The Market Is Still Range Bound

Stocks had a poor day on Tuesday as the S&P 500 fell 0.64% and the Nasdaq fell 1.02%. The Nasdaq was hurt by Qualcomm which was down 5% because the merger with Broadcom was struck down by President Trump on Monday night. I still think the market is stuck in its range. At this point, most movements don’t impress me even if the market moves by more than 2% in a day. Nothing matters until the market makes a new high or a new low. My statements in January that the stock market was having a full year’s worth of returns in 3 weeks look accurate as those gains were temporarily repealed. They will come in much slower.

At some point in the first half of the year, the market should pass the all-time high. The correction in February was healthy because it prevented stocks from becoming in a bubble. While some investors think stocks are in a bubble now, the reality is until margins and earnings fall, stocks will continue moving higher. However, at January’s pace, even double digit earnings growth couldn’t keep up with returns. In that case, stocks could have crashed without a recession or earnings weakness because stocks could’ve looked expensive on a forward earnings basis.

White House Causing Uncertainty

President Trump’s Secretary of State, Rex Tillerson, was replaced by Mike Pompeo who is regarded to be a protectionist. This is on the heels of the steel and aluminum tariffs. Adding to that tariff, Trump is planning to get tougher on China, particularly with regards to allegations of intellectual property theft. Europe and America could have had a joint effort on this, but the water has been muddied now that the U.S. has implemented a metals tariff on Europe. China has a $375 billion trade surplus with America, which Trump wants to whittle down.

It was reported that Trump’s aides brought him $30 billion worth of tariffs on China, but Trump wanted more, so it was raised to $60 billion. It’s tough to say what this means for the market until we get more details, but it’s safe to say this could be a near term negative catalyst for the stock market. I don’t think stocks will crash because this isn’t as much of a shock as the metals tariff was. There’s no need to jump to conclusions about a trade war and Smoot Hawley level tariffs. There’s no reason to get squeamish until the Chinese act in a significant retaliatory manner to these actions. The geopolitical aspect of this is extremely important because it appears Trump wants to pressure China to strongly encourage North Korea to de-nuclearize. The situation will come to a crux when Trump meets with Kim in the next 2 months.

I often like to discuss the fundamentals of earnings and the economy instead of these geopolitical events because it’s easier to forecast earnings and growth. Personally, I don’t have an edge on what the result of the Trump-Kim meeting will be, but it’s important to keep it on your radar screen. If I was looking to buy a stock around the time of the meeting, I would hold off on the chance the meeting doesn’t go well. This will get you better entry points.

Small Caps Outperform, But Should You Buy?

Small caps have done relatively well recently because of the fears of tariffs. In theory, tariffs protect domestic production at the behest of foreign imported products. This could increase the costs of all businesses, but it could also improve the competitive advantage of small caps who are mostly domestically focused. The chart on the left shows the 3 month at the money implied volatility for the Russell 2000 and the S&P 500. There have been studies which show the S&P 600 index fund does way better than the Russell 2000. Either way, the chart shows the small cap volatility has fallen closer to large caps. It is in the 8th percentile in terms of relative volatility because usually the small cap volatility is significantly higher than that of large caps.

The chart on the right shows the realized correlation between the small and large caps has increased in the past few months. Ultimately, I don’t ascribe much to this because the future correlations will depend on the catalysts which move the market. Tariffs might cause decreased correlation because, as I mentioned, they may hurt international firms more than domestic ones. Correlations are interesting, but causation is what provides an edge. This is why the saying “correlation doesn’t imply causation” is popular. Correlation is mostly meaningless unless there’s causation, (often there isn’t).

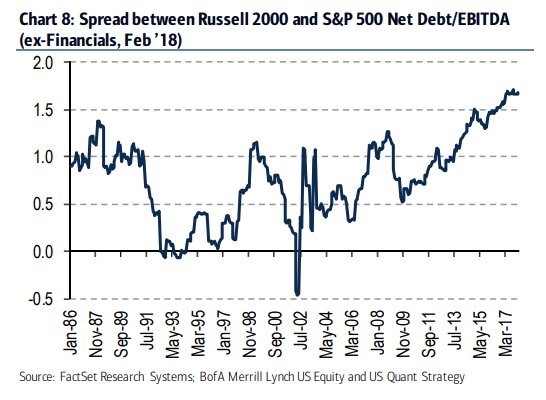

Clearly, you shouldn’t buy small cap stocks blindly based on tariff potential even if it’s paired with shorting the S&P 500. As you can see from the chart below, the spread between the Russell 2000 and the S&P 500’s net debt to EBITDA is the highest in at least 32 years. That’s because small cap earnings haven’t recovered from the 2015-2016 earnings recession. The scary part for the Russell 2000 is that the loss making companies aren’t included in the earnings multiple. As of November 30th, 2017, 34.2% of firms in the Russell 2000 were losing money. That’s a scary consideration most overlook when buying that index. As of November 30th, 2017, the weighted average long term debt to capital ratio for Russell 2000 firms was 35.3%.

Conclusion

The near term action seems to be affected by geopolitics this year more than last year. The flood of news seems to never let up as the reports of tariffs remain in the headlines almost every day. If stocks rally to a new all-time high, they would be making good use of the phrase “climbing a wall of worry.” The effect of tariffs on small caps is food for thought. More research, such as looking at the relative debt ratios of small caps versus large caps is necessary to make a smart decision on your allocation.

Recent Comments