CEO Confidence Is High?

Let's review the details of the coronavirus, valuations, and the decline in rates. Skittishness in markets is potentially unlike anything we have seen in the last 10 years. Last year, CEO confidence was pointed out by the bears as a signal of a recession. Low confidence needs to be combined with other factors for there to be a recession. They lost confidence because of the trade war.

To be clear, if there is a recession in 2020 because of the coronavirus pandemic, this bear call doesn’t suddenly become right. CEOs weren’t bearish in the summer of 2019 because of the coronavirus which appeared about 6 months later.

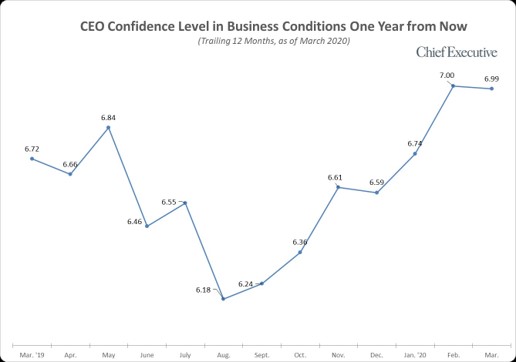

As you can see from the chart below, CEO confidence in business conditions in the next year bottomed in August and has since moved higher. This confidence is rated on a 1-10 scale. Even in March, confidence was high. This sustained optimism is based on the beliefs that the coronavirus will subside. And that trade negotiations with China will continue. Firms will need to find new ways to support their supply chain, but clearly this wasn’t enough to make CEOs pessimistic.

CEO confidence in the next year is high, but current conditions aren’t as great. Current conditions index fell 7.5% to 6.6/10 which was the lowest reading since September 2017. It’s clear the economic data will plummet in March. Personally, I think the economic data bottomed in February in China, will bottom in March for Italy, and in April for America. Italy is experiencing the worst of the virus now. While America and the rest of Europe are up next unfortunately. Good news is the situation is under control in China and almost under control in South Korea.

The chart below shows how the coronavirus is impacting CEO confidence. As you can see, only 17% said it had a severe impact on their confidence. 24% said it was major. 28% said it was minor or insignificant. All stocks are falling because of the coronavirus. Personally, I’d rather buy a stock that’s down 20% that will experience a minor impact than a company that’s down 40% that will experience a major impact.

President of Parr Instrument Company stated, the current economy is weak and gave it a 4/10 rating. He said, the environment had an “extremely weak start to 2020. China is in a severe downturn…coronavirus hysteria is killing economic activity, and a recession is likely to follow. Too much uncertainty in the marketplace with an election year thrown in on top of it all.”

Another CEO, who runs a mid-sized industrial supplier, gave it a 5/10 and said the trade wars are being “further exacerbated by the global coronavirus outbreak.” I disagree. I think the coronavirus makes it more likely countries will work together because they have to.

If President Trump put a new tariff on China, the market would fall further. He has more pressing matters to attend to. He must stimulate the economy and prevent the outbreak from getting worse.

CEOs were also asked about the stock market correction. Keep in mind, this survey was from March 3rd to the 5th, so it doesn’t include the massive decline on Monday March 9th. I’m guessing that decline caused every CEO to be very concerned. The correction was deemed insignificant by 18% of CEOs. And severe by only 4%. 26% said market volatility had a minor impact on confidence and 16% said it had a major impact.

It's not surprising because a normal correction shouldn’t cause trouble. Now that it has gotten larger, it's likely well over 10% said it had a severe impact. 58% said this was an overreaction that will resolve in the near term and only 22% said it was warranted because of the coronavirus. Some CEOs are probably uncertain about that prediction now.

Investors - Very Bullish?

Several investors have become very bullish on stocks. To me very bullish means to expect much more than a 10% rise in stocks in the next year. Many are bullish because of valuations. Earnings will be weak in 2020, but by the 2nd half of the year, investors will look past the weakness. They will look at 2021 earnings which will have easy comps. At worst, this will be a mild recession. Stocks are coming close to pricing in the worst-case scenario.

As you can see from the chart below, the stock market had a very expensive 19.1 PE at the top. Now it only has a 15.8 PE which is reasonable. Keep in mind that when energy has a small weighting in the index, overall PE is higher because energy stocks are value stocks. Energy has the lowest weighting in decades. Personally, I prefer other low PE stocks than those in the energy sector.

The stock market is the cheapest versus the bond market since March 2009 which is the bottom in the market. As you can see from the chart below, the S&P 500’s dividend yield is 1.65% above the 10 year yield. However, keep in mind this data excludes earlier in the 20th century when dividend yields being above the 10 year yield was normal.

Some investors say that stocks aren’t cheap. It’s just that treasuries are very expensive. Treasures are extremely overbought in the near term. However, demographics and low growth have been pushing yields lower for longer. It's unlikely the 10 year will hit 4% or anything wild like that.

If the 10 year yield rose to 1.5%, it would still be below the S&P 500 while not being that expensive. I’m very confident the bottom PE multiple of 13.6, hit in December 2018, won’t be reached. The market is mostly done with this correction, but let's not call for a bottom just yet.

Recent Comments