Dividends Meet Options

If you’ve made an option trade, you’ve probably seen the disclaimer warning of potential dividend risk. Most probably gloss over that information and never consider how their option trades could be impacted. However, we got flooded with emails last week asking questions about this type of risk, which was a great to see. In response to the quest for information on this subject, I took one of my sessions last week to outline the risks and some rules of thumb. Now I’m bringing this information to the blog!

Dividend dates

Before you can really have a discussion of dividend risk in options, you need to understand the relevant dates. A company will frequently declare a dividend following their earnings report. This declaration includes a the amount along with the record date and the pay date.

The record date is when the company will record all of their shareholders of record. That makes sense that they’re not doling out cash to just anybody, but what does it take to become a shareholder of record?

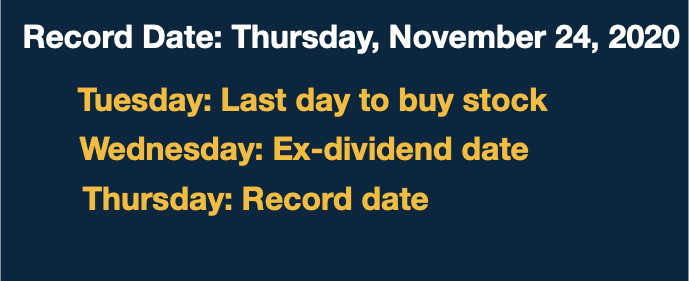

In order to understand this, you need to understand the process of being officially recognized as a shareholder. This is usually described as T+2 or trade plus two days. For virtually all non-OTC stocks it takes two days following the trade date for you to be officially recognized as the shareholder of record.

Understanding T+2 allows you to arrive at the ex-dividend date. The ex-dividend date is the date in which the stock is purchased, you won’t be recognized as shareholder of record on the record date. This is the date the stock will drop by approximately the amount of the dividend. For example, if the dividend is $1, the stock will fall by approximately $1 on the ex-dividend date. That means that you would need to purchase the stock the day before the ex-dividend date in order to get recognized and paid. The image below breaks this down.

Dividend Risk

Now that you know the dates of interest, let’s talk about how it impacts the options. Here are a few affects to consider:

- Extrinsic value of the options is adjusted for the decline in the stock price on the ex-dividend date

- Traders who are short on the ex-dividend date have to pay the dividend

- Short calls are the only option that carries “dividend risk”

Since the stock declines on the ex-dividend date, the call option extrinsic value will be lowered relative to the put option extrinsic. If the dividend is big enough, it will require the strikes to be adjusted as in what typically happens following.

The process for shorting involves borrowing the shares from the broker and selling it. That means that margin account holders at the broker may have just had their stock sold and the dividend would need to be replaced. In this circumstance, the trader who is short shares of the underlying stock will be replacing the dividend.

You may be wondering why call sellers are exposed to dividend risk. This happens because of the obligation of the call seller. The call option buyer has the right to buy 100 shares of the underlying stock per contract. Since the call option seller was paid the premium, they are then obligated to provide the shares to the call option buyer if exercised. Depending on when the option is exercised, this may cause the call option seller to be short 100 shares of the stock per contract if the shares aren’t currently owned.

Dividend Risk & Assignment

The risk of an option seller of having an early assignment occur on the day before the ex-dividend date is where the risk comes in. That means that the call option seller becomes short shares of stock on the ex-dividend date. As was already discussed, that means that they will pay the dividend. This can be particularly troublesome if the short call was part of a spread trade and the dividend is particularly large. This could cause you to lose more than your max loss.

In order to better understand this, let’s talk about when early assignment of a call option is likely to occur. Here are a couple of conditions that makes the chance more likely:

- Short call is in-the-money (ITM)

- Extrinsic value of the call is less than the dividend

There is no incentive to exercise an out-of-the-money (OTM) call option. This is because the call option buyer who exercised will be paying more for the stock than it is selling in the market. That means only ITM calls will likely be exercised.

When an option is exercised, the option owner will only realize the intrinsic value of the call option and the extrinsic value is lost. That means that they would need to be compensated for their loss. This is where consideration of the dividend is important. In this case, the dividend would need to replace the lost extrinsic value at a minimum.

Dividend Risk Example

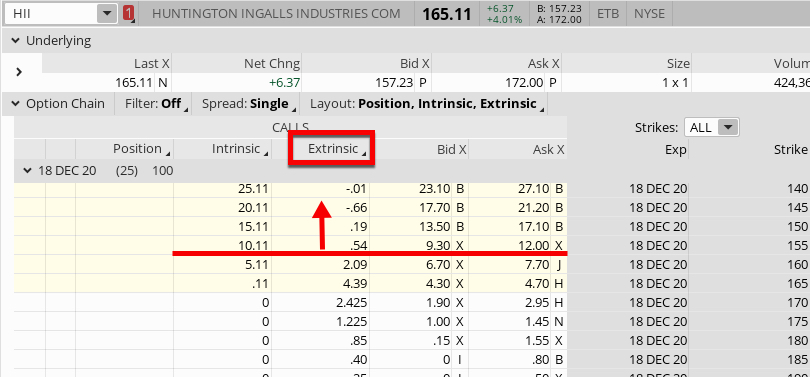

Here is an example using Huntington Ingalls Industries Inc (NYSE: HII). The company is set to go ex-dividend on November 25, and they pay a $1.14 dividend. Looking at the option chain for the December expiration will give you a sense of which options might have a greater chance of being exercised early.

As you look at the extrinsic value column, you’ll notice that the 18 DEC 20 $155 call strike price has extrinsic value of $0.54. That amount is much less than the dividend of $1.14, which means that there is some risk of early exercise. The $160 call option has $2.09, which won’t be able to be replaced and so has very little chance of early exercise. In this case, all of the strike prices at $155 or less has a chance of early exercise.

What would typically happen is that the option would be exercised Tuesday afternoon. This would leave the option seller short on the ex-dividend date on Wednesday. That event would require the call option seller to pay the dividend.

Conclusion

It’s important to understand dividend risk as a call option seller. This will allow you to know when you should close a trade early. Hopefully, this will prevent the potential for early assignment and being short on the ex-date. This is a big reason for selling OTM call options and having rules surrounding closing before expiration. This helps prevent the instances where early exercise will be more likely. Hopefully, this serves as a primer on the subject to help keep you from having to accidentally pay the dividend in the future.

Learn how to deal with uncertain markets by learning about the Vomma Zone. Not a subscriber? Become a TheoTrade member.

1 Comment

Stephen Brennom

November 24, 2020Good topic with a clear explanation. Thanks. On an anecdotal note for a stock that isn't wanted as a holder, with the advent of no-fee stock trades, low-or-no-cost options trades and no assignment fees, there can be some circumstances when setting up and executing a combo covered call a few days before the ex-div date and embracing early assignment rather than avoiding it can produce a better return than a comparable cash-covered Put sale.