Motor Vehicle Sales Weaken

December motor vehicle sales report put a dent in any thesis that December retail sales growth will be strong. Motor vehicles and parts category has the highest weighting in the retail sales report. I still think non-store retail sales growth will accelerate. However, motor vehicles and parts weakness can counteract that positive impact. Specifically, in December total vehicles sales were 16.7 million which fell from 17.1 million and missed estimates for 17 million. That’s a 3.9% decline from last year. Domestic vehicle sales fell from 13.3 million to 13 million.

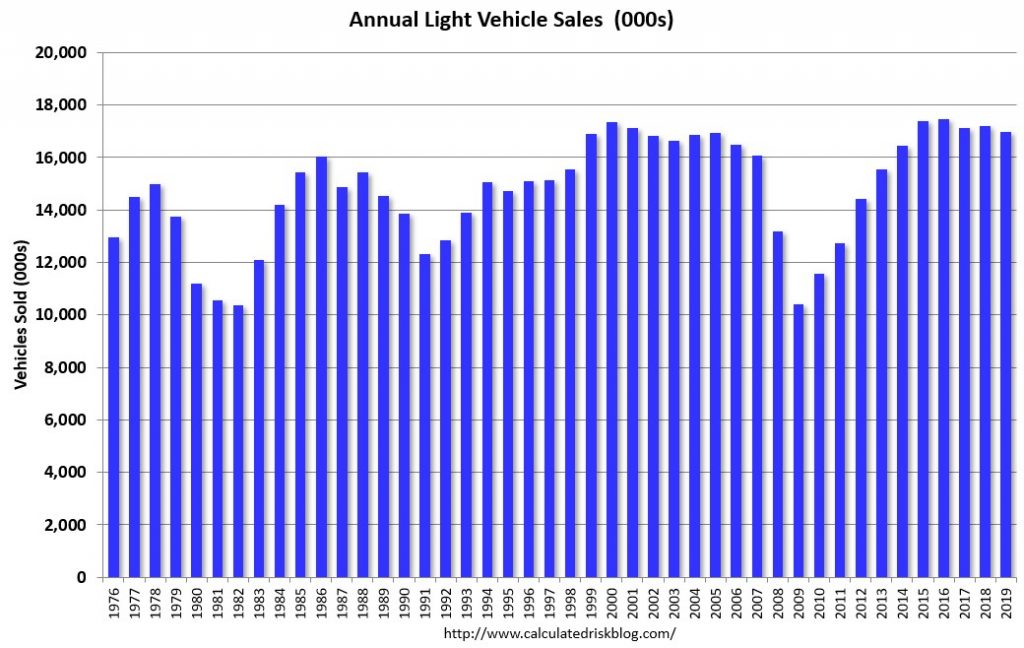

Now we have total sales data from 2019. As you can see from the chart below, light vehicle sales were 16.97 million per month which was down from 17.21 million. That’s a 1.4% decline. It’s interesting that in a year with a strong consumer, vehicle sales still fell. Sales would have been worse if the consumer was in trouble. 2019 was the 7th best year for vehicle sales. The best was 2016.

It’s interesting that there were strong sales in 2015 and 2016 because that was the period of the last slowdown where the economy almost fell into a recession. Clearly, not all data shows there was weakness. That’s partially why it can be said with certainty there wasn’t a recession then. It’s interesting that sales were also strong in 2001 which was a recessionary year.

Furthermore, the fact that sales in 2000 and 2001 were greater than sales in 2019 despite population growth is important. With baby boomers reaching ages where they can’t drive cars and millennials delaying buying cars, demand per person has shrunk in the past 2 decades. Millennials get their driver’s license later than previous generations. They are moving to cities where a driver’s license is less necessary.

Another trend in vehicle buying is the switch to light trucks (includes SUVs) from sedans. As you can see in the chart below, 73% of vehicles sold were lightweight trucks. This trend has been ongoing for several decades. The trend was reversed temporarily by the spike in oil prices in the late 2000s and the financial crisis. Sedans are cheaper and more efficient.

Americans aren’t worried about fuel prices since they have been low in the past few years. That has been a huge detriment to the advancement of electric cars. It’s amazing that Tesla has been able to survive in such an environment. I think oil prices will rise in 2020, but not enough to make people switch to electric cars en masse. Unless there is a major geopolitical event, WTI oil shouldn't rise above $100 again in the next few years.

Markit Services PMI

December Markit services PMI rose from 51.6 to 52.8 which beat estimates for 52.2 and the high end of the consensus range which was 52.3. This pushed the composite PMI up from 52 to 52.7 which beat estimates for 52.2. Markit now shows the service sector expanding quicker than the manufacturing sector just like the ISM reports.

It was the 2nd successive rise in new business as improved client demand led to the fastest new orders growth in 5 months. New orders growth was temporarily negative in October. Just like in the manufacturing report, foreign demand increased. This was the first increase in foreign new business since July.

Employment increased for the 2nd straight time and growth was the strongest since July. In the past few months, the Markit data had been way too bearish on the labor market. In the comment sections, these reports would say that we should see weakness by the end of the year, but it never came. Backlogs were unchanged. Input costs increased for the 3rd straight month and prices were up the most since July. This is due to supplier and wage costs.

Those on the low end of the labor market are getting the most wage growth. This will increase again in January because of the minimum wage hikes. Output prices increased at even faster rate; output inflation was the highest since February. 1 year confidence also improved. In the comment section of the report, it says the overall results are consistent with 1.8% GDP growth. Growth should come in above that because of the smaller trade deficit which I will detail in another article.

Strong ISM Services PMI

As you can see from the chart below, the ISM services PMI was solid. It increased from 53.9 to 55 which beat estimates for 54.5 and met the high end of the consensus range. It was slightly below its 12 month average of 55.5, but it was the highest PMI since August.

Spread between the services and manufacturing PMI is the largest since October 2015. Within the report, the business activity index was up 5.6 points to 57.2, but the new orders index fell 2.2 points to 54.9. 10 industries had growth in business activity and 7 had a decline in business activity.

Employment was down 0.3 to 55.2. December BLS jobs report comes out this Friday. Consensus is for 155,000 jobs created which is down from 266,000 in November, but still solid. Prices index was stuck at 58.5 and the new export orders index fell 1 point to 51. Services PMI is consistent with 2.2% GDP growth which is 0.4% above the Markit estimate and 0.2% above the median consensus.

Within the ISM services comments section, there was one mention of the trade war. A construction firm stated, "Weather and the holiday season have had an impact on residential new construction sales and production. While demand is outstripping supply in the housing market, business is down due to global trade insecurity causing affordability, labor and cost pressures."

It’s good to see demand outstripping supply. That will lead to increased starts in 2020. A retail trade firm stated, "The shorter-than-normal holiday season tightens sales opportunities; however, initial trends have been favorable.” It’s good to see favorable trends. This supports bullishness on the holiday shopping season.

Recent Comments