Negative Job Creation Is Coming

This current slowdown is nowhere near as bad as the one in March and April, but it is worth watching because the situation is unstable. The goal is to avoid too much weakness before the vaccines go out. We will start to see a recovery in February. That leaves us with at least 6 more weeks of economic weakness.

We knew that there wouldn’t be a massive jump in initial unemployment claims this week, but some did see further weakness in the labor market.There might be outright job losses in the December BLS report.

Investment banks and economists are now agreeing with me because of this latest initial claims report. We are already closing in on getting a stimulus, but more might come after the news breaks that the economy lost jobs. After all, one of the catalysts for the current stimulus talks was the weak November BLS reading.

By the way, the Emerson polls show the GOP up 3% in each race. That puts the average of recent polls at Loeffler up 0.2% and Perdue up 1.2%. It’s looking less likely that the Dems will win both seats. The PredictIt betting market shows there is a 70% chance the GOP maintains the Senate and a 31% chance the Democrats win it. The election is in 17 days; the holidays are in between now and then, so most don’t anticipate any major turns in the races.

Another Weak Jobless Claims Report

The increase in claims last week was revised even higher as there were 862,000 claims which was 9,000 higher than the initial reading. This report was interesting because seasonally adjusted claims rose, but unadjusted claims fell. The consensus expected a decline to 806,000 seasonally adjusted claims because they thought last week had a backlog of data from the week of Thanksgiving.

They were very wrong as seasonally adjusted claims rose to 885,000 which was just 30,000 below the high end of the consensus range. Unadjusted claims fell. They were down from 956,000 to 935,000. That helps explain why the chart below shows a 1% increase in PUAs combined with unadjusted claims.

Remember, last week there was a massive increase in PUAs, largely because of Nevada. This week they were up 45,000. There is a ton of fraud here, so you can’t take it too seriously.

In the week of November 28th, there was a 1.6 million increase in total claims as it rose to 20.6 million. Now about 14 million people would lose benefits if the government doesn’t extend them. McConnell stated it is “highly likely” Congress will work through the weekend to get a stimulus/budget done.

If there isn’t a spending bill by Saturday, the government will shut down. The more important deadline is December 26th which is when pandemic benefits end. It seems like there will be a $600 stimulus check given out. Since June, 8 million people have fallen into poverty; all people are getting is $600 and $300 in unemployment for 16 weeks.

Continued Claims Hit A Cycle Low

It's surprising that continued claims fell sharply in the week of December 5th because initial claims rose sharply last week. There is seemingly a never-ending number of benefits running out that makes it look like the labor market is getting better. It isn’t because people just go on extended or pandemic benefits. Specifically, continued claims fell from 5.781 million to 5.508 million which is 19,000 below where it was 2 weeks ago.

Thursday was a terrible day in the battle against the pandemic as there was a record high in cases, hospitalizations, and deaths. The 7 day average of deaths is 2,560. It will probably get above 2,750 within the next few weeks because cases and hospitalizations are still hitting new highs. Even worse, Pfizer says it has millions of vaccines waiting to go out, but the government hasn’t told it where they should go. The worst case scenario is the vaccines aren’t distributed quickly.

Not Good Retail Sales Report

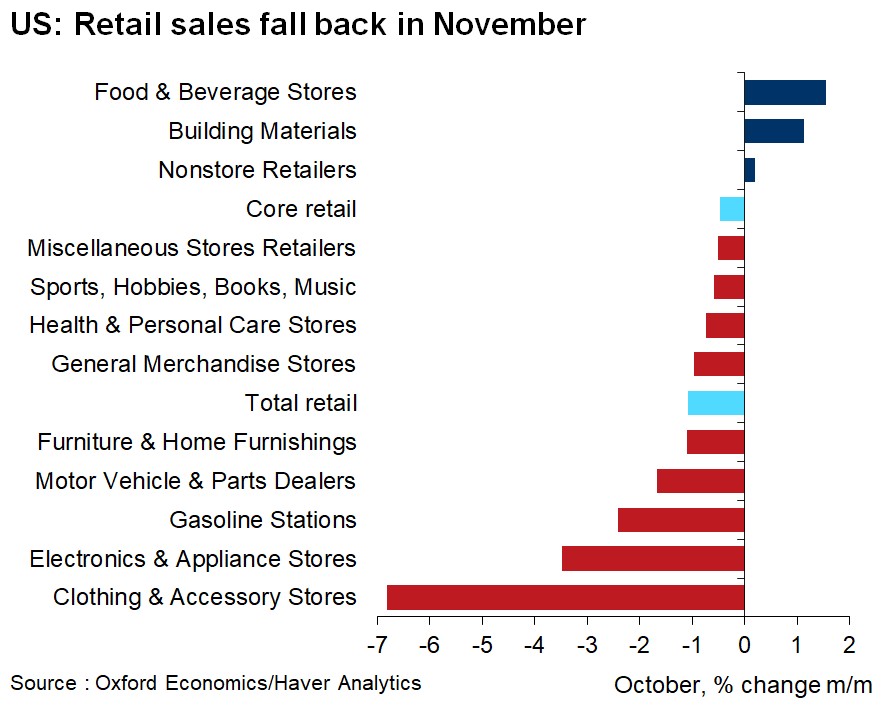

The $600 checks can’t go out quickly enough because the November retail sales report was disappointing. This certainly throws cold water on the idea that we had a great holiday shopping season. It adds credence to the slowdown theory which is now reality.

Headline monthly retail sales growth was -1.1% which missed estimates for -0.3%. Plus, October’s growth was revised down 0.4% to -0.1%. Yearly growth in retail sales excluding food services fell from 8.3% to 7.1%. We will likely see further deceleration in December. If there wasn’t a fiscal stimulus about to be passed, we can say there might be a yearly decline in spending in January.

Core monthly growth was -0.5% which missed estimates for 0.1%. Plus, October’s growth was pushed down 2 tenths to 0%. As you can see from the chart above, clothing accessories had a massive decline, while food and beverage stores had an increase. This is like a mini March/April in that people are stocking up on necessities because of lockdowns.

Motor vehicles and parts did poorly, which is important because it is the largest category. Its monthly growth was -1.66% and its yearly growth fell from 10.42% to 6.04%. Online monthly growth was 19 basis points which is weak, but its yearly growth improved to 29.16% from 27.73%.

This year holiday spending is largely online. Investors are excited to see if there are yearly declines in spending starting in March when the comps are tough and the vaccines should allow for more gathering.

Running Out Of Money

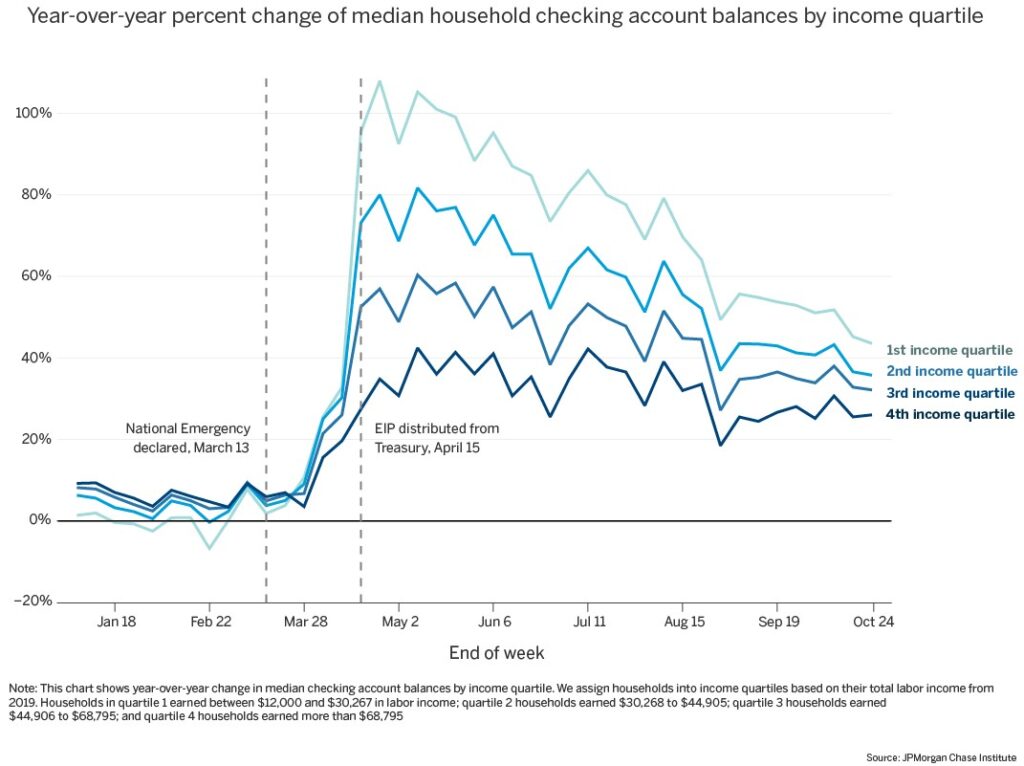

People have more money in their bank accounts than they did before the pandemic, but their accounts are dwindling as the chart below shows. Keep in mind, this data doesn’t include November which had some weakness in the labor market in its 2nd half.

If this data was updated through the end of the year, I’d expect a sharp decline like we saw in August when the $600 in weekly pandemic benefits went away. This chart underestimates the need for more stimulus. By the time we get data that shows how much it is needed, it will be too late. That’s why the stimulus needs to be passed now.

Recent Comments