chart below, S&P 500 retailers plus food and staples retailers is expected to have 15% earnings growth in Q4. Without Amazon, growth will only be 6.8%.

Amazon dominates online sales which are taking share from brick and mortar stores. Since Amazon gets a huge portion of its earnings from its cloud division, the picture is muddied. Because of this, it may simply be better to say retail earnings growth isn’t expected to grow in the double digits.

That’s interesting considering the strong sales growth seen in the Redbook report for the week of Black Friday. I think this will be a great holiday shopping season since wages are growing quickly while inflation falls. It’s possible these estimates are too pessimistic.

October New Home Sales - Q3 GDP Revised

Q3 is far in the rearview mirror, but it’s still worth following the GDP updates. They are closer to reality than the initial reading.

Sometimes the revisions give you new information. The first Q3 GDP revision kept GDP growth at the same rate which was 3.5%. The price index stayed at 1.7%. Real consumer spending growth was revised from 4% to 3.6% which missed estimates for 3.7% growth.

Its contribution to GDP growth fell almost 2 tenths to 2.45%. This is important since the consumer is expected to keep its momentum going in Q4. The main difference between Q3 and Q4 is gas prices are much lower. Spending on gas still counts as part of consumption spending in GDP just to be clear.

As you can see from the chart above, inventories were a big boost to GDP growth and imports were a big laggard. Inventories helped GDP growth by 2.27% and imports hurt GDP growth by 1.91%.

October New Home Sales - Residential investment hurt GDP growth by 0.1%.

The recent weakness in housing suggests that might get worse in the next few quarters.

Business investment wasn’t as bad as initially expected as it helped growth by 0.35%. That’s important because it means the drop off in growth caused by the fiscal stimulus wasn’t as big as initially reported.

Since the fiscal stimulus will boost spending even less in Q4, I wouldn’t be surprised to see investment growth slow further. Government spending added 0.44% to GDP which is slightly less than the initial report.

Overall, the 2 main takeaways from this update are consumer spending was less than initially reported and business investment was a bit stronger than first reported.

October New Home Sales - Q3 Corporate Profit Growth Falls

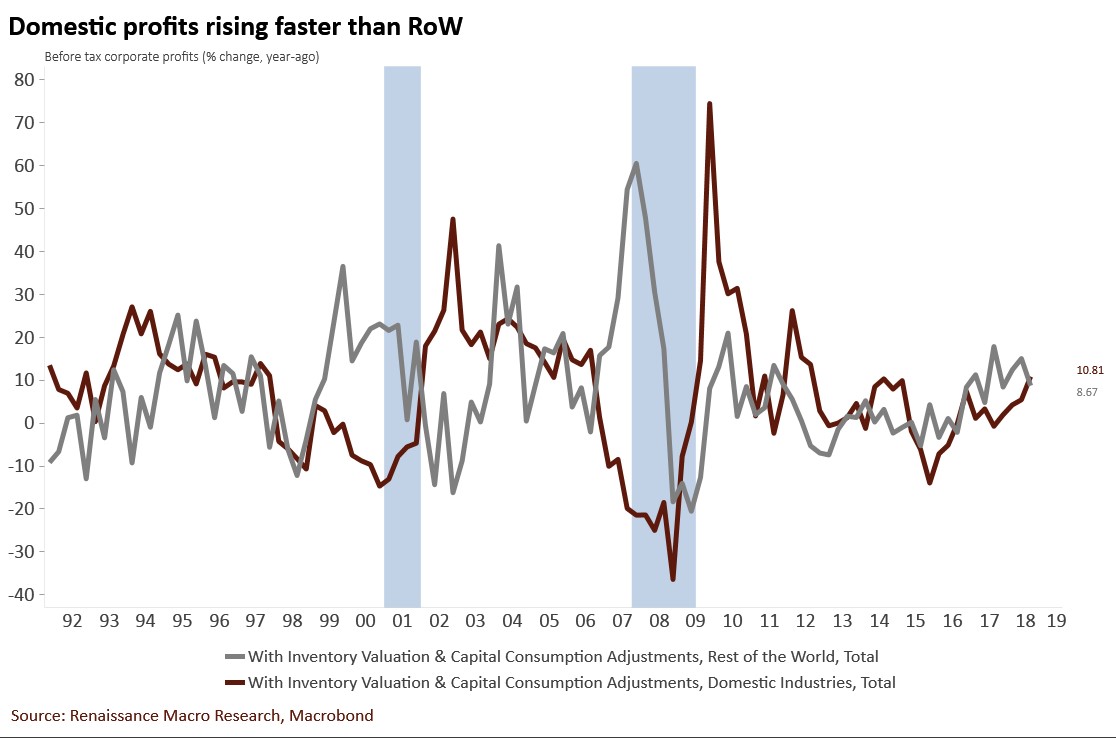

Even though S&P 500 EPS growth in Q3 was over 30%, corporate profit growth fell from 6.4% to 5.9%.

Keep in mind, corporate profits include more than just S&P 500 firms and they aren’t adjusted for buybacks like EPS is. It’s also notable that the headline growth number doesn’t include inventory valuation and capital consumption adjustments.

Including those changes, pre-tax corporate profit growth was 10.3%. After tax corporate profit growth was up 19.4%. Taxes on corporate income fell 32.9% partially because of the lower tax rate.

As you can see from the chart below, domestic industry profits are now growing faster than profits from the rest of the world.

October New Home Sales - International Trade In Goods Report Shows Deficit Increased

The trade deficit increased even as President Trump is trying to utilize tariffs to lower it. The trade deficit increased from $76 billion to $77.2 billion in October.

Ultimately, I still think a trade deal will be worked out because both sides need one. With global growth slowing, politicians don’t want to add to the weakness. Trade pulled down Q3 GDP growth by almost 2%. It could do the same in Q4 if the deficit remains similar in the next two months.

Exports were down 0.6% which was much lower than September’s 2% growth. They were still up 7.8% year over year in October.

Possibly because of the tariffs, food, feeds, and beverages exports were down 6.8% monthly and 2.8% yearly. Exports of capital goods and autos fell, and exports of industrial supplies were up.

Imports were up 0.1% monthly which was below the 1.7% growth in September. Slowing import and export growth is in tune with the WTO outlook which Q4 expects global trade growth to be below trend.

Like exports, imports were up sharply on a year over basis as they increased 10%. Imports of consumer goods were up 3.5% and imports of autos were up 2.3%. Those are key parts of the trade disputes. Imports of capital goods fell sharply.

October New Home Sales - New Home Sales Fall

As you can see in the chart below, October single family home sales were 544,000 which missed estimates for 575,000.

They were below the lowest estimate which was 553,000. As you can see, this was a 12% year over year decline. This is down from the November 2017 peak of 712,000.

The only good news from this report was that September new home sales were revised from 553,000 to 597,000.

Median prices fell 3.6% to $309,700. Year over year prices fell 3.1% which shows new home prices are much weaker than existing home prices. 336,000 units of supply came into the market. It spiked inventories because sales growth was negative.

Supply relative to sales increased from 6.5 month in September to 7.4 months in October. The higher this ratio goes, the more prices will fall. Sales fell in each region. They fell 7.7% in the south possibly because of hurricane Michael.

However, the sharper declines in the northeast and Midwest can’t be blamed on the weather.

October New Home Sales - Conclusion

The housing market is continuing to weaken which will hurt residential investment.

Some good news is business investment isn’t slowing as much as we thought. However, some bad news is consumer spending growth wasn’t as strong as we thought. I think this holiday shopping season will be fantastic.

Amazon is going to be the biggest beneficiary of this growth since it is taking so much share.

Recent Comments