Trouble For Congress

Did anyone think it would be that easy for the government to pass a stimulus? The Republican proposal is $8 billion more than the bipartisan agreement. Plus, it got rid of liability protection, but that wasn’t enough for the Dems because the GOP got rid of the part of the plan which is unemployment benefits. The GOP’s plan calls for $600 in payments per person and child, but slashes unemployment funding from $180 billion to $40 billion. We can see how the Georgia Senate election goes and see if that changes anything for the future.

It’s interesting that the bond market and value stocks didn’t react to this news and growth stocks fell. Anyone saying stocks fell because of this snag in negotiations was wrong. The good news is that the GOP will probably come up with another proposal since both sides are still open to getting something done. The GOP could easily get rid of the $600 checks and give people $100 to $300 per week in unemployment benefits.

Conversion Rate To Permanent

In the November labor report, the number of permanently laid off people increased, but it wasn’t up much. We are quite close to this peak, but it will probably still increase in December and January. After those reports come out, we can do the final tallies on the impact of the COVID-19 recession. That's assuming there will be some health and economic benefits from the vaccines evident in February. It all comes down to vaccine distribution.

In the week of December 5th, initial unemployment claims are expected to only rise 12,000 to 724,000. Initial reaction to last week’s report was that it was helped by Thanksgiving. These estimates only see a small increase, but claims may rise more than this.

The chart above gives us more information on the state of permanent layoffs. As you can see, the conversion rate to permanent layoffs is still near where it was at the peak of the last cycle. Specifically, it is the percent of non-permanent non-employed workers who became permanent layoffs in the following month.

This metric peaked almost a year after the recession ended. It’s no surprise the rate is still high because even though the recession is over, COVID-19 is severely inhibiting a full recovery in the labor market.

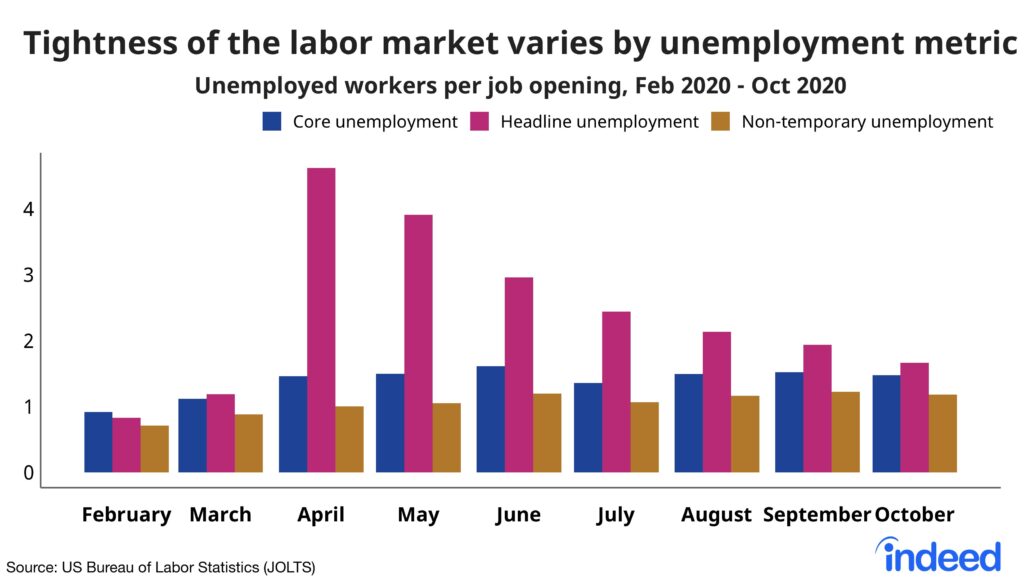

The October JOLTS report came out on Wednesday. The number of job openings rose from 6.494 million to 6.652 million which beat estimates for 6.4 million. The number of hires fell from 5.886 million to 5.812 million These are ok numbers for what was a decent month for the labor market. Investors are interested to see how bad the numbers get in November and December.

The chart below shows the ratio of unemployed workers per job opening fell across 3 metrics. We all remember in 2019 when the labor market was so tight that there were more openings than unemployed people. We are very far from that, but if the labor market quickly right sizes following the vaccine distribution this winter, we could see nearly a full labor market by the end of next year.

Another Fed Meeting Is Coming

The December Fed meeting is next Wednesday. It’s important because it includes a summary of economic expectations. The Fed will keep rates the same. The most interesting monetary policy change will come after the vaccines are distributed.

It’s possible by the middle of next year talks of rate hikes and ending all QE will be prominent. The first rate hike won’t be until 2022 at the earliest though. Remember, growth stocks will crash way before the Fed hikes rates. A rate hike isn’t needed to end the speculation.

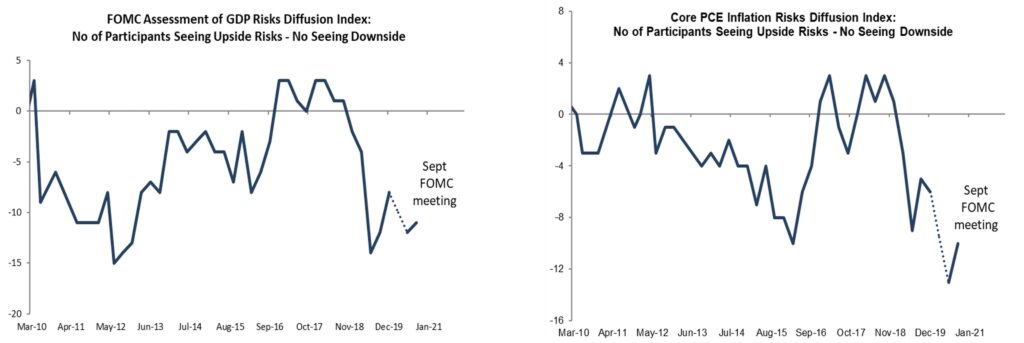

As you can see from the chart above, at the September Fed meeting virtually all FOMC members saw downside risks being greater than upside risks in terms of GDP. Even more saw downside risks to inflation. If we’re talking about the next 3 months, downside risks on both are larger than upside risks.

If we’re talking about the next year, upside risks are greater. The Fed isn’t going to jump the gun like markets. It won’t even discuss rate hikes until the vaccines are give out to everyone. Some are probably thinking about how these diffusion indices are from September and since then we have gotten vaccines.

Travel Isn’t Increasing

The chart below shows the yearly change in TSA throughput up until early December. It’s no surprise air travel growth has stopped improving following the Thanksgiving holiday. Almost all mobility trackers are showing people are less likely to gather in groups. It’s highly unlikely that there will be an uptick in travel around the December holidays. However, we can expect a massive uptick of in-person gatherings starting in the spring.

As for now, the results are gruesome. They have no chance of getting better in December. The 7 day average of new cases was 204,456 which is a new record high. There are 106,688 people in the hospital which means deaths will increase for the next 2 weeks.

The early results following Thanksgiving aren’t good even though there wasn’t that much of an increase in mobility. The 7 day average of deaths is 2,276 which is a new high. It was wrong to be optimistic late in the summer. Optimism worked for value stocks, but not for the health of the country.

Recent Comments