U.S. Economy - What Caused The Consumer’s Uncertainty?

U.S. Economy and Consumer Uncertainty reach an impasse. Preliminary May consumer sentiment reading and the expectations index hit a 15 year high. Both will likely come down when the final reading is released because of the newly implemented tariffs. The chart below reviews why consumer spending fell earlier in the year.

As you can see, for those making below $50,000 per year and for those making between $50,000 and $125,000 annually, the biggest issue was the government shutdown. The good news is it’s over. Bad news is there could be another related issue this fall because the debt ceiling wasn’t raised after it was hit in March.

U.S. Economy - Delayed tax refunds also hurt spending. Consumers view tax refunds as ‘found money’ which means they spend the money right away. That’s why any delay in tax refunds can significantly impact retail sales. This explains why the weak April retail sales reading was blamed on the consumers getting less tax refunds than they expected. The benefit of lower taxes was evenly distributed last year.

Consumers formed budgets based on how much taxes were taken out of their paychecks. To be clear, the benefit of the tax cut is greater than the impact of smaller refunds.

Impact of the trade war will soon wipe away the tax cut gains for the middle class.

U.S. Economy - It will be interesting to see how consumers react to this indirect tax increase. If they react negatively swiftly, then President Trump’s power in the negotiations with China will be diminished. He always likes to play up how the trade war is helping the U.S. Economy and hurting China.

In this sense, short term negative news would be good for the intermediate term. It could end trade war.

Finally, the stock market was the biggest factor for those making more than $125,000. It’s a big problem when this group stops spending money because they have the most disposable income per person. They have the most assets which is why the stock market affected them the most.

U.S. Economy - Reflexivity effect of the stock market’s decline explains why the Fed cares about it so much. Luckily, this group had the most saying no factor caused them to spend less. That’s because small expense and income changes don’t affect the rich as much as they do the poor.

U.S. Economy In A Deep Slowdown?

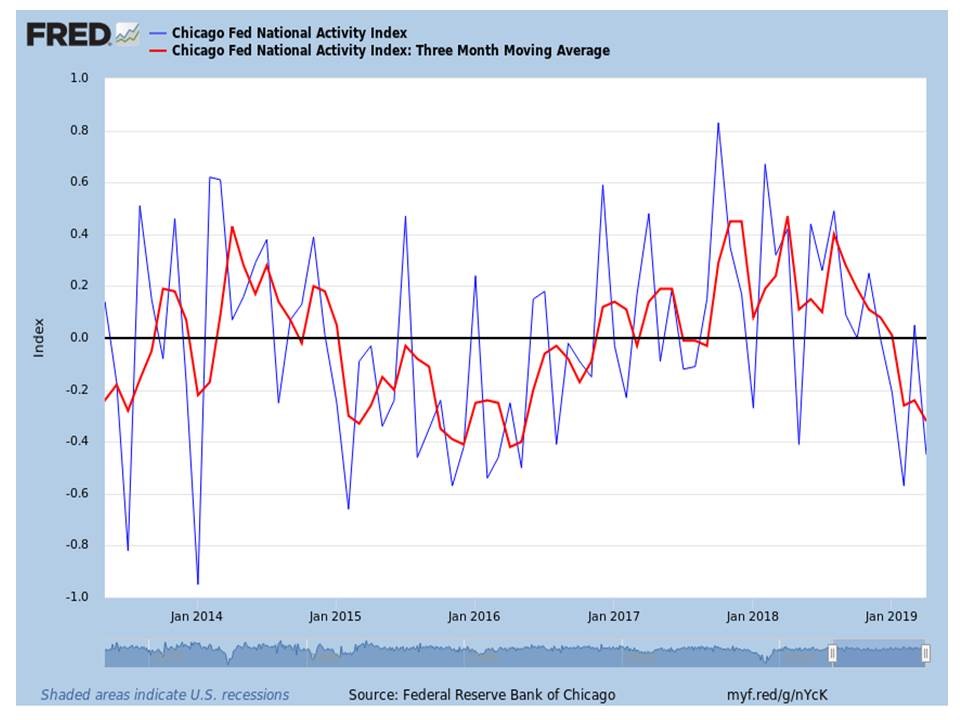

Chicago Fed National Activity index fell from 0.05 to -0.45 in April. The March reading was revised sharply higher from -0.15. Even though the April reading missed estimates by 0.3 and missed the low end of the consensus range which was -0.33, the 3 month moving average was better than the original reading as it went from -0.24 to -0.22.

Obviously, it fell from the revised 3 month average which was -0.16. Anything negative means the U.S. economy is growing below trend. The 3 month average is followed. There are many random monthly readings that don’t follow the trend as you can see from the chart below.

This indicator signals a recession when it falls to -0.7. Weakest reading in the past few months was -0.57 which was near the 2015-2016 slowdown trough.

U.S. Economy - More readings like we had in April will push the 3 month average to that slowdown’s trough. This chart is a great response to any of the bulls who wonder where the slowdown is. They only look at the stock market and cherry picked data.

Just because there are some positive economic reports doesn’t discount the fact that the economy has been in a slowdown since late last year. Cherry picking data won’t help you invest better. It will just support whatever you believe. The reality is there isn’t enough evidence to state the economy is out of this slowdown yet.

U.S. Economy - April industrial production report, specifically manufacturing, caused production related indicators to hurt the overall index by -0.44. I think it’s possible the negative impact moderates in the May reading because of the improvement in the Empire Fed and Philly Fed regional indexes. Also, there’s evidence calendar effects may have caused the industrial production report to be weak.

Personal consumption and housing segment hurt this index by 5 basis points

U.S. Economy - Which is worse than the neutral reading in March. Despite the positive preliminary reading in the consumer sentiment index, I expect the May contribution to get worse because of worries about tariffs. April retail sales were hurt by the seasonal adjustment which aimed to correct the effect of the later Easter holiday.

Just because April retail sales might have been stronger than the headline reading indicates, doesn’t mean May will be great. I think it could be weak because of the trade war worries expressed at the end of the University of Michigan survey. Finally, the employment and sales/orders/inventories readings weren’t changed much which is worse than the slight positives in March.

U.S. Economy - FOMC Member Doesn’t See Rate Cuts

U.S. Economy - On Monday, the Atlanta Fed President stated he doesn’t expect imminent rate cuts. That’s what I have predicted. Even though the economy is in a slowdown, there isn’t evidence of a recession afoot. It’s possible that the economy could rebound in the 2nd half if a trade deal is made. If it’s not made, the economy could continue to be mired in a slowdown without a recession.

His comments explain why the chance of a rate cut at the June 19th meeting fell from 10% to 6.7%. Also, the chance of a July cut fell from 24.9% to 20.2%. Usually, when weak economic reports come out, the chances of rate cuts increase. That explains why the market expects a rate cut this year. If the Fed denounces cuts, the chances decline.

U.S. Economy - While the Fed can use forward guidance to affect the futures market, it will catalyze a stock market correction if it gets too hawkish. That explains how future policy is based on both the Fed and the market. The Fed’s power varies depending on how much it wants to go against the market. If the Fed doesn’t cut this year, it will likely cause a stock market correction unless the economy improves.

Recent Comments