Market Predictions - Still Expecting A Trade Deal Between America & China

2018 was a tumultuous year for markets partially because of the uncertainty caused by U.S. trade policy.

Deals were made with countries such as Canada and Mexico. But the tensions with China were ratcheted up much of the year. Then in early December, a 90 day truce was made where the 2 nations would negotiate a deal without raising tariffs on each other. The U.S. tariff rate on Chinese goods would have increased to 25% this year without the truce.

Making a deal will be tough because little progress was made when President Xi and President Trump last met. Plus, the Chinese New Year celebration occurs during the 90 day window as it is on February 5th.

Even with the lack of reported progress, many think a deal will be reached in Q1 2019. A communication window is open, and both countries are seeing their economic growth decelerate.

The principle cause of the weakness isn’t the trade war, but it hurts firms’ ability to invest because of the uncertainty.

Even a slight economic boost from a trade deal would help. It would go along nicely with China’s big fiscal stimulus.

To be clear, I still think China will have a rough year. However, those catalysts are still positive.

Latest news on trade is seen in the chart below.

For the first time since the first half of 2018, China is buying American soybeans. This is either a sign tensions are easing or that China really needed American soybeans because the Brazilian harvest season is over.

U.S. trade representative, Robert Lighthizer called China’s purchases of soybeans empty promises and stated he wants more tariffs on China. That’s not positive rhetoric. It’s also not a surprise as he has been a hawk on trade his entire career. He argued for tariffs in 2008.

Market Predictions - Fed & Fed Funds Futures Market Differ Dramatically

Monetary policy is a huge variable to consider when predicting where asset prices and the economy will go in 2019.

Current Fed guidance is to continue the balance sheet unwind of $50 billion per month and to raise rates twice in 2019. There’s a small minority who believe because real rates are barely positive and the labor market is nearly full, the Fed can keep up with rate hikes without a problem.

We know this is a minority opinion because of the Fed funds futures market.

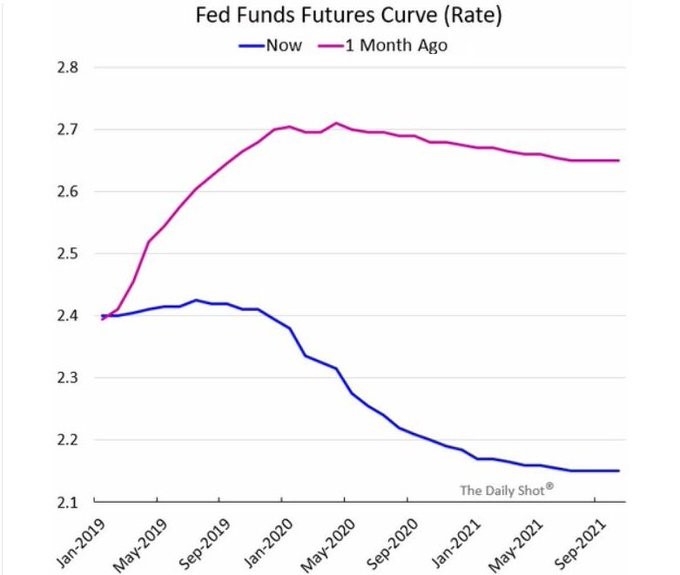

As you can see from the chart below, the market has shifted sharply in the past month. The market expects rate cuts in 2020.

Fed funds futures market has had a terrible track record of predicting rate policy in the intermediate term in this cycle. However, the Fed is limited in how much it can hike rates because the yield curve can invert, and tight policy can push the economy into a recession.

If Bernanke or Yellen were chair, it would be easy to predict zero rate hikes in 2019. It’s much tougher to make that forecast now because Powell is less dependent on the stock market.

Powell might be able to sneak in one more hike in early 2019 before the economy weakens further. There’s no reason to hike into a slowdown with low inflation. But Powell has been clear that’s his plan.

Market Predictions - Yield Curve Inversion Coming

The more the Fed raises rates, the flatter the curve will get. Hawkish guidance and lowered expectations for future growth are a recipe for a curve inversion.

As you can see from the chart below, the difference between the 10 year yield and the 3 month yield is only 19.9 basis points. The more the curve inverts, the greater the accuracy of the signal. Personally, I expect a full inversion by the first half of the year.

The yield curve is supposed to be a leading indicator for the economy, but it became a catalyst for lower stock prices late last year.

Even though there was no chance of a recession in the next 6 months, stocks anticipated the worst because the 3 year yield rose above the 5 year yield. Front running caused sharp volatility for an expansion still in its late stages. Usually, stocks rally the most at the end of the cycle.

Market Predictions - Stock Market Cheap?

Presently, I can’t give you my prediction for stocks in 2019 because my signals have diverged.

On the negative side, earnings revisions are bad and the yield curve is flatting. Also, the Chinese economy is weakening at a quicker pace. Finally, the ECRI leading index is negative.

On the positive side, the leading indicators don’t signal a recession is coming as quickly as stocks suggest. Jobless claims are also low. Investors have gotten very negative, and multiples shrunk sharply in 2018.

As you can see from the chart below, investor sentiment is the worst since early 2016, which was a major buying opportunity.

Keep in mind, stocks will only recover like in 2011 and 2016 if economic growth stops slowing.

Stocks are a great value if there isn’t a recession in the next 12 months. I won’t leave this section without a prediction. I think stocks will move higher in the next few weeks on a trade deal and normalizing sentiment.

Market Predictions - GDP Estimates

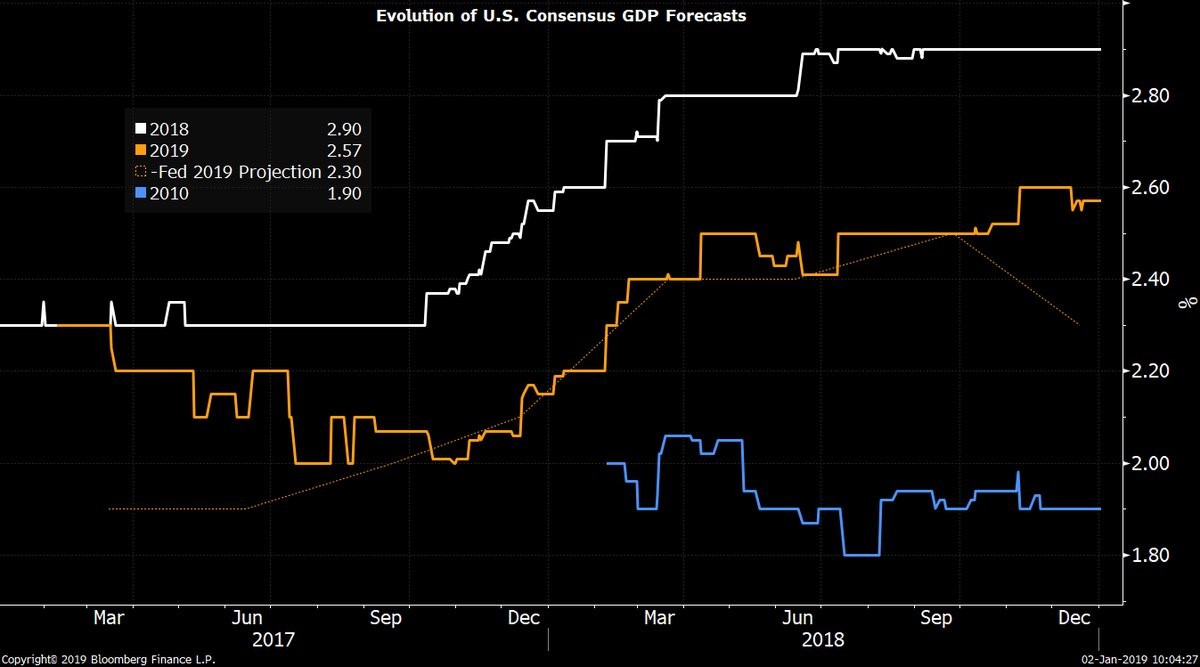

The chart below shows the forecasts for 2018 and 2019 GDP growth.

Slowing global economy and fading effect of the fiscal stimulus seem to be in the estimates for slower 2019 growth. If growth ends up being 2.6% in 2019, I think that would be a huge win for stocks based on their current valuation.

If there’s no recession, the current trailing and forward PE multiples make stocks a buy. I was anticipating being very bearish in 2019, but the 20% decline late in 2018 has altered my perspective.

Recent Comments