Still A Bubble

The past few days have been mixed for stocks, but there is still a ton of speculation in the market. The biggest example of this speculation is in Apple stock. Apple was up 2.9% which put it just 1.7% below its record high. It rose on the story that it will have a new EV out by 2024. Elon Musk stated Tim Cook wouldn’t have a meeting with him when the company was ramping up production of the Model 3 (for Apple to buy Tesla).

Elon is floating this story because he wants to merge with an automaker to help scale production. Elon always talks about how the company was in trouble in the past. We all wonder if he talks about how bad 2020 was 3 years in the future.

If Apple does come out with an EV, it’s a signal Apple has run out of room to grow. All of the major internet firms are in trouble. How can they grow on such big bases? It would be a perfect ending to 2020 if Apple stock hits a new record on this story. However, make no mistake about it, Apple is way overvalued.

Upgrades Gone Crazy

We've almost never seen so many upgrades. They are especially laughable with Tesla because analysts chase the stock higher which, in turn, pushes stock price up; it’s a self-fulfilling cycle. Most have no choice but to raise their price target because they will look foolish otherwise. If you have a price target that’s half of Tesla’s current price, it’s like sticking your neck out. Tesla’s rampage has shown us that’s a bad idea. That’s exactly why it’s near its ultimate top.

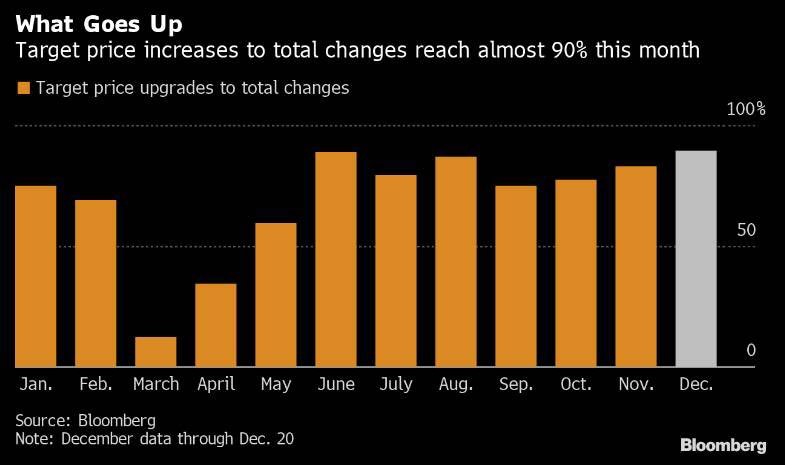

Of course, Tesla isn’t the only stock we are seeing upgrades on. In fact, almost every change is a price target increase these days. As you can see from the chart above, almost 90% are increases. Analysts were very wrong to make so many downgrades in March and April. June’s upgrades were just a reversal of those moves. The upgrades in December are different because they are increases from already high price targets.

Valuation models are being thrown out the window or misused. On the hand, valuations on energy stocks are ruthless. For growth companies, analysts look at the addressable market. For energy stocks, analysts price a long term negative growth rate.

Retail Loves Ark Invest

Ark Invest is a group of actively managed ETFs that invest in disruptive innovation. That includes stocks such as Tesla and Crispr. Crispr stock is up 187% year to date despite not having much in sales. Forget about profits. Those won’t come for many years. The Ark genomics fund was up 5.1% on Tuesday putting it up 216% year to date. Cathie Wood, the founder of these funds, is being called a genius.

It’s silly to call someone a genius based on recent returns. Everyone has a good year once and awhile. The more risk you have taken this year, the more explosive your returns have been because retail has piled into story stocks like those in genomics.

From October 2014 to March 2020, Ark’s genomics fund was up 35%. No one called them a genius then. From March until now, the fund is up 331%. You can’t use 9 months of data to determine if someone is a great investor let alone a genius.

As you can see from the chart above, the Ark innovation ETF traded $1 billion today which was more than Netflix and Disney. The Ark genomic revolution fund added $880 million in flows. All the Ark ETFs traded $2.3 billion in flows which was a record. The previous record was $2 billion on Monday. A lot of that will convert to inflows which could give the company $600 to $800 million in new cash to invest. Only Vanguard does more than that.

Retail investors are pouring their hard earned money in these funds. After such a great year, Cathie Wood is predicting more success as she thinks she will deliver returns in the lows 20s per year. That’s fairly unlikely because the market has already gone parabolic. Her stocks will likely implode next year making such returns impossible. The 5 top holdings in the flagship innovation fund are Tesla, Roku, Crispr, Square, and Invitae.

SPACs Are Going Crazy

This is a massive bubble in SPACs which are just fee generators. There have been 234 offerings this year as you can see from the chart below. This raised $81 billion. When you combine high fees with hot stocks that don’t have a business model that generates profits, you are asking for trouble. About 300 SPACs have gone public in the past couple of years. We might have 1,000 by the end of 2022 if this bubble persists which it won’t.

There are only 4,000 listed companies, just for context. It’s funny because before this SPAC mayhem started, many people were discussing how the number of public companies has been in a long term decline because of the giant tech monopolies.

Many of the companies that went public in the late 1990s went bust. This increase in public companies won’t change anything about the way the economy is structured. It’s all surface level. The monopiles are still earning massive profits as most of the newly public SPACs lose money.

Conclusion

This is a bubble market as genomics stocks have gone crazy thanks to Cathy Wood. This just adds to the number of industries in a bubble. We already have online gambling, cryptocurrencies, SaaS, semiconductors, electric vehicles, SPACs, and online retail stocks in a bubble.

This list grows each month, but this won’t end well. It also will end soon because of the amount of new supply that will be coming in 2021. Investment bankers always bring new supply when investors irrationally demand it.

Recent Comments