The Stock Mania Goes Vertical

Still A Bubble The past few days have been mixed for stocks, but there is still a ton of speculation in the market. The biggest example of this speculation is in Apple stock. Apple was up 2.9% which put it just 1.7% below its record high. It rose on the story that it will have…

Consumers Don’t Like What They See?

Redbook Sales Growth Bumps Up Redbook spending growth in the week of December 19th rose from 2.5% to 6.5%. That’s actually a good reading. It had been in the low single digits for a while. If it can stay in the mid-single digits, it will be a positive sign. As for now, it’s just 1 week…

Best Breadth Ever? Mania Lives On

Slight Decline Monday Following the stimulus agreement and the worries about a new COVID-19 strain, the stock market opened down largely on Monday. Throughout the day, the market recovered. It only ended up down modestly, with small caps ending up. Small cap value was the biggest loser. You can say investors were scared about the…

We Finally Got A Stimulus!

The Stimulus Is Finally Here Congress finally passed a stimulus. We have been waiting for one since October. Most didn’t think anything would pass initially, but also it seemed improbable that people on unemployment would be left out to dry. What really pushed Congress in the direction towards getting a deal done was the weak…

Tesla Added To The S&P 500

Finally, A Small Decline The stock market finally sold off on Friday, but it was only a modest decline. The S&P 500 fell 35 basis points. It was a very weird day for individual stocks because of quadruple witching and indexing. Index funds needed to make changes to their weighting as well as add and…

Holiday Spending Is Down?

Weak Data From Chase In this article we will include a few tracking updates on how the economy looks in real time as we end the year. There has been differing data on the consumer. We’ve seen some data points suggest consumer confidence is high and that they expect to spend a lot more in…

Will Stocks Ever Fall Again?

Stocks Can’t Possibly Go Down We never thought we would see stocks spike on news of vaccine shipments being marred in confusion, but here we are. Stocks only go up everyday no matter what the valuations are. For example, Shopify rose 2% on Thursday, putting its year to date return at 189%. This is now…

Job Losses In December A Strong Possibility

Negative Job Creation Is Coming This current slowdown is nowhere near as bad as the one in March and April, but it is worth watching because the situation is unstable. The goal is to avoid too much weakness before the vaccines go out. We will start to see a recovery in February. That leaves us…

Stocks Will Never Fall Again?

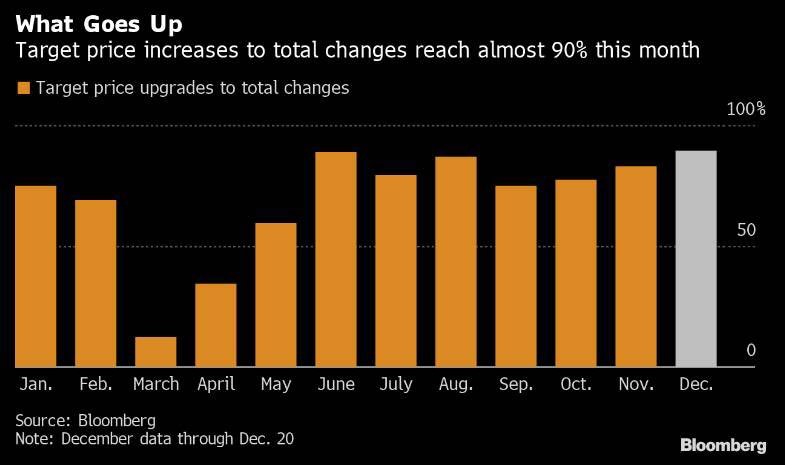

Bullish Backdrop We have the vaccine starting to go out, a $900 billion stimulus, and the Fed saying it won’t hike rates through 2023. It feels like the stock market can’t fall with such a great backdrop. Pesky tech valuations are no match for momentum and the onslaught of buying from millennial retail investors. Many…

Fed Keeps The Pedal To The Metal

Stimulus Is Almost Here The stimulus is almost here. The latest details are the $900 billion stimulus will include checks between $600 and $700. It will also include $300 in weekly unemployment insurance for 16 weeks. This new bill is a revision of the $748 billion bill that excluded the politically divisive choices. This new…

Recent Comments