I have been following Snapchat for a few years. I found myself wondering if the company would be able to do its IPO in time before the credit cycle ended. In fact, CEO Evan Spiegel himself seems to be knowledgeable about the perils of Federal Reserve money printing. It’s an interesting parallel as his company is now benefiting from a policy which he said “created abnormal market conditions” which means “most value-driven investors have left the market.” I’m guessing Evan is aware that he is lucky because it appears Snap’s IPO will be in time before the market falls. Without a doubt, there will not be any value driven investors buying his stock.

It’s a sign of the crazed QE bubble economy we live in that a company that puts dog ears and a dog nose on your face for selfies is about to do a $22.5 billion IPO. If the IPO does raise the intended amount of money, it will value Snap at over double the valuation Facebook received at its IPO. Facebook was at a different point when it did its IPO as investors were questioning if had enough young users. The emergence of Instagram answered this question which is why the stock rallied. Of course, that’s not the only reason for the rally. The other reason is Facebook can target users which has allowed it to raise prices on ads. Up until this year it has been able to simultaneously raise prices and raise the number of ads on the service. This year the ad load will stop growing.

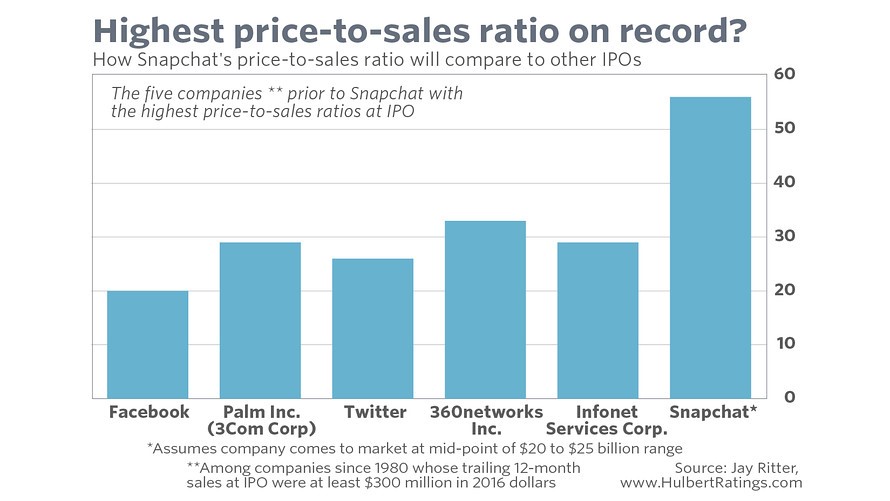

As you can see from the chart below, Snap’s IPO will be the most expensive ever on a price to sales ratio. As I said, this is a sign of the times as the median stock currently has the highest price to sales ratio on record. The Snap IPO reminds me of Shake Shack’s IPO. It’s rare to have a well known IPO reach such unprecedented multiples. However, because of the run up in Shake Shack’s stock, it became the most expensive stock in the entire market. This was a dubious title as its performance has been negative since then. It’s difficult to determine where bubble stocks will go because the increase that got them to that price was irrational. It’s a matter of figuring out when the irrationality will lead to panic.

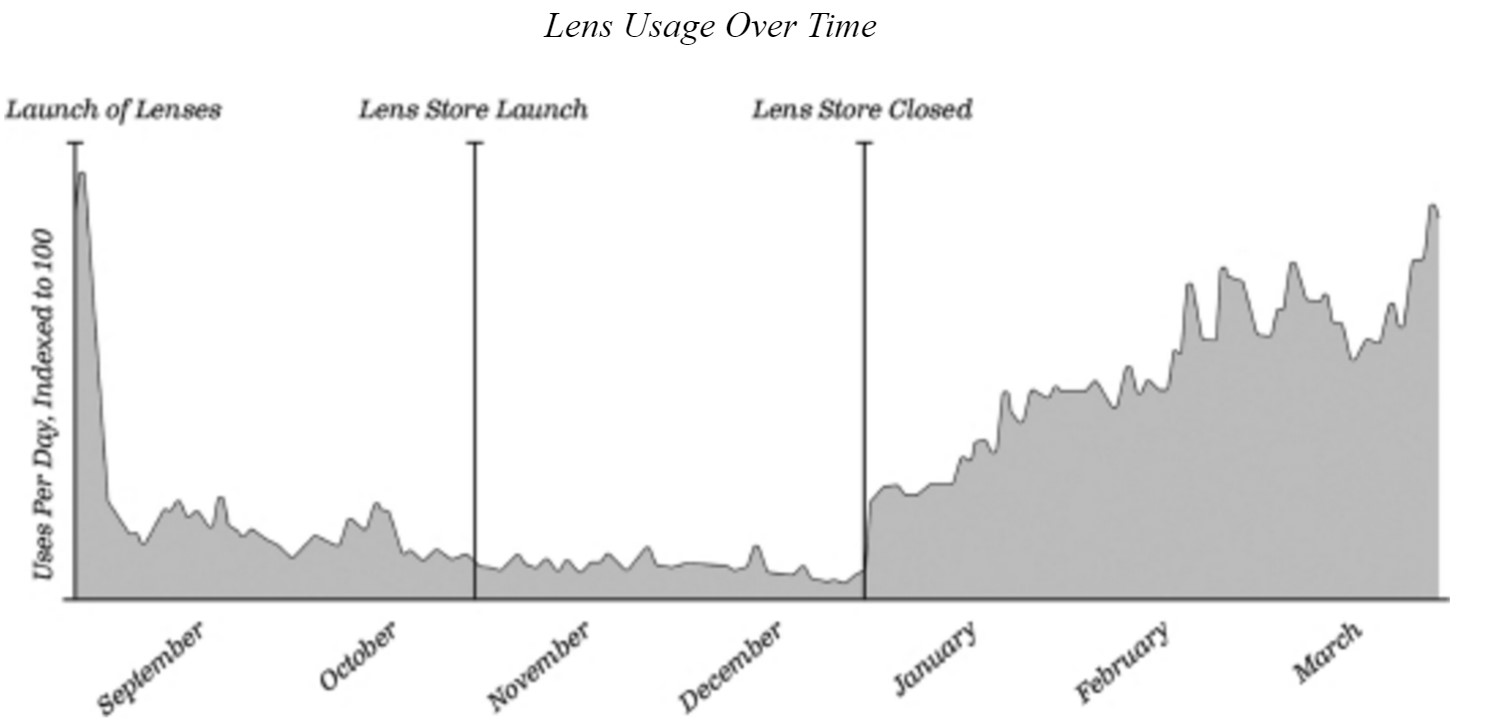

An interesting part of the S-1 filing is when Snap revels how it tried to charge for its lenses. Snap explains how this was a failure as usage decreased after the lens store opened and increased after it closed as you can see in the chart below. It’s not a surprise that usage increased when it became free. It tries to put lipstick on the pig by saying the company is great at building products for self-expression, but the reality is Snap has tried to sell features and has failed. This provides insight to any Twitter investors who have been begging Twitter to start charging users. This concept sounds good in theory, but social media firms are advertising firms. They can’t sell their services. One example of a messaging app selling features is Line which sells stickers. Line generated $268 million in revenues in 2015 by selling stickers. That sounds like a Farmville type business model which isn’t sustainable and probably won’t work for Snapchat.

Another way Shake Shack and Snap are alike is both have successful firms they were compared to. Shake Shack was supposed to be the next Chipotle. This was before Chipotle’s health scandal when it was still a high-flying stock. The reality is there was nothing special about Chipotle to begin with other than it was in the good graces of Wall Street so it received a high multiple. Shake Shack ended up becoming the next Chipotle, but not in the way which was expected as both fell as the market realized there was no reason to give them premium valuations. The fast-casual space was a gold mine for the early entrants, but now it’s crowded as burritos and hamburgers don’t have much intellectual property which make them unique.

Snap is being compared to Facebook. While Facebook is an overvalued darling of Wall Street like Chipotle was, I think it has better fundamentals than Chipotle because it has a wider competitive moat. Its competitive moat is scale and ad targeting. While it is great for Snap that Facebook is a more stable company, it’s going to be tough to reach those milestones. Facebook used Instagram to solve its issue with attracting younger users. Snap doesn’t own another social network which can appeal to the older folks it’s missing out on. Being a millennial-only app won’t let it grow its user base enough to satisfy investors. Any change to get older users on board may offend the core users. Snap likely will never gain the targeting capability Facebook has. The best summary of Snap is it is like Twitter except it has a more engaged user base. The reason for that is it is better at creating new features. This dynamic may change after the company goes public.

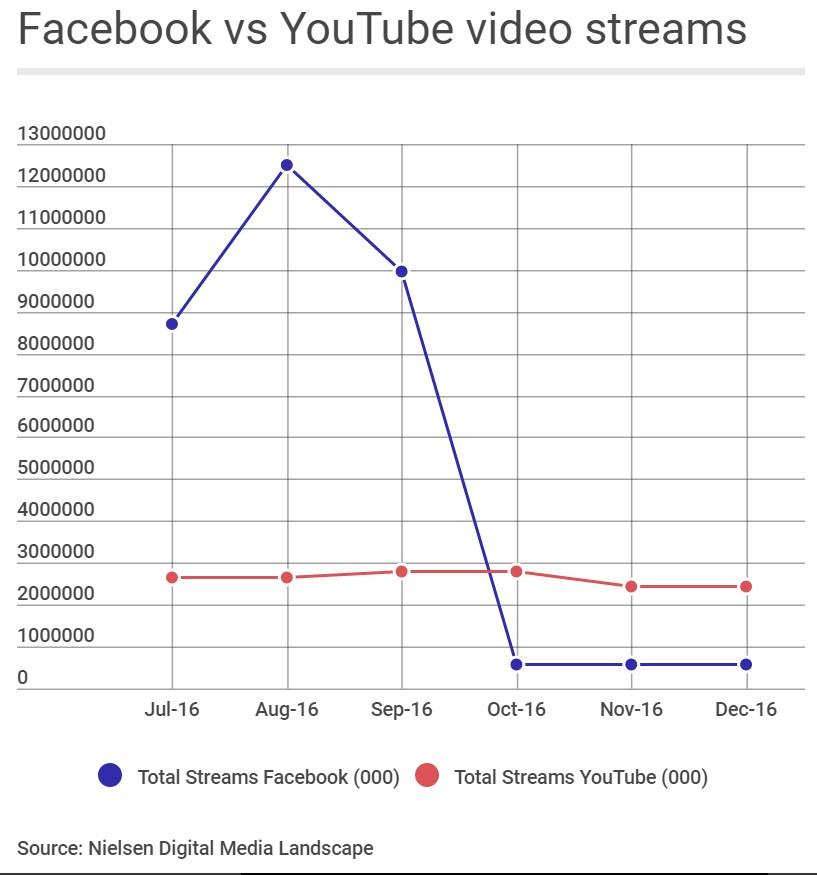

One alternative comparison between Facebook and Chipotle is to say customers cared about Chipotle’s scandal, but they ignored Facebook’s scandal. I think Facebook’s scandal was worse because Facebook’s glitch was massive. As you can see in the chart below, after the revisions Nielsen made to the way it measures Facebook’s video views, the total views in Australia declined 94%. Facebook was never bigger than YouTube. It’s interesting how a few Chipotle restaurants causing illnesses caused the stock to drop over 50%, yet when Facebook’s view count turned out to be mythical, the stock rallied to an all-time high.

Conclusion

Snapchat’s valuation is absurd. It needs to be avoided. In the best-case scenario, the stock should tread water as the company tries to come up with a business model ‘on the fly’. With Facebook stock being rewarded for the company unintentionally lying about its metrics, you have to wonder if the investment landscape is living in a post fact world.

Recent Comments