Apple Larger Than Energy

Despite the huge growth in American oil production to a record high due to advancements in fracking, the energy sector’s weighting in the S&P 500 is the lowest since at least 1990. Part of that weakness might be because some view this production as unsustainable due to high decline rates.

A main reason is oil prices aren’t high enough to make fracking highly profitable. Fracking costs more money than traditional drilling; its explosion has kept a lid on oil prices. Frackers are the marginal producers; they are the most impacted by prices. Costs also increase when oil prices increase, so they don’t gain all the additional profits when prices rise. That being said, if prices do rise, this sector will do well.

To be clear, I don’t like the energy sector in 2020 because its weighting is very low. As you can see from the chart above, its weighting would need to more than double to get to its long term average. Now, I’m not that optimistic on the sector. It's just that global cyclical expansion will likely increase demand and push up prices. Many sectors such as tech have already priced in this expansion, while energy hasn’t.

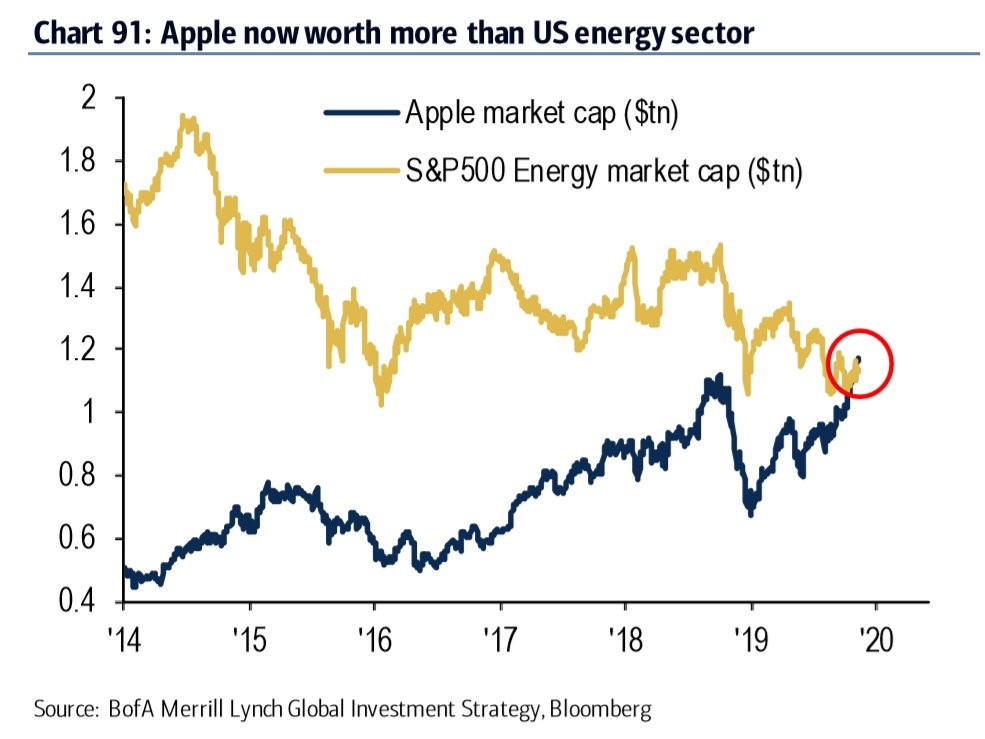

The chart below is fun to look at because of my prediction of energy doing well and Apple doing poorly, but it’s also not the reason many have these forecasts. As you can see, Apple’s market cap is larger than the entire energy sector’s market cap. This reflects energy’s poor returns and Apple’s amazing recent returns. However, I don’t use market cap to make investing decisions.

Dallas Fed Index Falls

Based on the soft data surveys, December was a weak month for manufacturing. It was terrible on a rate of change basis. Every one of the 5 regional Fed indexes fell. As you can see from the chart below, the average of the 5 went negative for the 2nd time this year. The average was slightly worse in June.

Specifically, the Dallas Fed general activity index fell from -1.3 to -3.2 which missed the census of 1 and the lowest estimate which was -3. Even though all indicators pointed to the Dallas Fed falling, for some reason economists were optimistic. Hopefully, they aren’t as optimistic about the ISM PMI because we expect it to be weak on Friday.

Dallas Fed report wasn’t as weak as the headline index suggested which is good news. Production index rose 6 points to 3.6. Shipments were up 7.5 points to 3 and new orders were up 4.6 points to 1.6. Furthermore, the company outlook index rose 3.4 points to 1.3 and the outlook uncertainty index fell 11.5 points to 5.6 (less uncertainty). There might be less uncertainty because phase 1 of the trade deal was agreed to.

Now let’s look at the expectations category. Here, the general business activity index fell 0.9 to 6.4, but there was also some underlying strength. Production, new orders, and shipments indexes rose 5.6, 3.9, and 3.9 points to 36.9, 32.6, and 30.1. In the comments section, there was only 1 mention of tariffs. A computer and electronic product manufacturing firm stated, “With the next round of tariffs suspended indefinitely, our uncertainty of costs has decreased.”

Markit Manufacturing PMI Falls

Final December Markit manufacturing PMI was the same as the flash reading which means it fell 0.2 to 52.4. That’s not as bad as the regional Fed reports indicate. This was a rare situation where the ISM PMI didn’t come out on the same day as the Markit PMI. Based on the regional Fed reports, ISM PMI will likely fall more than the Markit PMI did. That would expand the difference between the two.

Manufacturing growth is somewhere between slightly negative and slightly positive. More importantly, it looks like the green shoots shown in previous reports have died off. December was a step back for the manufacturing sector. That doesn’t mean there won’t be a recovery in 2020 though. Q4 still had the highest quarterly Markit PMI since Q1.

Specifically, output growth fell, but was still moderate. There was higher client demand and an improvement in new order volumes. New business growth was the 2nd strongest since April. This growth was the result of new clients and an increase in export sales. It was the 3rd straight increase in new export orders.

Input price inflation accelerated to a 9 month high because of higher supplier costs and tariffs. Tariffs will go away, but the upturn in global demand should push supplier costs up. Similarly, output inflation was the joint highest since February. Manufacturing optimism increased from November, but was still muted.

Finally, employment growth was the 2nd fastest since May. As you can see, this report had some underlying strength despite the decline in the headline index just like the Dallas Fed report.

Global Manufacturing PMI Also Falls By 0.2

Partially driven by the 0.2 decline in the US PMI, the global manufacturing PMI also fell 0.2 to 50.1. America actually had the 3rd strongest PMI. The best was Greece and the 2nd best was India. Europe remained a laggard as Germany had the 2nd weakest reading. That’s interesting...

As you can see from the chart below, the European Citi surprise index is the highest since the start of 2018. Reports are beating estimates, but the manufacturing sector is contracting. Weakness wasn’t only in Germany. Italy, Austria, the Czech Republic, Spain, the U.K. Poland, the Netherlands, and Ireland all had PMIs below 50. France was the only EU nation with an above 50 PMI. The output index fell from 51 to 50.4. Just like in America, the output and input prices indexes were up. They increased 0.9 and 1 point to 51 and 51.3.

Conclusion

It’s interesting to see charts showing Apple with a higher market cap than the entire energy sector. I think Apple is overvalued and energy is undervalued, but not for this reason.

Regional Fed reports have shown weakness in December. Markit report wasn’t as bad, but it did fall 0.2. Global manufacturing PMI also fell 0.2. Even though America’s PMI fell, it was the 3rd best. Europe’s really lagged even though it has a relatively strong surprise index.

Recent Comments