Government Shutdown - 5 Day Winning Streak

The stock market is on fire as the S&P 500 is on a 5 day winning streak. It was up 0.45% on Thursday. The 14 day RSI has gone from below 20 on December 24th to 52.08.

It’s on its way to signaling the market is overbought. CNN fear and greed index increased from 27 to 31. Put to call ratio is now signaling greed is back. S&P 500 is up 3.58% for the year.

This rally is based on the fact that the U.S. economy isn’t going into a recession soon and the Fed is now dovish. Nasdaq was up 0.42% and the Russell 2000 was up 0.46% as this rally has lifted the whole market.

I can’t see how the market reaches a new high with Germany about to go into a recession and China slowing quickly. The market’s near term direction will be determined by earnings season which will start to heat up next week.

Major banks report next week with Citigroup reporting on Monday, Wells Fargo and JP Morgan reporting on Tuesday, and Bank of America reporting on Wednesday.

Government Shutdown - Retailers Underperform

As I mentioned in my previous article, the retailers had a rough Thursday.

XRT retail ETF fell 1.6%. One of the beleaguered retailers I didn’t mention was Kohl’s. Its stock fell 4.68%. Its holiday sales growth was only 1.2% after it grew 7% in 2017.

Even with this low sales growth, the firm increased its 2018 EPS guidance from $5.35-$5.55 to $5.50-$5.55.

The December retail sales report is supposed to come out on Wednesday, but I’m not 100% sure if it will because of the government shutdown.

We did get the Redbook same store sales report because it is calculated by a private company. It showed year over year growth of 8.9% in the week of January 5th. This growth is over twice the rate seen at the start of last year.

Some of the reports like factory orders, international trade, and wholesale trade haven’t come out because of the shutdown.

However, stats like the jobless claims, JOLTS, and BLS monthly jobs report have been released. All the data that hasn’t been released will come out when the partial shutdown ends.

This is about to be the longest shutdown ever. President Trump doesn’t seem interested in giving in on his demands, so this might last a few more weeks.

Government Shutdown - Sector Performance

All the sectors rose except consumer discretionary which fell 0.23% because of the weakness from retailers. The best 2 sectors were real estate and the industrials which increased 1.55% and 1.44%. I don’t see how the industrials can keep rallying with the weakness in manufacturing.

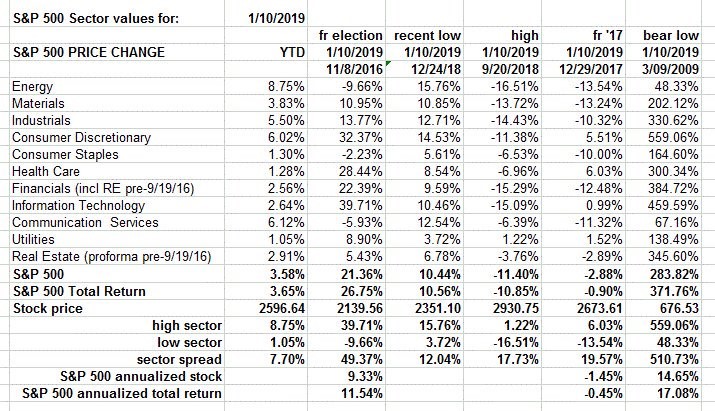

The table below shows each sector’s performance since the 2016 election, Christmas Eve low, the September 2018 record high, late 2017, and the bear market low in 2009. It also shows year to date performance.

Utilities are the only stocks up since September, but they are the worst performers year to date. Consumer discretionary sector is up 14.53% since Christmas Eve as it is being led by Netflix and Amazon which are up 38.81% and 23.23%.

Netflix reports next Thursday. It will be interesting to see how much the hype around “Bird Box” drove subscriptions.

Government Shutdown - Q1 GDP Estimates Fall Sharply

Q4 GDP growth will probably be solid. The CNBC rapid update hasn’t been updated since December 21st. It shows the median of 10 estimates is for 2.9% growth.

On January 10th the Atlanta Fed GDP Now estimate was unchanged at 2.8% after the Philly Fed Fed’s manufacturing survey and the initial jobless claims report were included in the model.

In the NY Fed’s Nowcast from January 4th, the GDP growth estimate was 2.49%. The Q1 forecast is for 2.14% growth. That’s not including the effect from the government shutdown. If growth ends up being 2.14% without including the shutdown it’s a problem because the shutdown will likely push it below 2%.

Finally, the St. Louis Fed Q4 estimate is 2.6%. Usually, the St. Louis Fed is very optimistic, so this is a bit disconcerting.

In its latest note, JP Morgan stated it is lowering its estimate for Q1 GDP growth from 2.25% to 2% because each week the government is shutdown, GDP growth is hurt by between 0.1% and 0.2%.

Government Shutdown - This GDP estimate cut accounts for the first two weeks of the government being shut down this year.

If the shutdown lasts all month, the estimate will fall to about 1.75%.

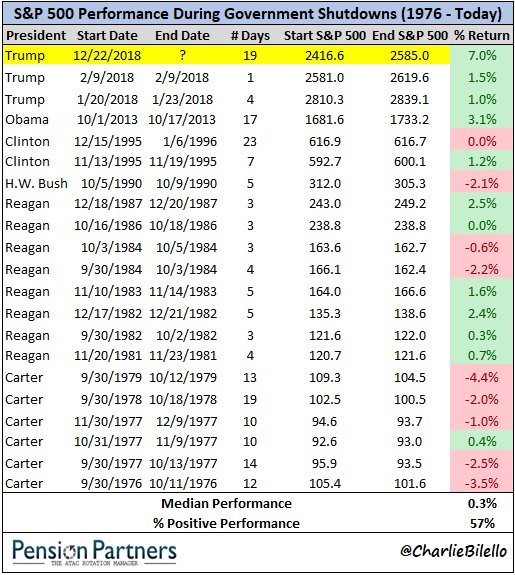

It’s interesting that stocks have done really well during this shutdown even though this is about to be the longest one ever.

As you can see from the table below, this has been the best performance during a shutdown ever. Shutdowns are historically non-events as the median performance is a 0.3% gain, but it will be interesting to note at what point the market starts to care.

I think when the stock market starts to falter, there will be extreme pressure to find a solution. There’s already pressure because Federal workers and contractors are going without pay.

Government Shutdown - China Falters

China is less of a driver of global growth now than it has been for most of this expansion. As you can see from the chart below, China peaked at driving 36.3% of global GDP growth in 2016. In 2019, it is expected to drive 32.4% which is the lowest percentage since 2011.

The good news is as China falters, its influence shrinks. The bad news is it’s still a huge part of the economy. 2019 is expected to be a terrible year for the Chinese economy even though the government is implementing a fiscal stimulus.

Hopefully, a trade deal is made in the next few weeks. New reports suggest a top Chinese official will likely visit America to discuss the trade deal later this month.

Government Shutdown - Conclusion

I think the stock market is overbought. Even if the government shutdown lasts another week, it probably won’t cause stock market volatility.

The impact to Q1 GDP growth will be substantial. It could bring growth below 2%. At some point it will hurt stocks if it goes on for several more weeks. It’s impossible to tell when it will start hurting stocks because there has never been a shutdown that long.

Recent Comments