Chinese Newspaper - Another Decline On Wednesday

After a Chinese Newspaper issued a warning, stocks took a dive. S&P 500 has now had its first 5% decline of the year as it fell 0.69% on Wednesday. It is down 5.5% since April 30th. That pushed the CNN fear and greed index down another 2 points to 23 which is extreme fear.

Personally, I don’t see investors at that stage yet. However, we are seeing the first signs of worry. I can easily see a short term bounce, but stocks are headed lower in the intermediate term.

You can’t have stocks rally with negative trade war headlines, weak economic reports, and terrible earnings revisions. GDP growth in Q2 will likely be below 2%. Q2 EPS growth will likely be negative. And there won’t be a trade deal in the next few weeks.

Ships that left China on May 10th are now reaching America and paying the 25% tax. The first real impactful tariffs are now hurting an economy that already is mired in a slowdown. For investors to get bullish, we need either stocks to fall at least 10%, or there to be a trade deal. Or for earnings estimates to stabilize, or even economic reports to be consistent with above 2% GDP growth.

Trade War Gets Worse

Chinese Newspaper - With the recent economic weakness and the 5.5% decline in the S&P 500, President Trump’s negotiating position just went up in flames. I think that’s why we’re seeing negative comments from China recently. We don't know if Trump will give in at all. But it would be beneficial for him in the short run. Trump is up for re-election in 17 months.

If he doesn’t make a deal now, the economy could go into a recession, which would hurt his chances. If he does make a deal, there could be a burst in economic activity in the 2nd half of 2019. That could last until November 2020.

Regardless of what deal President Trump makes, he will spin it as a big positive just like he has with his deal with Canada and Mexico. He won’t be able to run on no deal.

The People’s Daily, which is the official newspaper of the Chinese Communist Party, stated “We advise the U.S. side not to underestimate the Chinese side’s ability to safeguard its development rights and interests. Don’t say we didn’t warn you! United States, don’t underestimate China’s ability to strike back.”

It’s not a far leap to suggest Chinese leaders agree with this statement.

Chinese Newspaper - Threats from China are growing which means the chances of a deal anytime soon have diminished.

Chinese Newspaper - A scary part of the article from this newspaper is that the phrase ‘don’t say we didn’t warn you’ has only been used 2 other times in history and both of those times were used prior to full-on wars. It would be tragic if this trade war became a real war. I don’t anticipate that occurring, but it is a tail risk.

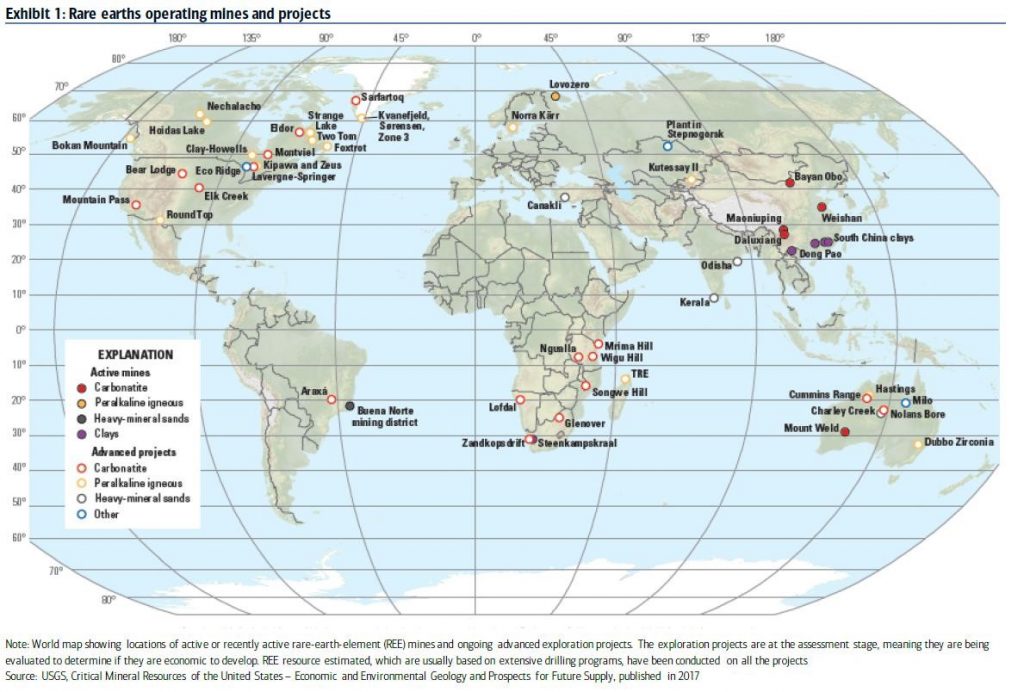

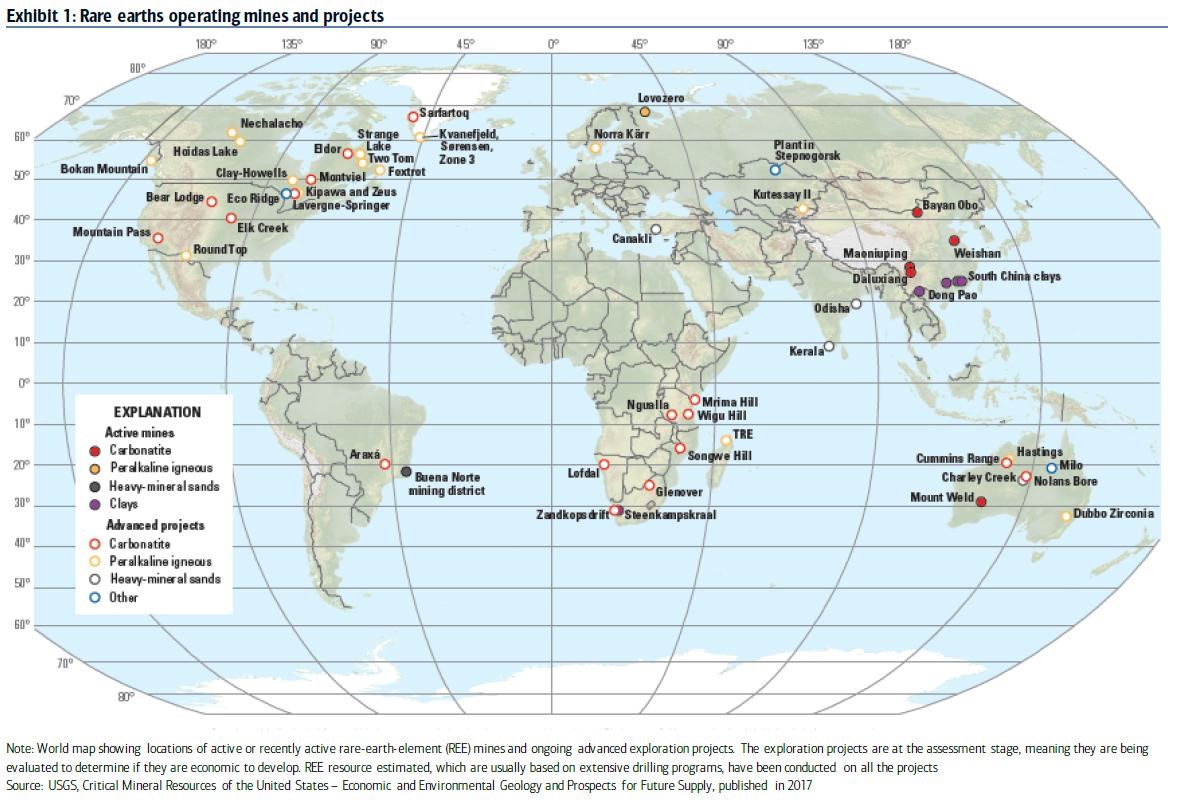

This newspaper also stated, “Will rare earths become a counter weapon for China to hit back against the pressure the United States has put on for no reason at all? The answer is no mystery.”

The map above shows the active and advanced projects for various rare earth minerals. Rare earths aren’t actually rare, but they are expensive to mine. China produced 78% of the rare earths in 2018 and owns 40% of global resources.

Technically, America only imported $175 million worth of rare earth minerals, but they are critical in making products such as smartphones, electric vehicles, and advanced precision weapons.

If China could stop exporting products which use rare earths, it could cripple the American economy.

Chinese Newspaper - Because these rare earths are found in such small amounts in a variety of products, it would be tough for China to stop exporting them to America. It would also hurt the Chinese economy. However, China specifically gained market share of these rare earths as a strategic resource.

China made the prices low in the 1990s to wipe out the competition. This weapon has been built up for decades. It was made to be used as a threat. The fact that it is now being used should shock no one. However, it would shock many if the threat is acted upon.

Sector Breakdown

Chinese Newspaper - Nasdaq fell 0.79% and the Russell 2000 fell 0.94% on Wednesday. The decline in the small caps shows cyclical weakness is a critical catalyst of this correction. VIX rose 2.29% to 17.90. I think it can easily get above 20 before this correction is over.

Every single sector declined on Wednesday. Once again, the utilities led the decline as the sector fell 1.34%. This sector was extremely overbought before it started this recent 3.09% 3 day selloff. The only other sectors that fell more than 1% were communication services and real estate which fell 1.1% and 1.16%.

Fed Expected To Cut 3 Times

Chinese Newspaper - The 10 year yield is at 2.27% and the 2 year yield is 2.11% which is 16 basis points lower. If the stock market falls, the 2 year yield will likely fall which increases the number of rate cuts the Fed is expected to make.

As you can see from the chart below, the USD swap markets are pricing in 77 basis points of rate cuts by the end of next year. The futures and swaps market aren’t accurate about rate decisions that far in advance. However, if the Fed doesn’t guide for a cut this year at its June 19th meeting, I expect the market to fall at least 5%.

Further weak economic reports, more trade war threats, and a Fed that won’t cut rates could cause the stock market to fall to its December low this summer.

Chinese Newspaper - Conclusion

Latest news on trade is hugely problematic. The economic report I am most anticipating is the PCE report on Friday.

Consensus is for both 1.6% core and headline inflation. High inflation isn’t an issue at all. Hopefully, the Fed realizes this and cuts rates at its September meeting.

Recent Comments