Global Monetary Policy

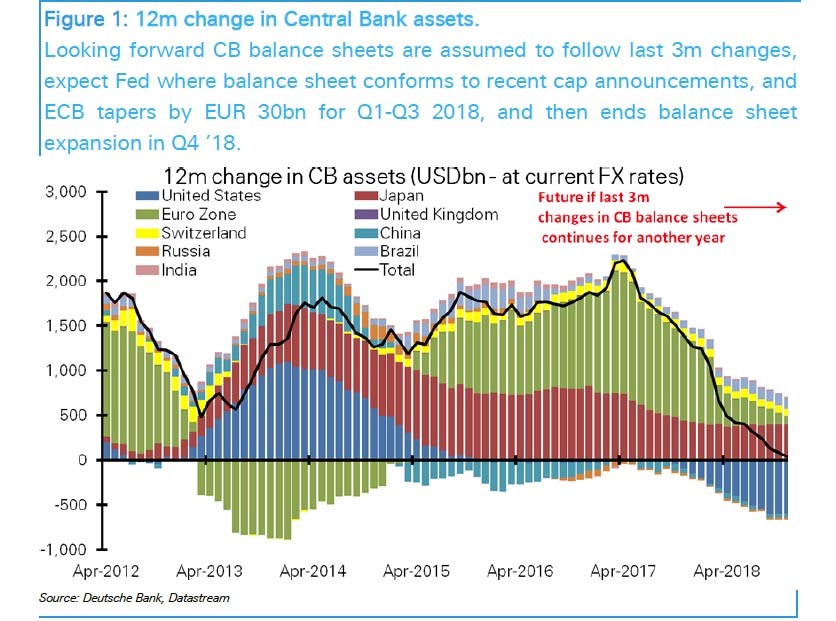

The chart below is unique because it shows 9 central banks, giving a more complete picture of the liquidity being added to the financial system. As you can see in the description, this includes the expectation that the ECB will taper to 30 billion euros per month for 9 months and then taper to 0 in Q4 2018. As you can see, the tapering has left the total still above the lows of 2013. In 2018, we will see the lowest bond buying since before the financial crisis. Sometime in 2019 the net buying will be negative if everything goes according to plan.

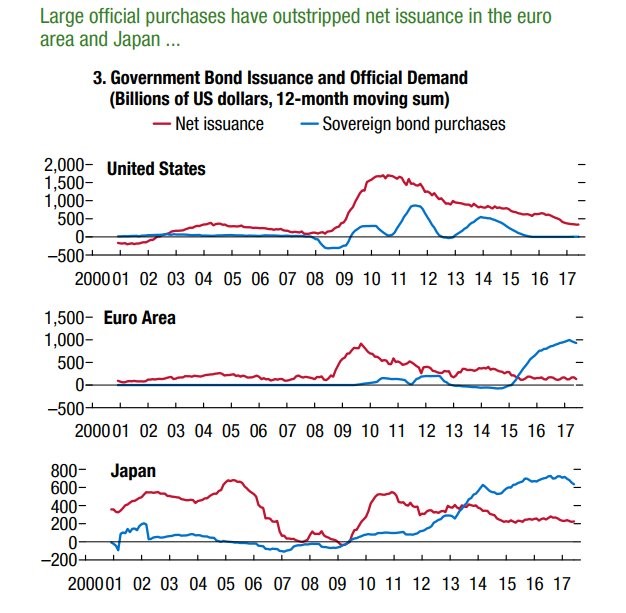

The chart below compares the three major central bank’s bond purchases relative to their issuances. As you can see, the ECB and the JCB have been much more aggressive in purchasing government bonds than America has been which is why I think the ECB’s decision on QE is more important than the Fed’s unwind. The net issuance switched to being lower than the sovereign bond purchases in 2015 as the recent buying started ramping up. Japan has also had higher bond purchases than net issuances. Keep in mind, this is only looking at government bonds. The JCB buys stock ETFs and the ECB buys corporate bonds. They’ve more than made up for Fed tapering. It’s uncertain the exact dynamic of how the international central bank policies influence foreign markets. All we know for sure is while the ECB and JCB did their QE, the dollar rallied. This year the dollar fell as the ECB started to taper its purchases; they will probably end next year.

Taylor Is Getting His Time In The Spotlight

There was another switch in the odds for Fed chair on Wednesday as Powell’s chances fell by 9% to 43%, Warsh’s chances fell by 2% to 28%, and John Taylor’s chances increased by 10% to 13%. John Taylor has lingered in the single digits for the past few months; his peak was previously 10%. Taylor is getting his time in the spotlight now that he’s being considered. I wouldn’t be surprised if his odds surged temporarily like many of the other candidates. This is all speculation; speculation comes in waves. We won’t know for sure until the pick is made.

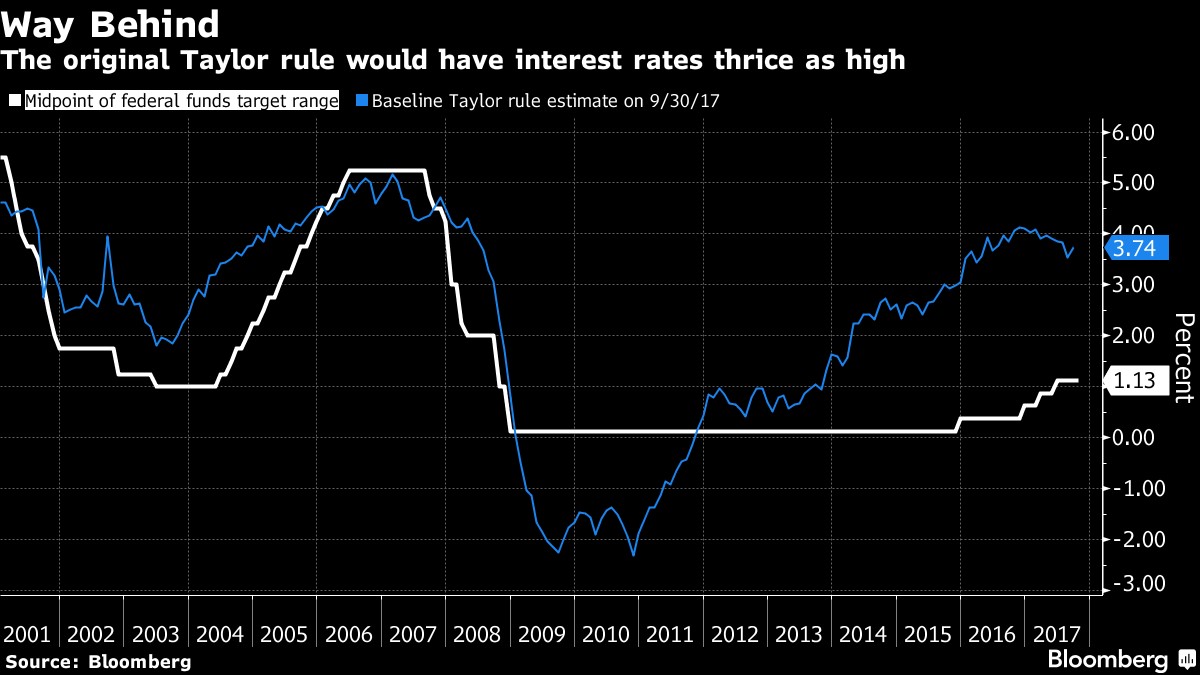

John Taylor is the creator of the Taylor Rule for the Fed funds rate. It calculates where the Fed should put rates based on a number of macroeconomic factors that are put into a formula. The Fed looks at it when making policy, but doesn’t follow what it says exactly. It’s mostly utilized by Fed critics to provide a better baseline of what policy should be. It unifies critics on what the rate should be. The goal of this rule is to promote a rules based approach to Fed policy, so the Fed doesn’t go rogue. For the most part, the Taylor Rule has had a higher rate than the current one. This would make some viewers feel if Taylor was picked, he would be hawkish.

As you can see from the chart below, the current Taylor Rule has rates above 3%; that’s triple the current rate. Taylor has said he wants the Fed to have a formulaic reasoning for why it makes policy decisions. If Taylor is picked, it would be interesting to see the reaction policy makers have to him. They don’t like the concept of having a rules based approach to the Fed. However, we’re at a time where the establishment understanding of inflation and unemployment is being challenged by the data. The guiding principle of the Phillips Curve is that when unemployment falls, inflation increases. It makes sense that wage inflation would rise when there is a tight supply of workers. My contention as to why it has been wrong is because the unemployment rate isn’t accurately reflecting the slack in the labor market. If there are many part time workers who can work full time such as college graduates who work at Starbucks, the wage inflation won’t be as high as economists expect.

Normally, you’d expect Taylor not to make much headway if he’s picked because not many people at the Fed agree with him. However, I wouldn’t be surprised if he convinced some because they are currently confused about inflation. If he were to say inflation is actually higher than the reports show, he’d be able to get rates higher. This situation is similar to President Trump’s election because once he got in office it was difficult to govern since many people in government disagreed with his policies. If Taylor was picked, there would need to be a compromise between the two philosophies of monetary policy. At the very least, I think picking him or Warsh would bring uncertainty to the markets since the Fed chair would disagree vehemently with FOMC voting members.

With the 3 main candidates now being Warsh, Powell, and Taylor, the odd man out is Powell since he’s not as much of a reformer of policy. That makes me less bullish on his odds. To be clear, I think there would be a minor selloff in stocks and bonds if Warsh or Taylor are picked. There would be a potential for a much larger correction if they were able to get their way and raise rates much higher than the goal of 2 hikes in 2018 which is where guidance stands now.

Conclusion

The Fed is the least consequential central bank when it comes to bond buying. However, President Trump’s pick of Fed chair is important because Taylor and Warsh want to bring the Fed in a new direction. That would worry some stock investors because the Fed has been the stock market’s best friend for the duration of this bull market since rates have been below the Taylor Rule for the past five years.

Recent Comments