Markit PMI Was A Disaster

If the stock market wasn’t down much, there was no virus, and the Markit services PMI was this weak, we'd say sell stocks and brace for a recession. Services PMI fell from 49.4 to 39.8 which beat estimates for 39.1. Obviously, we are in an unusual time in which the economic data is way behind the markets.

Stocks barley flinched at this news and it doesn’t change the outlook in the intermediate term. Economic data from this spring will be thrown out. We only need to see how bad it gets to determine how tough it will be to recover. We’ll be looking at the COVID-19 cases and fiscal policy to formulate opinions on markets in the next few months.

This service sector reading sent the composite index down from 49.6 to 40.9 which is the equivalent to a 5% GDP decline in Q1. Finally, we have a PMI that is consistent with the weakness we’re seeing. ISM reports have been predicting unrealistically high GDP growth because they include the buildup in supplier delivery times. Markit is predicting a 5.5% decline in full year 2020 GDP.

Let's focus on the difference between the final and flash readings because the economic weakness was mostly in the 2nd half of the month. Shockingly, the final services reading was 0.7 higher than the flash reading. That doesn’t make much sense because the economy was shutdown in the 2nd half of March.

Either way, the decline in output was the worst ever (since October 2009). Job losses were the joint worst since December 2009. I will be reviewing the labor report later in this article. Confidence, which had been high in the previous few months, fell to the lowest level in this survey’s history as firms expect business activity to be unchanged. For firms that are usually optimistic, an unchanged prognosis is quite negative.

These firms are worried about the longevity of the COVID-19 outbreak and the following economic recovery (it could be rough). Comment section of this report stated the weakness in Q2 will likely eclipse Q1. That’s realistic since the shutdown should be in place for all of April and at least some of May.

ISM Services PMI Also Falls

To be clear, the chart below has the right data. The headline is just wrong. It should say non-manufacturing. ISM services PMI fell from 57.3 to 52.5 which beat estimates for 43 and the highest estimate which was 47. Just like the manufacturing report, this one was held up by the supplier deliveries segment as you can see from the chart below. Supplier deliveries index rose 9.7 points to 62.1 because the supply chain is busted and non-essential workers are being forced to stay home.

Excluding that index, this was by far the worst report since the last recession. It will easily eclipse the 2001 recessionary low this spring. Business activity segment fell 9.8 points to 48 and the new orders index fell 10.2 points to 52.9. It's amazing that it managed to stay above 50.

This PMI is consistent with 1.4% GDP growth. That’s grossly inaccurate. ISM should consider adjusting their metric to not include deliveries so it can come up with more realistic projections in recessions. 5 industries reported growth and 9 saw a decline in business activity. 5 industries with growth were Health Care & Social Assistance; Accommodation & Food Services; Construction; Public Administration; and Finance & Insurance. In the comments section, 8 out of 10 firms mentioned COVID-19 or coronavirus.

An information firm stated, “Like most businesses, we cannot fully project how the coronavirus will impact us. By displaying prudence and avoiding panic, we are trying to navigate this crisis. As human capital is our greatest expense, protecting that capital is job one. Supply chains are overstressed and will normalize only when the panic subsides.”

New Prediction From Oxford Economics

Latest jobs report isn’t that important because it doesn’t reflect most of the weakness that has been happening in the past couple weeks because of the shutdown. Therefore, let's start with Oxford Economics’ latest projection for the April report following this BLS reading.

As you can see from the chart below, the firm predicts there will be 24 million people unemployed. That’s up from the previous projection for 20 million job losses. Unemployment rate is expected to spike to 14% instead of 12%. That’s massive dislocation in the labor market that will take many quarters to recover from.

Much Worse Than Expected Jobs Report

Despite the pandemic, most economists didn’t think this would be a terrible jobs report because the cutoff date was the week of March 12th. They were wrong as it was a very bad report. This is only the beginning of the weakness coming this spring. There were 701,000 jobs lost which missed estimates for 150,000 lost.

In the household survey, 2.987 million jobs were lost which is well over double the worst monthly reading ever. Unemployment rate rose from 3.5% to 4.4% which was above estimates for 3.9%. The underemployment rate rose 1.7% to 8.7% which was the biggest increase ever.

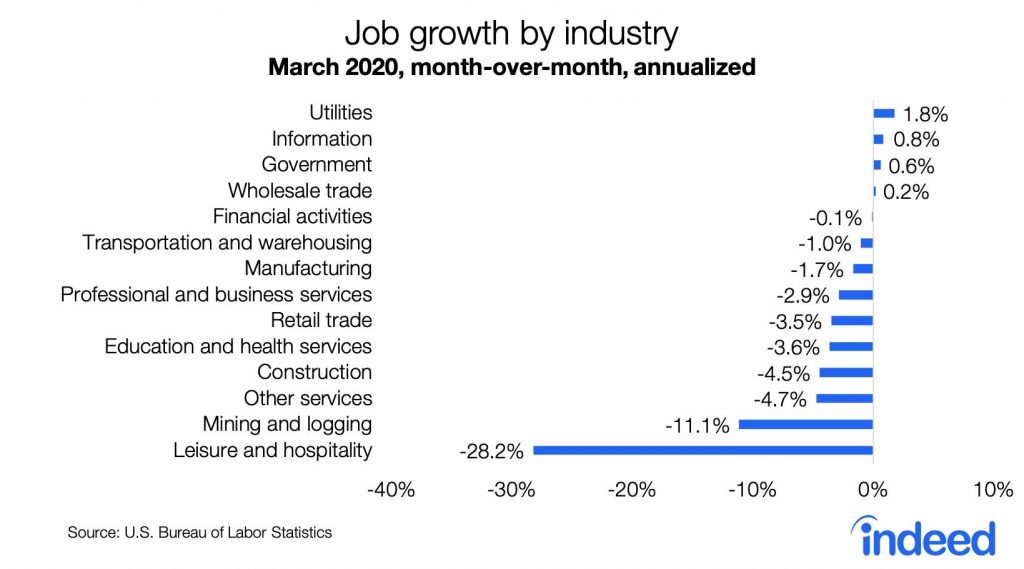

Manufacturing actually only lost 18,000 jobs which was 2,000 better than expected. The chart below shows the growth in each industry. Utilities, information, government, and wholesale trade were the only ones that added jobs. There was a huge contraction in leisure & hospitality and mining & lodging. Leisure & hospitality lost 459,000 jobs.

Health and social assistance lost 61,200 jobs. Usually this industry is recession resistant, but it isn’t when there is a pandemic and non-essential workers need to be let go. Government added 12,000 jobs, information added 2,000 jobs, wholesale trade added 900 jobs, and utilities added 800 jobs.

Labor force participation rate fell from 63.4% to 62.7%. Yearly growth in average hourly earnings was 3.1% which was up from 3%. That could be related to the growth in information and the decline in leisure & hospitality which pays its workers the least. Length of the workweek fell 0.2 hours to 34.2 hours.

Recent Comments