Trade War - Soybean Inspections

It’s very important to avoid listening to cynics who claim soybeans aren’t important. They are America’s largest export to China.

The trade war between China and American appears to be getting worse. It’s important to follow this commodity closely.

America has a mixed economy while China has a command economy. China has embraced some parts of the free market in the past couple economic cycles.

This means America needs to issue tariffs to indirectly force its private firms to stop buying Chinese products.

It’s much easier for the U.S. government to issue tariffs which say ‘you can technically still buy Chinese products, but you’ll go out of business if you do so’, than to make it illegal. That’s the type of decree the government of a country with a command economy would issue.

The tariffs are also a better negotiating tactic. It’s slowly squeezing the Chinese economy like how a snake squeezes its prey. If it became illegal to purchase Chinese goods, then there wouldn’t be many ways to threaten China. That is, outside of a traditional act of war after the law was enacted.

The reason I’m framing the discussion in this way is because China can just stop buying American products, making the tariffs meaningless.

There’s a threshold where private industries can’t buy Chinese products. That’s irrelevant if the Chinese government decides not to buy American goods anymore.

China has switched to buying Brazilian soybeans instead of American soybeans which will hurt American farmers without a high tariff being enacted.

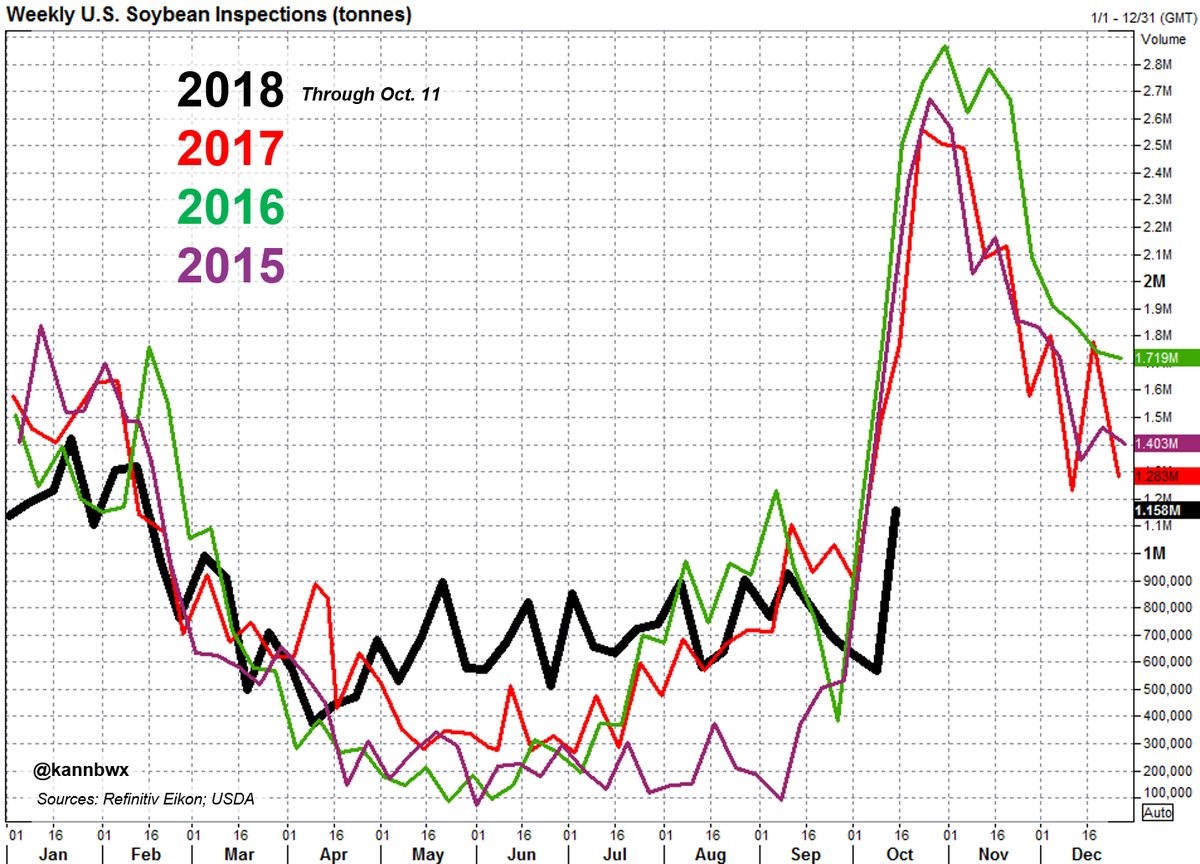

The chart below shows the soybean inspections throughout the year, going back until 2015. As you can see, inspections usually soar in October and November.

They have increased this October, but not nearly as much as the past 3 years. Two American soybean shipments to China were inspected for export last week.

Weekly exports increased to 1.158 mmt which is above the trade range of 500kt-700kt. But the inspections are usually above 2 mmt by this point in the year. There has been about a 50% decline in inspections to China.

Trade War - Lobbying On Tariffs Soars

The stock market was ignoring tariffs heading into October.

Then we had the correction which appeared to have come out of nowhere. There weren’t any news events or economic reports which came out right before the decline.

However, that doesn’t mean it was completely random. Tariffs are going to slow economic growth in 2019 which certainly should prevent stocks from rallying endlessly. That headwind could be on top of an already weakening global economy.

I don’t think the bull market is about to end. And, I don’t think the situation is as rosy as investors pictured 3 weeks ago. I am bullish on stocks in the short run. There are many indicators which suggest the market is oversold even if a bear market is coming.

That being said, I’m more neutral on stocks for the next 12 months. This is due to the points I highlighted and the hawkish Fed.

As was mentioned on the Fastenal conference call, tariffs are costing the firm money. This really eats into this cycle’s profitability growth.

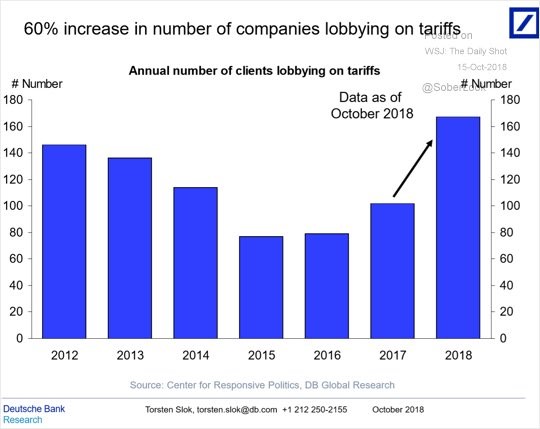

Costs caused by government policy justify spending money on lobbying. The goal is to reverse the trade war.

As you can see from the chart below, the number of companies lobbying on tariffs as of October is up over 60% from last year. I would guess the money spent is up similarly.

Unfortunately for these firms, most of what they want isn’t occurring. The deals with Mexico and Canada keep the metals tariffs in place.

There are a few firms getting what they want. And there are firms in favor of tariffs because they want to prevent Chinese dumping. It’s a big victory for American aluminum and steel companies to force users to pay more if they want to buy from the competition.

Trade War - Soaring Trade Deficit With China

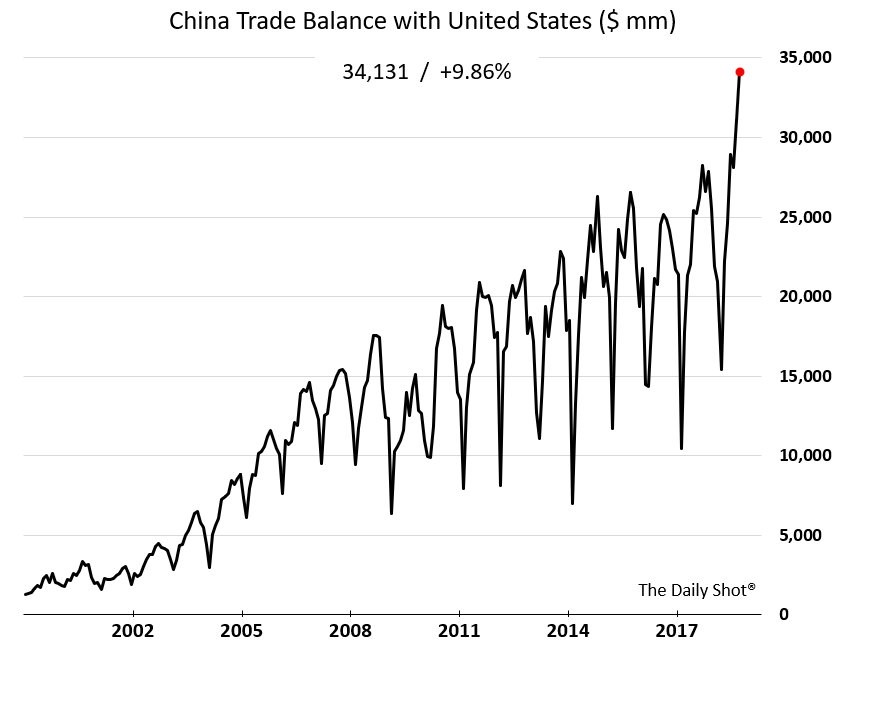

As you can see from the chart below, the trade surplus China has with America is up 9.86%.

It is soaring to new record highs because firms are getting out in front of the tariffs. That partially explains why Q2 GDP growth was so strong.

After the firms build up inventory, the buying stops as firms wait out the trade war. This is like a bear eating food to build up fat for the winter.

You can see in the first chart of this article soybean purchases from May to July 2018 were higher than the previous 3 years. Now they are much lower.

We are seeing that with American imports of Chinese goods is why the trade deficit with China has exploded. This will affect Q3 and Q4 GDP growth. Because a 25% tariff is expected to occur starting in 2019, there could be a burst of imports in December.

Trade War - Inventory Changes

Inventory will be a big catalyst of Q3 GDP growth as you can see from the chart below.

Ever since inventories were withdrawn in Q2, I anticipated inventory growth in Q3.

Since the economy is strong, it’s not a surprise to see inventory investment increasing. The bears are skeptical of inventory investment and they think investment estimates are too high. They’re skeptical because inventory doesn’t affect growth in the long run. It moves growth from quarter to quarter.

The estimates are based on the inventory reports which have come out so far.

The Atlanta Fed projection has a good track record, so I think the inventory boost to GDP growth will be near where it expects.

We’re at the point in the cycle where the GDP Nowcasts are the most accurate. There are still hard data reports from September which haven’t been released yet. The advanced Q3 GDP report will be released on October 26th. That’s Friday of next week.

Trade War - Conclusion

The next 3 months of economic reports will be a preview of what the economy will look like in 2019. That is, if the tariffs stay in place. And also if the tariff on Chinese products and services rises to 25% as threatened.

American trade with China will plummet, sending growth in both countries much lower.

The only good news is American inflation hasn’t increased yet even with tariffs and a tight labor market. It fell in the latest CPI report.

Recent Comments