Yesterday’s Fed rate hike and hawkish guidance has had big impacts on global markets. It has accelerated the sovereign bond selloff. I have made the claims that central banks have been keeping interest rates low to fund the debts governments have run up. You can argue that the Fed now has no choice when it comes to raising rates because it must try to get in front of Trump-flation. The central banks’ positioning makes the debts countries have run up look even worse. If the Italian bond yields are allowed to rise once the ECB tapers, the yields will skyrocket and Italy will have a tough time meeting its obligations. Just because stocks are rallying, doesn’t mean all is well with governments and their currencies.

The dollar index is now at 103 which is another new high for the cycle. The numbers simply do not add up for corporate profit growth to be the highest in 6.5 years while the dollar continues on this bullish path. Some investors have claimed this is a ‘buy the rumor, sell the news’ situation where the dollar peaks on January 20th when Trump is inaugurated. I don’t see why Trump getting inaugurated is a news event because there’s nothing new about it. The real news event will come sometime in the first 90 days of his presidency when he has his first conflict with Congress.

The Fed needs other central bankers to act in tune with its hawkishness to avoid the dollar rally from accelerating further. The other option to stop this rally would be for Trump’s fiscal policies to disappoint. Someone who is bullish on equities can’t use this second possibility as an excuse to buy stocks because a Trump disappointment would be bearish for stocks as GDP growth wouldn’t accelerate. The first scenario where global interests rise also isn’t a positive because bonds become more competitive with stocks in terms of asset allocation.

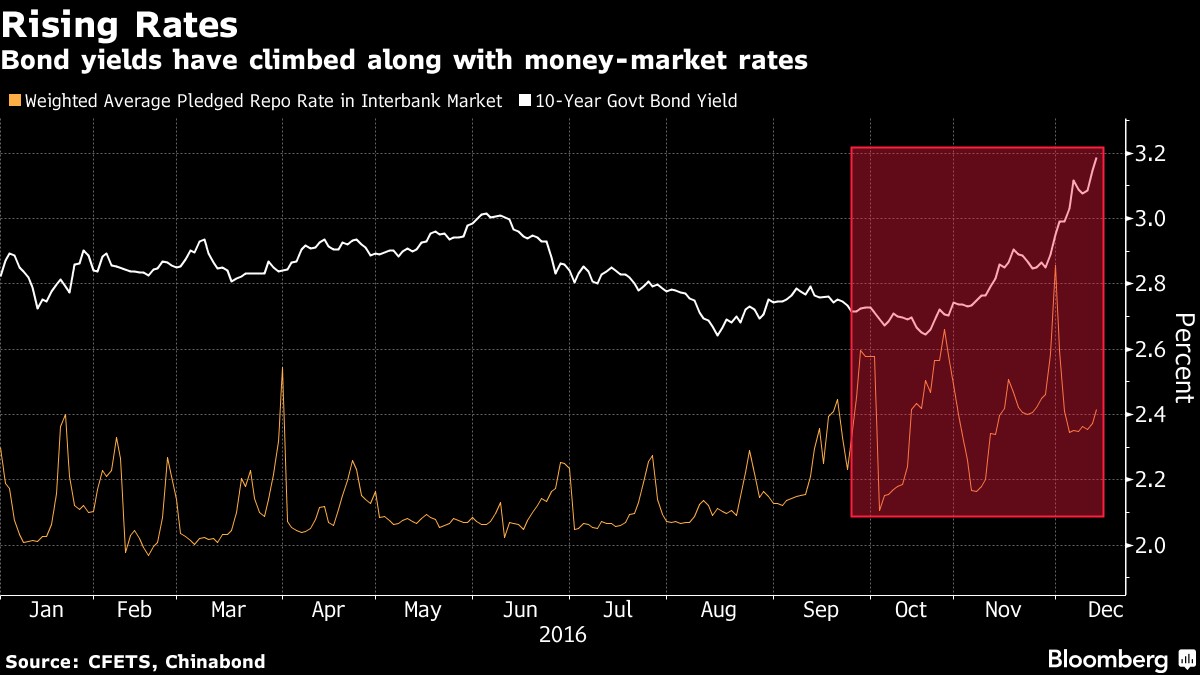

One other bubble the Fed’s hawkish guidance has helped burst is the Chinese government bond market. Today the Chinese 10-year bond and 5-year bond futures had their biggest declines ever as the 10-year fell 2% and the 5-year fell 1.2%. The markets were halted and the Chinese Central Bank had to inject $22 billion in liquidity into the money market. The chart below of the Chinese 10-year bond is updated as of yesterday. Today the yield rose to 3.4% which is a 16-month high. China’s debt-to-GDP ratio is 280% and state owned enterprise debt to GDP is 110%. This higher than other countries. Japan’s SEO debt to GDP is 31% and South Korea’s ratio is 28.9%.

Yields rising would crimp SEOs and cause the banking system to weaken as non-performing loans increase. A weak banking system hurts credit growth and would slow the economy further. If the Chinese government provides a capital injection to stabilize SEOs, it would cause the Yuan to further depreciate and capital flight from the country to accelerate. Running a communist/capitalist country is messy. China has relied on low interest rates to fuel bubbles in various assets such as real-estate, stocks, and commodities. Rising interest rates pokes the real bubble which is the Chinese government itself.

Gold has been one of the biggest losers after the hawkish announcement yesterday by the Fed. It has given up almost its entire rally this year as its now only up about 5% ytd. Newmont mining stock has fallen 33% since the peak in August. Gold peaked right after bond market peaked in July. At the peak of the sovereign debt bubble, gold became a positive yielding security for the first time in its history. The argument against gold has always been that it doesn’t have a yield or cashflow. It doesn’t provide investors with capital for owning it. When yields went negative, a 0% yield became a high yield in relative terms. This was always a dubious reason to own gold because negative yielding sovereign debt was bound to selloff. Now that the selloff is happening, that reason for owning gold has vanished and the yellow metal’s price has fallen.

This scenario explains one of the reasons to trade gold. Gold will go up and down depending on the macro situation. If inflation gets out of hand then gold will rally, but if remains stable, then gold will sell-off. While I think the Fed will be more dovish than the market is pricing in, I also think there’s a possibility that Trump’s policies don’t create as much inflation as is expected. If these two things cancel each other out, then it would lead to a flat gold price.

The real reason to own gold is because the dollar is printed by a government which may not be able to fund its liabilities without printing more paper currency. The more printing that goes on to pay the debt, the more the dollar is devalued. Gold is a hedge against that risk. Some gold bugs who are long gold because of this reason, try to explain gold’s near-term movements with a bullish lense. There is no reason to do this unless you make money from selling it to retail investors. The reality is gold can fall in the next few months, but it will have no impact on the reason to hold it for a hedge. Gold is not pricing in a dollar collapse. When it does, it will move much higher. It’s impossible to predict when that will be.

Bitcoin has been rallying. It is in the high $700s as it looks to challenge its all-time high of over $1,100 back in 2014. Those who weren’t knowledgeable about Bitcoin claimed the 2014 rally was like the tulip bubble. This is not the case at all as Bitcoin is a dollar hedge just like gold because it has a limited quantity. It is a digital gold which gives it storage and transactional advantages. From what I understand, Bitcoin trades based off of technical indicators. I’m not a chartist, so I find it tough to predict the price. It can also move based off of news. A positive headline of a new company accepting the currency or the number of coins being created being cut in half are possible positive catalysts for the price. A negative catalyst would be a regulatory crack down on owning it. Bitcoin also has a relatively small market cap, meaning it can be easily manipulated. Given these factors, I find guessing where the price will be, even more difficult than predicting where gold will go. However, I am also in favor of owning it as a hedge.

Conclusion

Stocks and the dollar have rallied due to Fed hawkishness. This can’t continue because multinationals’ profits will fall if the dollar rallies. This would make stocks even more expensive than they already are. Fed guidance is also negative for Chinese bonds. As yields rise, SEOs will be crimped which will eventually cause a capital injection by the government which could hurt the economy in the short term as private capital leaves it. Gold has fallen and Bitcoin has rallied in the short term; both still represent excellent ways to hedge against a debt-fueled dollar bust.

Recent Comments