Consumer Confidence Reversed Sharply

Generally speaking, we usually see recessions after consumer confidence is high. A problem with shorting on that basis is consumer confidence can be high for a few years. Most wouldn’t recommend shorting when consumer confidence is high. There needs to be a negative catalyst. This economic shutdown caused by COVID-19 was the catalyst. It's probably the sharpest decline in consumer confidence ever. And it’s sad to see optimism turn to despair.

In January, 74% of consumers thought they would be in a better financial situation in the next year. Now the chart below shows 70% of consumers think the economy is in a recession or a depression. They are correct as the economy is in a recession. 12% more consumers see this recession/depression than the prior week.

Ronald Reagan famously said a recession is when your neighbor losses his job and a depression is when you lose your job. We are seeing the greatest spike in job losses since the Great Depression. It could be the worst labor market ever for a short period.

Furloughs Are Being Announced

On Wednesday, Tesla announced its hourly workers will be formally furloughed on April 13th which will allow them to apply for unemployment insurance. You can argue that is a good thing. The Freemont factory had been shut down since March 23rd. It’s better to get furloughed than to be stuck not getting paid for work, yet not being able to apply for benefits.

Furthermore, the firm announced it is cutting vice presidents’ pay by 30%, directors’ pay by 20%, and lower salaried employees’ pay by 10%. Some workers are working from home. The firm stated it will resume normal production on May 4th, but I don’t have confidence in that goal.

Obviously, it’s not just Tesla that is furloughing workers. On Tuesday, TJX Companies which owns TJ Maxx, HomeGoods, Marshalls, and Homesense said it will furlough the majority of its 286,000 workers. That pushed the retail furloughs over 1 million. More than 200,000 retail stores have been closed. TJX closed all of its 3,300 stores.

These actions explain why so many people think the economy is in a recession. It’s almost impossible to not know someone impacted by this recession because it impacts at least 40% of the labor market.

Market Share Of The Biggest Companies

The largest companies got bigger in this bear market. This bear market impacted some of the major tech players less than most firms because they actually benefit from people doing more business and consuming more content online. As you can see from the chart below, 19% of the S&P 500’s market cap is held by just 5 stocks. Microsoft stock is up 2.81% year to date as its Teams and Skype services benefit from the increased use of video calls.

LinkedIn might also be seeing more traffic as the workplace is in flux and more people are looking for a job. There has been a spike in usage on the other social networks. These big firms will unlikely lose market share soon even though the chart makes it look unsustainable. Because Microsoft and Amazon are so strong, it will prevent the market from falling to a new low this year.

Streaming Services All Benefit From Shutdown

Recent success of Disney+ brings home the point that firms that make it easier to stay home have been doing well. On Wednesday, Disney announced that it had 50 million subscribers to its video streaming service which was almost double the amount it had as of February 4th. Stay at home orders have been a huge tailwind for subscriber growth.

Verizon’s web traffic increased 20% in a single week. In the week of March 16th, Nielsen stated streaming viewership increased 22%. Disney stock rose 6.75% after hours because of this announcement.

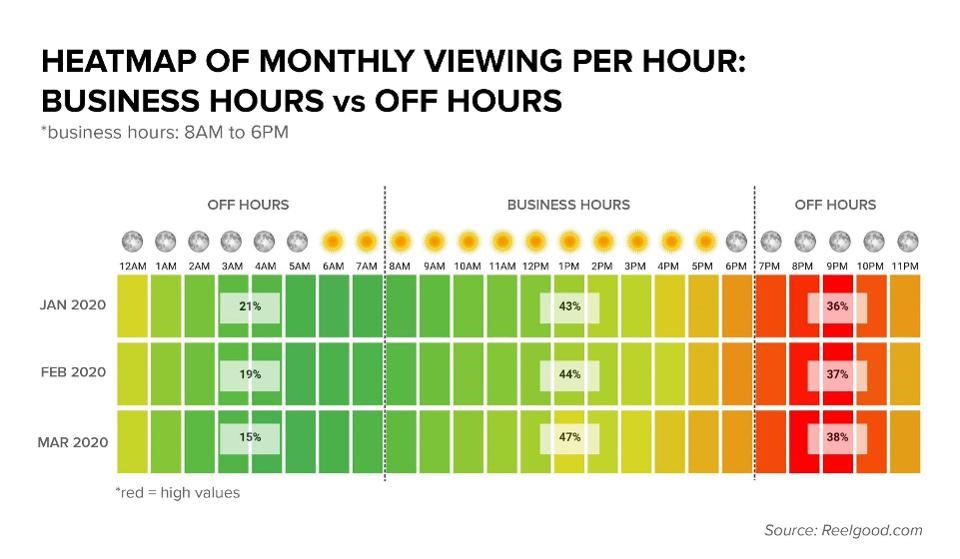

Netflix stock is up 12.53% year to date. Streaming is up 101% compared to the first week in March. As you can see from the image below, because many people have lost their jobs and are working from home, people have been watching more streaming services during normal work hours. In the last 7 days, 51% of the video streaming has occurred from 8AM to 6PM. That’s compared to 43% in January.

According to the website Reelgood, Netflix had 42% market share, Amazon Prime had 22.1% market share, and Hulu, which is owned by Disney, had 17.2% market share. It’s amazing how the situation has changed for the streaming services in the past 8 weeks. Before the shutdowns, we were talking about how crowded the space had become. If you subscribe to a few services, it can end up costing more per month than traditional cable.

Over the top services were supposed to save consumers money. Now the conversation has shifted as virtually all services are doing well. Right now, competition doesn’t matter. It probably will matter much more in a few months, but it's likely that plenty of the new subscribers to these services will stick.

Obviously, churn will pick up a bit because people will use them less when the shutdowns are over. Plus, some people will have watched all the shows they want on some platforms because they have extra time at home. That being said, this entire cycle of new subs and some excess churn will be a net benefit for the streaming firms like Netflix and Disney. Obviously, Disney has other issues because its parks have been shut down and sports aren’t on which hurts ESPN’s ratings.

Conclusion

Consumer confidence has had a sharp decline as people went from being the most optimistic ever to seeing a recession/depression. Over 1 million retail workers have been furloughed. Top 5 mega cap tech stocks dominate the stock market like never before.

Shutdown orders have been a huge boon for the streaming services just as it looked like they might be hurt by the recent influx in competition. For now, Netflix is insulated from the competition as the time spent streaming video has increased.

1 Comment

Kevin Morgan

April 10, 2020Something doesn't add up when the US is quickly headed to 25% or more unemployed, a giant swath of corporate America is literally shut down...and stock prices are less than 10% below where they were just four months ago. It's strains credulity. It is proof positive of a vastly inefficient market.

The quick bounce back projections for GDP for Q3 and Q4 are fallacious. The pace of businesses opening, rehiring employees, and doing nominal levels of business will be extremely slow, compared to the rapidity of the economic collapse. Who's gong to suddenly rush out and spend at restaurants, fly on airplanes, vacation at the B&B, buy new iphones? No one; everyone is going to continue economic hunkering down, and physical hunkering down. It will take at least a year, minimum, for nominal economic recovery. Is that priced in at current levels? I don't think so.

The historic strength of the B wave rally mirrors the historical strength of the A wave price collapse. Hence, comparisons to prior bear market corrections upward are not a basis for concluding this bear market is over. Everything is happening per a standard market market price structure, but just much more quickly and powerfully in every direction. That's my thesis until there's evidence proving me wrong.

Why is everything so much more rapid and powerful? I suspect it's the changed nature of market participants today, with so much money control by algorithms. Are most of these algorithms cognizant of the probable longer term impact on fundamentals? No, perhaps only a few extremely "intelligent" AI based ones, vs. the standard more simple mechanical (pure technical) systems. There's also reason to believe that the big institutions in the market have an excellent reason to bid this market up: that enables them to distribute at higher prices, before the REALLY bad news starts to hit. Pump and dump operates on penny stocks...and the averages.

The fire hose of money to corporate America despite management practices solely focused on short term profit and bonuses at the expense of any risk management (vast debt, aggressive buybacks, low cash reserves) absolutely creates moral hazard. There is, as in 2008, zero accountability for risk taking when you are certain that the US government will airlift in cash if things ever go belly up.

Then there are the millions upon millions of unemployed. They are getting virtually nothing. Unemployment coverage in the US is a joke, and in many states (like Florida) worse than a joke. Add in the whopping $1200 for those with incomes under $100k a year, and what do you have? Enough money to last you maybe a month, on the outside. Are food riots coming to America this Fall? It is not outside the realm of possibility.

The proper way to keep the economy as healthy as possible is stop giving money to short term profit maximization only managed corporations and give it directly to the citizens. Guess where it goes then? Right into the corporations as actual purchases, payments, real business. Cash directly to the corporations does zero to help their orders, revenues, and ultimately earnings. Last I heard, in the long run, the stock market discounts future EARNINGS. So all the manna from DC in the just keeps the corporations paying their top brass, while literally leaving the citizenry starving and the economy in shambles. It shines a very bright light on who really controls the US government, and who the US government serves fairly exclusively, and is a horribly misguided policy in terms of it's failure to systemically keep the economy running with the least pain for the citizens. In any country I want to live in, the needs of the CITIZENS come before the needs of the corporations.

Watch out for the coming C wave down, It's very close to starting now.