Modest Stocks Rebound - A Mini Recovery

The stock market recovered on Friday after having two terrible days. In bull markets stocks recover slowly. In bear markets stocks recover quickly and then lose more value even quicker.

Fiercest rallies are in bear markets because traders fall into the trap of thinking the bear market is over. The market acted like it was still dealing with uncertainty. It rose and fell sharply on Friday.

The market opened green, then fell back to the flatline. And finally closed up 1.42% which is near where it opened the day.

The Nasdaq increased 2.29%. Russell 2000 only increased 8 basis points even though it was the most oversold heading into the day.

The best performer in the S&P 500 was Netflix. It rallied 5.7%. The best sectors were technology and consumer discretionary. They increased 3.15% and 2.15%.

Even after falling to a new 52 week low, Facebook only managed a 0.25% gain. It is in the dog house.

The worst two sectors were real estate and utilities. They fell 7 basis points and rose 6 basis points.

Modest Stocks Rebound - Fear Is Still Strong: I’m A Buyer

The market was so oversold, it would have been shocking if there was another down day. Even with the increase, the CNN Fear and Greed index is at 11 which shows extreme fear.

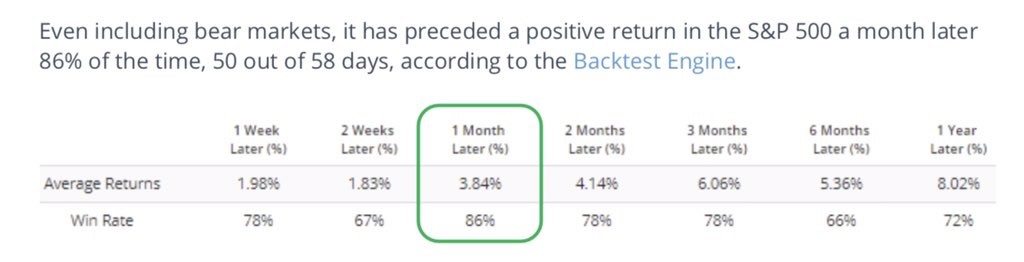

I’m still very bullish in the near term. I am bullish on the next month’s action based on the extreme fear shown in the CNN Fear and Greed index. The table below shows the index has successfully predicted gains 86% of the time even in bear markets.

Stocks rally more often in bear markets than they sell off in bull markets.

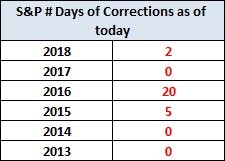

As you can see from the chart below, 2018 has only been slightly more volatile than 2017. There have only been 2 days where the stock market has been down 10%.

Even though the financial press and I have called this recent decline a correction, it’s still only a minor dip. I don’t question why it occurred because even in the best markets there are some downturns. I’m a buyer because the fundamentals are strong.

Modest Stocks Rebound - Not Much Inflation

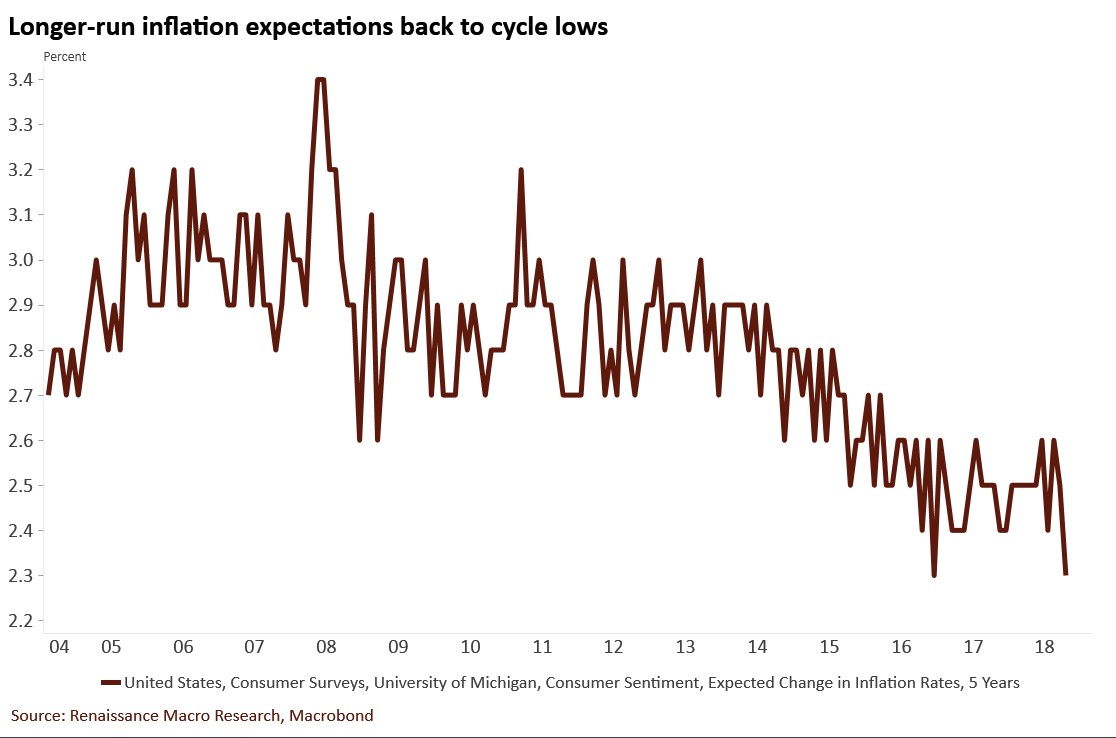

In the latest University of Michigan consumer sentiment survey, the 5 year inflation expectations fell 0.2% to 2.3%. You can see this in the chart below.

The year ahead inflation estimate increased 0.1% to 2.8%. The longer run inflation estimate is back to the cycle low as if nothing happened. Yet inflation is higher than last year.

It looks to me like consumers see this inflation in 2018 as temporary. That’s a fair assessment because the inflation caused by tariffs has moderated.

As I will show, the PPI and CPI reports agree with the assessment of future inflation as their September readings were weak.

Modest Stocks Rebound - PPI: Transport Services Drive Inflation

The PPI report was weak. Food and trade services dragged down year over year inflation. Shipping costs pushed it up.

September headline PPI-FD was up 0.2% month over month. This met the consensus and was above last month’s decline of 0.1%.

Year over headline inflation was 2.6% which was down from 2.8%. That difference is related to comparisons. Inflation went from 2.44% in August 2017 to 2.62% in September 2017.

Transport services were up 5.9% year over year and 1.8% month over month.

Costs are driven by the shipping industry which is having constraints for trucks and truckers. This labor constraint has lasted all year.

Food and energy prices were weak on a month over month basis. They were down 0.6% and 0.8%.

Goods prices fell 0.1% month over month. Services prices were up 0.3%. Services were up 2.4% year over year.

Construction has had capacity issues, which explains why its prices were up 3.4% year over year. They were only up 0.1% month over month.

PPI which excludes food and energy was up 0.2% month over month. That met estimates and was up from the 0.1% decline last month.

As you can see, the month over month comparisons were easy across the board. It was up 2.5% year over year which increased 0.2% from last month.

As I mentioned earlier, the effect from tariffs has worn off. Examples of this are that steel was flat month over month and aluminum fell 0.3%. Their pop earlier in the year is show by their year over year performance which is up 18.1% and 10.7%.

Trade services brought the headline and core reading down. Trade services prices were up 0.1% in September after falling sharply in the previous two months.

They were only up 0.9% year over year. To be clear, trade services track wholesalers and retailers. Inflation without food, energy, and trade services was up 0.4% month over month and 2.9% year over year.

Modest Stocks Rebound - Shelter Inflation Slows

Shelter inflation had been driving CPI, but it was soft in September. This explains why each metric missed estimates by 0.1%. Month over month headline CPI was up 0.1%. Year over year CPI was up 2.3%.

Energy fell 0.5% month over month and was up 4.8% year over year. Food prices were up 1.4% year over year. Transportation prices were down 0.3% as used vehicle prices fell 3% and new vehicle prices fell 0.1%.

Core CPI was up 0.1% month over month and 2.2% year over year. With this decline, I wouldn’t be surprised to see core PCE growth fall below 2% which is the Fed’s target.

Since shelter inflation is the biggest component of CPI and has been high, it has driven inflation this cycle. It wasn’t much of a driver in this report as it was up 0.1% month over month. Owner’s equivalent rent was up 0.2%.

Year over year shelter price growth fell from 3.38% to 3.29%. Apparel was up 0.9% month over month, but fell 0.6% year over year.

With this 0.3% decline in headline CPI growth and the 0.1% decline in hourly wage growth, real wage growth accelerated in September.

Recent Comments