Extreme Euphoria Is Back

With the rally in stocks on Wednesday, investors have once again become extremely bearish in the short term. Stocks are even more overbought than they were before that 3 day decline in late November. As of Tuesday, the 14 day RSI was at 74.4. With the rally on Wednesday, I’m guessing it hit 76 which would be the highest reading since January 2018.

On Wednesday, the CNN fear and greed index increased 9 points to 78 which is extreme greed. VIX category is still neutral, but it’s actually exhibiting extreme greed.

VIX was up 0.21 to 11.75. This put the streak of the VIX being below 15 at 33 trading sessions. It’s half the length of the fall 2018 streak, but it feels like stocks are very close to a correction.

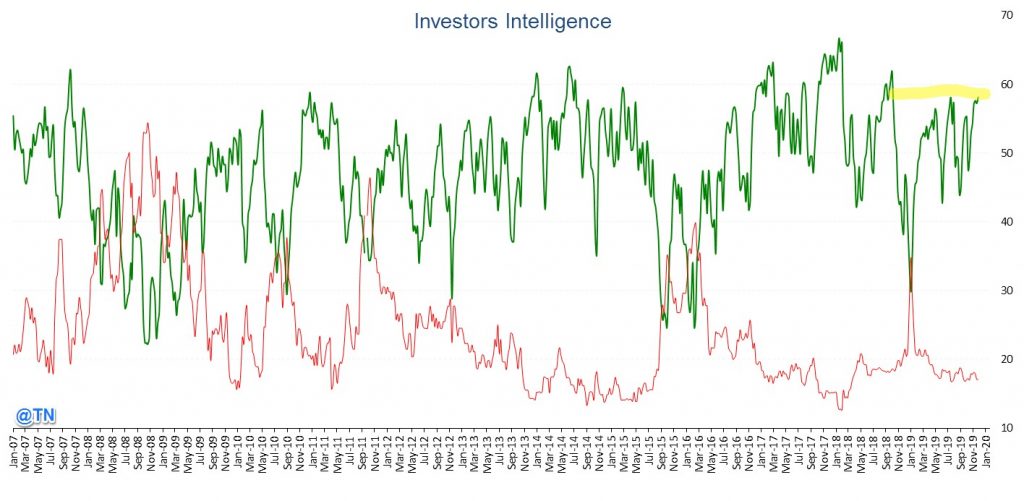

As you can see from the chart below, the Investors Intelligence sentiment survey showed there were 58.1% bulls and 17.1% bears. Percentage of bulls was the highest since October 2018. It’s no surprise the high for the cycle was in January 2018.

S&P 500 followed its 3 day losing streak with a 4 day winning streak as it is up 25.8% year to date. Personally, I don’t think it will beat 2013’s performance. Especially since I see a 5% correction coming in December.

As you can see from the chart below, the 20 day average of the intermediate term optimism index is extremely high. When it was this high in the past 21 years, the S&P 500 fell 73% of the time in the following week. And the VIX jumped 82% of the time in the following 2-4 weeks. An increase in the VIX wouldn’t be a big deal because it’s so low. Even without a correction, I’d expect it to increase. It was up on Wednesday even though the S&P 500 increased 0.42%.

Details Of Thanksgiving Eve Action

Nasdaq increased 0.66% to another record high. It’s up 31.2% year to date. Russell 2000 got even closer to its record high as it increased 0.61%. It’s up 21.17% year to date and is down 6.1% from its record high last year. There is currently a 62.4% chance of a rate cut next year.

There hasn’t been much movement in the Fed funds futures market because the bond market has been stable while stocks have exploded. 10 year yield increased 3 basis points on Wednesday to 1.77%, but it’s still down from its recent high in mid November. 2 year yield rose 4 basis points, putting it only 14 basis points below the 10 year yield.

The only down sector on Wednesday was the industrials which fell 0.18%. Best sectors were consumer discretionary and communication services which rose 0.83% and 0.63%. Healthcare sector rose 0.48%. Many think it’s going to start reacting to how Bernie Sanders does in the polls instead of Warren.

As you can see from the chart below, Warren has recently fallen below Sanders in the polls. PredictIt shows both have a 17% chance of winning. The dotted line shows when Warren unveiled her Medicare for All plan. If that’s why she fell in the polls, the healthcare stocks have nothing to worry about. No politician who supports that plan will win.

A betting market shows Kamala Harris, Julian Castro, and Cory Booker are likely to drop out soon, that there will be 8 candidates in the December debate, and that there is an 87% chance Yang makes the December debate.

Dallas Fed Index Improves, But Is Still Negative

November Dallas Fed manufacturing report’s general activity index rose from -5.1 to -1.3 which beat estimates for -2.5. Despite this increase, the production and shipments indexes were down 6.9 and 10.5 points to -2.4 and -4.5. New orders index was up 1.2 to -3. Even though we’ve seen some optimism in other business sentiment reports, this one’s company outlook index cratered 10.9 points to -2.1.

Plus, the outlook uncertainty index rose 5 points to 17.1. This is the exact opposite of the Kansas City Fed report. This report is weird because it’s common to see the outlook index differ from the 6 month expectations index. Expectations’ general business activity index rose 4.9 points to 7.3. Production index was up 1.7 to 31.3. Shipments and capex indexes were down 3 and 13.1 points to 26.2 and 9.8.

In the comments section of this report tariffs were mentioned 7 times and the 2020 election was mentioned 6 times. It’s clear the election is increasingly on business leaders’ minds. It seems like businesses are worried about left-leaning candidates such as Warren and Sanders.

If Biden or Buttigieg win the nomination, there might be less uncertainty. One fabricated metal product firm stated, “The most significant risk is political risk that could manifest through consumer sentiment.” We’ve recently seen Democrats become more confident and Republicans lose confidence.

Another fabricated metals firm stated, “Since policymakers, talking heads and the media have stopped talking about a recession on the horizon and shifted their focus to other topics, it's become clear that businesses are not experiencing the predicted turmoil.

Many small business owners are continuing to create jobs, raise wages and grow their businesses thanks to tax cuts and deregulation. A big thing that continues to hold us back is finding qualified workers.” I haven’t seen many optimistic calls on the economy other than from the stock market. I still see recession predictions. They might go away at in 2020.

Conclusion

There is extreme euphoria in the stock market. Don’t get confused and think the stock market is due for a 20% or more decline because investors are very optimistic. A 5% decline can wash away many of the bulls.

It looks like Biden is doing well in the Democratic primary, but there is still time for Buttigieg and Sanders to catch up. Dallas Fed manufacturing index rose, but was still negative. All eyes are on the ISM manufacturing PMI which comes out on Monday December 2nd.

Recent Comments