S&P 500 Gets Within Striking Distance Of Its Record

I was wrong to say the Nasdaq would have a good day because of Alphabet’s great earnings report as the index fell one basis point on Tuesday. The Russell 2000 was down 1.07% while the Dow was up 0.79% as it was driven by the 3.8% rise in United Technologies. The S&P 500 was up 0.48%. It needs to go up 1.86% to reach the record high set in January. The bad news is the CNN Fear and Greed index is at 64 out of 100 which means there may need to be a small sell off before it has the energy to reach its record high. There wasn’t a strong move in the dollar to justify the Dow & the S&P 500’s outperformance over the Russell 2000 as the dollar index was only down 8 cents to $94.59.

Let’s look at the sector by sector performance to get a feeling of the day’s action. Technology was up 0.5% even though the Nasdaq was down. The industrials were up 1.3% which helped the Dow. The best sector was telecom which was up 1.76%. However, it probably won’t do as well on Wednesday because AT&T was down 1.2% after hours because it missed revenue estimates. The two down sectors were consumer discretionary and real estate which fell 0.28% and 0.31% respectively.

Treasury Market

The treasury market calmed down after the sharp selloff on Friday and Monday. The 10 year yield fell slightly more than one half of one basis point to 2.9486%. The 2 year yield increased slightly less than one half of one basis point to 2.6331%. This slight flattening pushed the difference between the two yields to about 30 basis points. The Japanese central bank meeting on July 31st, which caused anguish in the Japanese bond market on Monday, abated because the JCB promised to buy the 10 year bond if its yield got to 0.11%. The yield fell in early action on Wednesday. The latest check has it at 0.078% which is down 0.008%.

I don’t expect any sharp action in the Japanese bond market until the meeting next Tuesday. I don’t expect there to be a severe change in policy after this meeting. I think the JCB may make very small changes to the way it implements policy or maybe it will just say it is looking into how it can change its techniques. Inflation and growth aren’t high enough to switch to hawkish policy. This all means that the U.S. yield curve will continue to flatten in the coming weeks.

Tariffs Become A Bailout

Even though the stock market is near its record high, America isn’t in a perfect situation to deal with tariffs because, as I have said, the people hurt by the tariffs aren’t the same people helped by the stock market going up. In a patchwork move which has many GOP congress people upset, President Trump has granted $12 billion in farm subsidies to help farmers deal with trade issues. The subsidies give Trump more wiggle room to negotiate because farmers are helped. However, the GOP can pressure Trump, causing him to end the skirmish and strike trade deals. The faster trade deals are negotiated, the better it is for the economy and stock market. I don’t think the economy and stock market care about who wins the skirmishes as long as they are resolved.

Earnings Update

You can tell the market is seeing much more action than the indexes reveal as stocks move violently because of their earnings reports. Overall, this earnings season has been great. The results have been good and the Q3 estimates have moved up. The biggest complaint is the size of the increase in Q3 estimates. The problem is Q3 estimates are so high that it’s difficult to raise the bar. In the end, stocks aren’t going to fall because earnings growth is +20% in Q3. They will fall if 2019 earnings growth fails to hit the high single digits.

The latest results show out of 118 companies that have reported earnings, 86% of firms beat EPS estimates and have an average growth rate of 26.22%. 79% of firms beat their sales estimates and turned in an average of 9.76% growth.

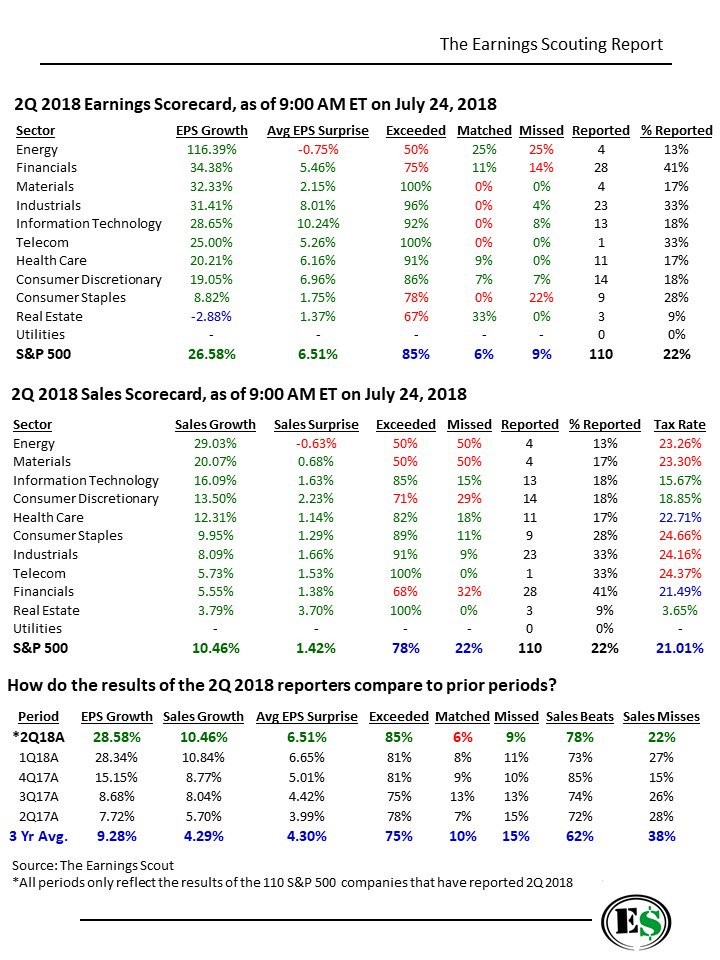

The chart below shows the breakdown of the first 110 reports as these charts get updated each day. Every single sector has a positive average EPS surprise rate except energy We can’t complain about energy as its EPS growth rate is in the triple digits. Since tech is the largest sector, it’s important for it to have great earnings. It hasn’t disappointed as the average surprise is 10.24% which is the highest sector performance. Only one of the 23 industrials have missed earnings estimates which is remarkable because investors were worried about the tariffs hurting their businesses. This explains why the Dow has done well recently.

The sales growth rate remains impressive as the average surprise rate is 1.42%. No sector has had more misses than beats. The bottom table is my favorite since it looks at past quarters at the current point. As you can see, the current EPS growth rate is now higher than the EPS growth in Q1 as the beat rate is higher and the miss rate is lower. It was always possible that the Q2 EPS growth rate would be higher than Q1 because the Q2 estimates were higher to start the quarter. My main hesitation about saying it would be better was the fact that the EPS surprises were amazing in Q1, making them tough to repeat. The current EPS surprise rate is amazing as the growth rate is just 14 basis points lower than Q2.

Earnings season is the one catalyst I feel can justify markets getting overbought. Therefore, we might see the S&P 500 barrel through its record if results continue to be positive. The biggest reports on the docket are Apple, Amazon, and Facebook.

1 Comment

Rod

July 25, 2018Thanks for another very good report... lots to think about