Jesse Felder recently shared the chart below which supports the same narrative which has been going on in bearish circles for months. The bears believe we are in another housing bubble. They never met an asset which they didn’t think was in a bubble. As you can see in the chart below, the residential housing index is higher than the 2007 top and the commercial index is much higher than the 2008 top. The key to understand is that just because prices are at higher levels than previous bubbles doesn’t mean they are in another bubble. For example, if Snap were to start earning money in 2018, the stock wouldn’t be destined to fall if it rose back to the mid-$20s again. Looking at prices and calling something a bubble is lazy.

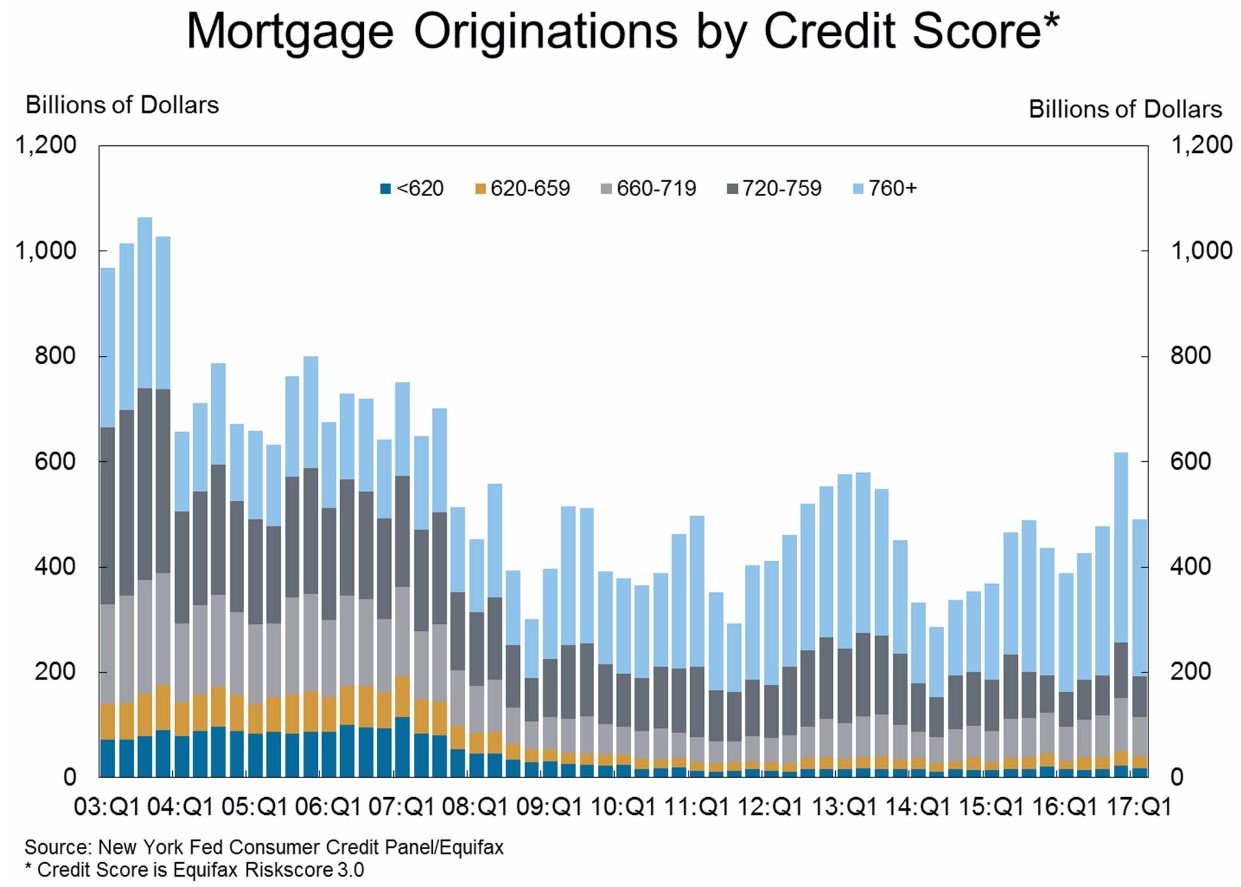

To be clear, if interest rates rise and the labor market weakens because of a recession, there’s going to be weakness in the housing market. If corporate earnings start tanking, then commercial real estate will fall. You can see the recent slowing of the price increases in commercial real estate as the earnings recession took hold in 2015-2016. Everything that rises and falls isn’t necessarily a bubble. A bubble is artificial and irrational buying of an asset usually because of government policy. The demand isn’t sustainable and will crack at the first sign of any weakness in the economy; it could even cause a recession itself. As you can see from the chart below, the mortgage applications in this cycle are much more heavily skewed to borrowers with higher credit scores than in the 2000s bubble. Therefore, housing isn’t in a bubble again. Also, the homeownership rate is much lower. It peaked at 69.2% and now it’s at 63.7%.

Thinking housing is in a bubble is suffering from recency bias. People get paranoid that the same crash will happen again. This paranoia is the exact reason why it won’t happen again. Millennials don’t value owning a house like their parents do. However, it could be the case of them not being able to afford a house more than changing values. This type of apathy that’s prevalent in this generation is not the sign of a bubble. Signs of unbridled enthusiasm exist in the cryptocurrency space. There’s also a weird feeling skeptical bullishness when it comes to stocks. Most investors admit that stocks are expensive, but they can’t imagine a world where stocks fall. It’s like the stock market had a party, but the party never ended when the day ended. Investors who think it’s too good to be true have been destroyed by those who don’t question why it’s happening.

In the short-term some bears are the most bullish investors on Wall Street as I’ve seen many calling for a melt-up. A melt-up is when stocks rally fiercely right before the top. When looking at the possibility of a melt-up you must define the specifics of the term to determine its likelihood. I would describe it as an over 20% appreciation in the S&P 500 in less than 6 months. We’ve come close to that as the S&P 500 is up 18.56% since the election. I would be shocked if stocks moved up 20% in the next 6 months because year over year earnings growth is about to start slowing. The only time I’ve seen very optimistic stock market forecasts of this nature is when investors overestimate the positive effect that tax cuts and the repatriation holiday will bring. The chance of Congress doing anything on fiscal policy is falling by the day.

I have described the chance of a large rally in logical terms, however, it’s worth noting that a melt-up is irrational; there wouldn’t need to be an underpinning of the rally. The definition of illogical behavior is that it can’t be predicted. That’s why it’s tough to predict where Tesla stock or ethereum will go in the short term. It seems the bears have shifted from predicting an unlikely 1987 style crash to an equally unlikely 1999 style rush higher. These types of predictions are fun to make, but if you can’t rationalize why a move will happen, it shouldn’t be discussed in a serious manner as a reasonable outcome.

The final point I would like to make is that bears often have a bait and switch when they make arguments. Don’t fall for hypocritical arguments. One example is when the bears talk about how badly the recent IPOs Snap and Blue apron are doing. Then they talk about how there’s excessive speculation. You can’t say capital markets are bad and then say there’s too much optimism. The reality is those IPOs were unsuccessful because they are bad businesses. However, there are plenty of good businesses doing well. There is a lot of optimism in stocks as people expect them to move up, like I mentioned earlier. However, the fact that a money losing social network is seeing its stock plunge has no relation to the stock market overall.

Secondly, the bears highlight bad trends and use them to explain the whole economy. The latest story is about how bad AMC is doing and how bad movie box office numbers are. I’d argue that this weakness is being caused by Netflix, Hulu, and YouTube. It’s so easy to access entertainment on smartphones, making movie theaters lose their appeal. This could be a disaster for malls because many have added movie theaters to try to make up for the lost traffic coming from the demise of retail.

Conclusion

We looked at some of the illogical bearish arguments which are made. High real estate prices don’t mean we’re in a bubble. Crashes in recent IPOs don’t mean the market is about to crash. There’s no logic to expecting a melt-up. Finally, the demise of some industries like movie theaters don’t mean the consumer is in dire straits. I wouldn’t say the consumer is in perfect shape, but clearly the weakness in box office sales is coming from shifting preferences.

Recent Comments