U.S. Treasuries - Fundamentals Of The Treasury Market

The long bond sold off sharply from the end of August until September. It has been steady in October. The question is where it moves next. Personally, I look at the bond market as a signal of the economy. From that, I use my opinion of the economy to predict where it goes.

The selloff late in the summer caught me by surprise. But it needs to continue in October before I start to question my expectation for a slowdown in 2019. My prediction is that year over year inflation growth will fall in the next few months.

In a previous article, I showed the net short position in the 10 year bond is at a record high. This implies there could be a steep decline in yields.

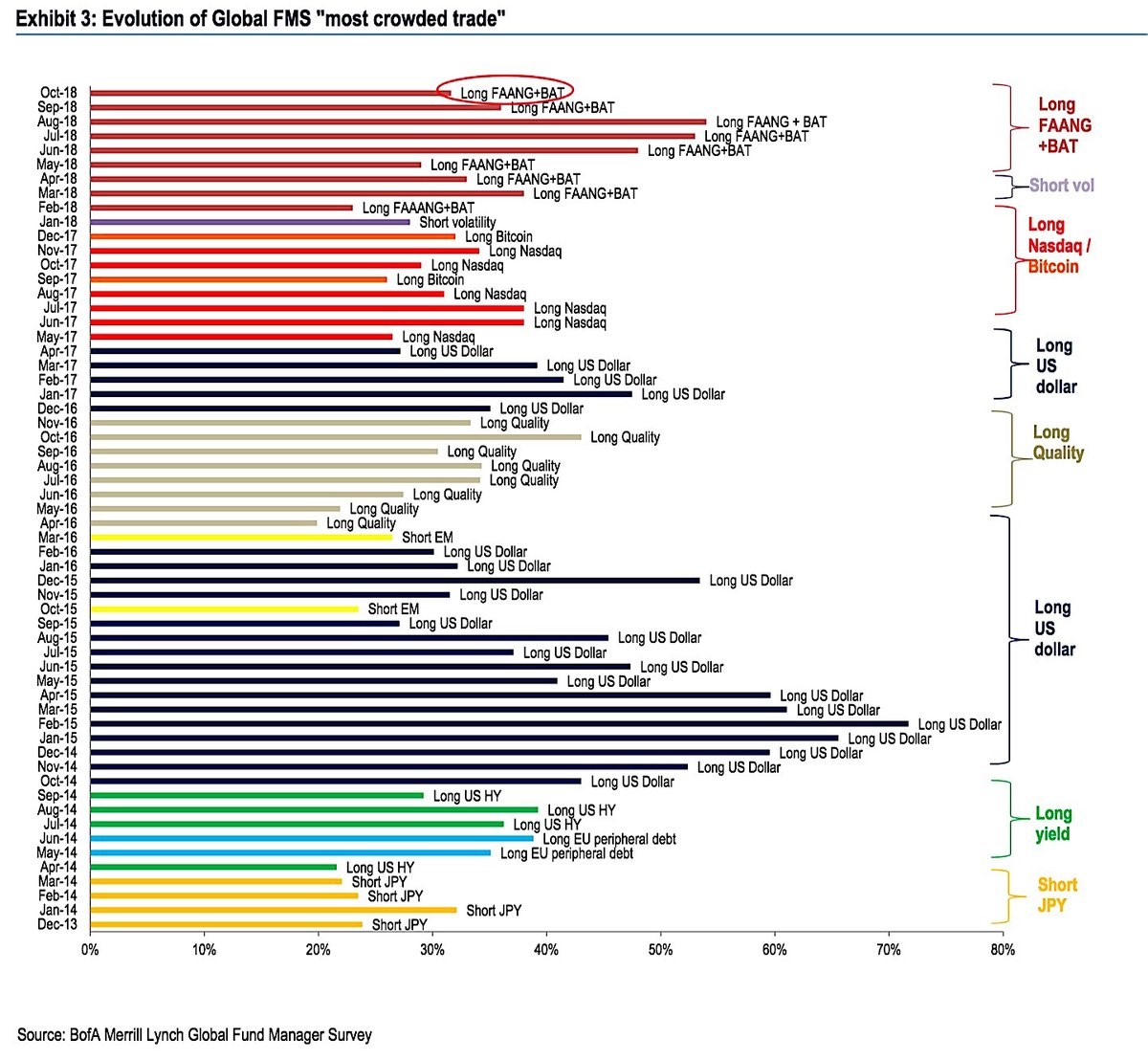

Generally, you don’t want to be in a trade that is overly crowded. The bad news for the treasury market is there will be an increase in supply in the coming quarters.

Budget deficit has increased 17% to $779 billion because of spending increases. The deficit is the highest in 6 years.

Fiscal revenue increased $14 billion and outlays increased $127 billion which is a 3.2% increase. Spending increase came from defense, Medicaid, social security, and disaster relief.

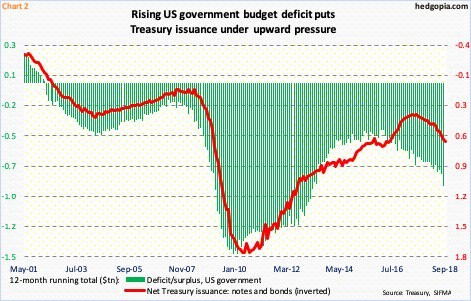

As you can see from the chart below, usually the deficit increases when the economy is weak and decreases when the economy is strong.

However, this year is an exception as the economy has been strong, but the fiscal stimulus catalyzed a bigger deficit.

It’s rare to see such a large stimulus at this point in the cycle. Technically, we can’t prove what point in the cycle we are in. Indicators like the unemployment rate, output gap, and the length of the expansion signal this stimulus could be the latest one ever.

U.S. Treasuries - The interesting aspect of this timing is figuring out the effect on the treasury market.

Usually, there is strong buying in treasuries during recessions in a flight to safety trade. In this environment, there is no flight to safety and supply is increasing.

There is also increased supply from the unwind of QE where the Fed is letting $30 billion in treasuries expire off its balance sheet per month without buying new ones.

As you can see from the chart above, the net treasury issuances are behind the deficit. It means new issuances will need to be executed to catch up. That could catalyze further weakness in the treasury market.

U.S. Treasuries - Yields Too High

Remember that with increased hawkishness from the Fed, the near term treasury yields will increase for the next few months at least.

When the 2 year yield peaks, we’ll know the Fed is nearly done with its rate hikes and that a recession is coming soon. It’s important to recognize that you can’t compare U.S. bond yields to other government bond yields without adjusting for hedging costs.

If there weren’t hedging costs, American bonds would have been purchased at a feverish pace.

That feverish pace could be coming soon. The chart below shows the U.S. dollar hedged 10 year treasury yield is higher than the German bund yield and the JGB yield.

The bund yield has been higher than the treasury yield for most of the year. However, the recent spike in treasury yields has increased the difference to the highest in over a year.

Treasury yield being higher than the 10 year JGB is a new occurrence. This divergence in yields can either cause the German bund and JGB yields to increase or the U.S. treasury yield to decrease. Personally, I’m bullish on the American long bond.

U.S. Treasuries - Fund Managers Still Scared Of FAANG

It’s interesting that the long FAANG+BAT trade is still considered the most crowded trade. These stocks haven’t been doing that well in the past few months.

Tencent is down 31.83% year to date. The number of fund managers who mentioned this trade as the most crowded is down about 20% since August. This could be a case where no other trade increased enough to challenge this one. Therefore, it is the ‘de facto’ leader.

There has been a bifurcation in the group of top internet stocks. Netflix stock increased 5.28% on Wednesday because of great earnings. However, Facebook has been in the doldrums. That's because of bad press and worries about regulations. And also because of the peak in the percentage of ads serviced on Facebook newsfeeds.

The latest worry about Facebook is a lawsuit it faces over fraudulent video view counts and fraudulent watch time.

This lawsuit alleges Facebook waited to tell advertisers after it found out the views were fake and that it tried to covertly switch to measuring watch time without anyone noticing.

Furthermore, the plaintiffs allege Facebook says it inflated watch time metrics by 60% to 80%, but the inflation was actually 150% to 900%.

Obviously, we will figure out the truth after this lawsuit is settled, but the media coverage of this story makes Facebook look bad. It dredges up the faulty numbers once again which could cause advertisers to lose trust in the firm.

It was convenient at the time for Facebook to delay telling the truth, but now it looks terrible. There is a group of investors trying to remove Mark Zuckerberg from his position as chairman.

If Facebook is found guilty, I’ll rescind my recommendation of the stock. As an investor, I can only analyze the company based on the numbers provided.

If they are false, my analysis will be wrong. Just like Netflix, Facebook’s earnings report will be extremely important. Given the low expectations, if results beat and the conference call goes well, the stock can pop sharply.

Recent Comments