S&P 500 Has A Great Year In 3 Weeks

The stock market has already had a good performance for the year with about 3 weeks in the books. The 6.22% return in the S&P 500 this year means the market has already pushed passed some full year projections. The euphoria is real as the market not only has the record streak without a 3% and 5% correction, it also has a record streak without a 2% correction as the last one occurred 5 months ago.

M&A Is On A Torrid Pace

Bank of America raised its S&P 500 year end target from 2,800 to 3,000 as the S&P 500 is already at 2,837.90. Bank of America is too scared to be caught looking bearish, so it quickly capitulated and increased the target based on momentum. I think year end price targets should be made based on earnings projections and the economy. We’ve barely gotten much information on either as the earnings season for Q4 has just started and many of the economic metrics from January haven’t been released yet.

Besides saying 2018 might be the year of euphoria, which it probably is, Bank of America said 2018 might be a year with record merger activity. As you can see from the chart below, 2018 looks like it will be a strong year for M&A as the volume of global deals from January 1st to January 22nd was $146.6 billion which is the quickest pace since 2000 which had $374 billion in that period. The trajectory of M&A has been up 6 years, but the tax cuts and repatriation holiday also play a role in this increased activity.

Investors Are Heavily Overweight Stocks In Relation To Bonds

Bank of America said fund managers’ cash allocation is at 4.4% which is a 5 year low and its indicator which measures analysts’ equity allocation recommendation percentage is up 5%. Despite this negative information which signals the bull cycle is almost over, Bank of America says the ‘great rotation’ out of bonds and into stocks hasn’t happened, so the bull run isn’t about to end. This is a bizarre point to make because the market is already expensive. You can’t say stocks are expensive because yields are low and simultaneously say stocks will go up when fund mangers sell bonds.

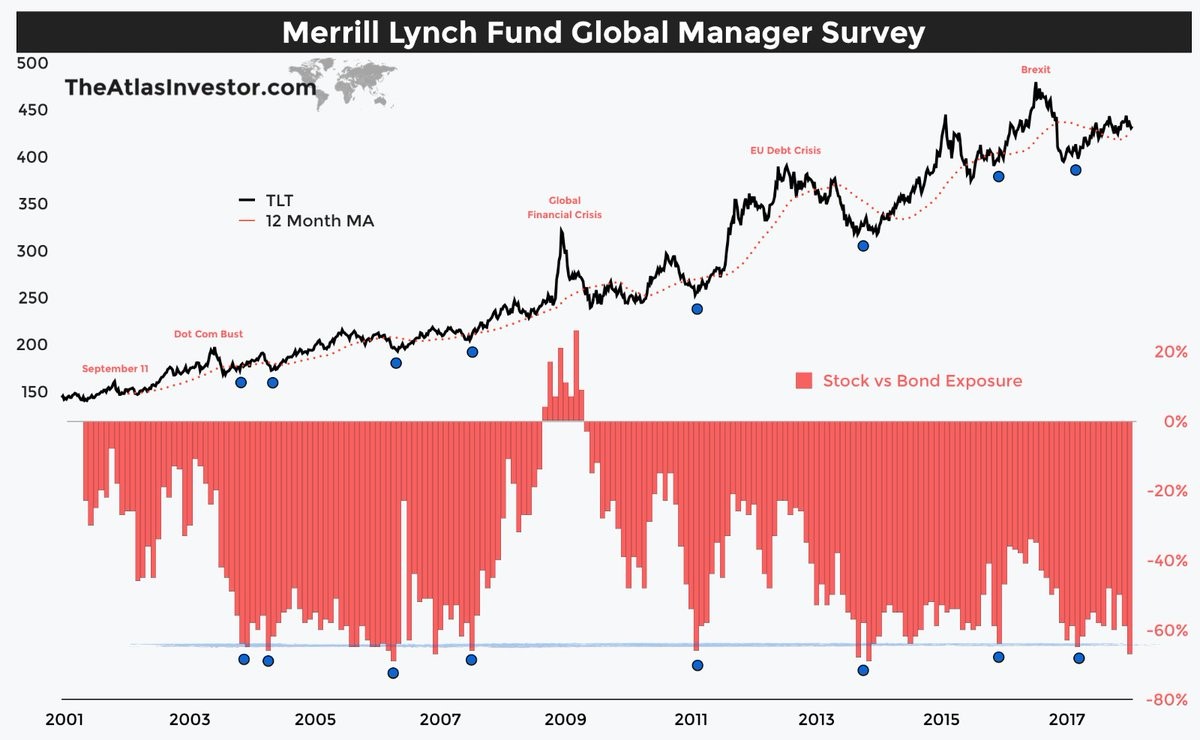

Secondly, the contrarian trade isn’t to go long stocks at the expense of bonds; it’s the reverse. As you can see in the chart below, the Merrill Lynch global manager survey shows fund managers are extremely overweight stocks in relation to bonds. I think yields can move higher, but it’d be a mistake to think stocks will get another wave of inflows because of this change. The conditions for the equity market are as good as they can get.

To further support the point that investors are already putting money in stocks and taking it out of bonds, the chart below shows 10 year treasuries had their worst risk adjusted total returns to start a year in their history (going back to 1962). If the ‘great rotation’ hasn’t started yet, like Bank of America says, then why are stocks having an amazing month and treasuries having a terrible month?

Is The ‘Great Rotation’ A Myth?

The entire ‘great rotation’ thesis is quite controversial. I disagree with the point that money will come out of bonds and into stocks for the same reason I believe that the cash on the sidelines argument is illogical. Just like how the cash that comes ‘off the sidelines’ and goes into stocks ends up in the pockets of investors who sold their stocks, the bonds that are sold to finance equity investments are bought by other investors. There will always be cash on the sidelines and there will always be investors buying bonds. The other point which goes against this ‘great rotation’ theory is that when bond investors sell their bonds, they don’t automatically put their money into stocks. They think of bonds as assets with not a lot of risk and stocks as fairly risky, so they put the money in other investments that they think aren’t risky.

To summarize, I don’t think saying the ‘great rotation’ hasn’t happened yet is a good justification for saying the bull market isn’t close to over. Firstly, managers are very heavily weighted in equities, secondly treasury bonds are selling off, and thirdly, I don’t think the concept is valid.

Did Netflix Have A Good Quarter?

Staying with the thesis that momentum in stocks has gotten overdone, Netflix stock is up 30.39% year to date. The firm reported earnings on Mondaywhere it met estimates for 41 cents of EPS and beat revenue estimates by $10 million as they were $3.29 billion. Domestic streaming net adds were 1.98 million which beat estimates for 1.29 million. International streaming net adds were 6.36 million which beat estimates for 5.10 million. The free cash flow loss was $524 million. Surprisingly the estimate was for an even worse number as analysts expected a $742 million loss.

Some are questioning if this beat actually was a beat. That is because the company added 2 million free trial subscribers. About 75% of those free subscribers have stayed on in the past, but the company added $10 billion in market cap because of this report which comes out to $5,000 per subscriber which added to the beat. It would take 35 years of those subscribers paying the monthly fee to make $10 billion in revenues.

Netflix has always been a quandary for value investors because it is a momentum name. The fact that Netflix stock is going up has as much to do with the speculative mood of the market as it has to do with the fundamental performance of the business. It is the first of the FAANG stocks to report earnings. The rest of the results next week will play a big part in how the first quarter shapes up for equities.

Recent Comments