XLE Unusual Option Activity Report

The Energy Select Sector SPDR Fund (NYSEARCA: XLE) gapped lower on the open yesterday as the price seemed ready to retrace following last week’s bounce. That quickly changed as Goldman Sachs raised its summer price target for oil. Their updated price target for the commodity heading into summer is now $65. The news was bullish for XLE as the price rallied into the close, bullishly engulfing Friday’s price range. While the price was responding positively, the options market was also responding in a bullish way.

Oil Inventory

After a brief spike in December, oil inventory has been looking to merge with its 5-year supply range, which is bullish for energy stock. The trend in inventories is moving counter to typical seasonal trends as supplies generally start to build this time of year.

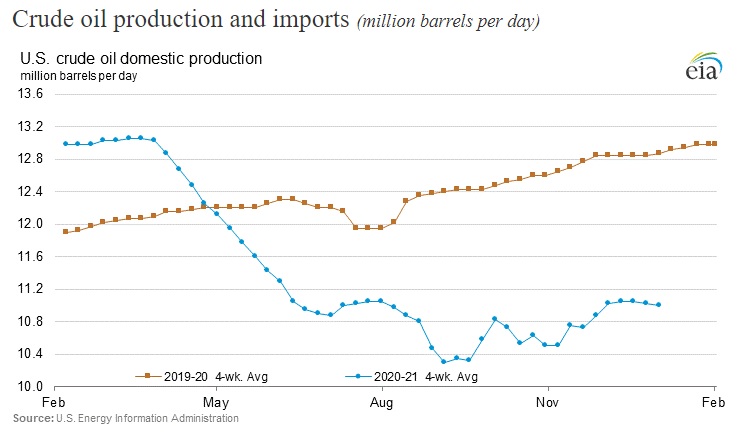

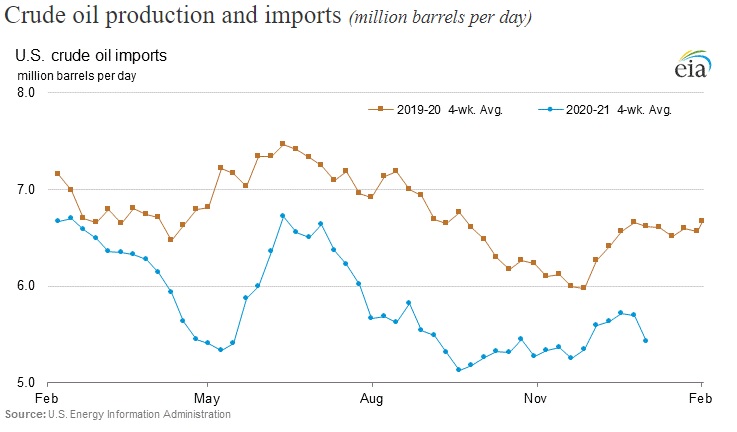

With supplies outside of the 5-year supply range, you may be wondering why the market has been bullish. One of the key drivers is the level of current production and imports. Currently, production is down nearly 2 million barrels a day.

Imports are down over 1 million barrels per day compared to 2020.

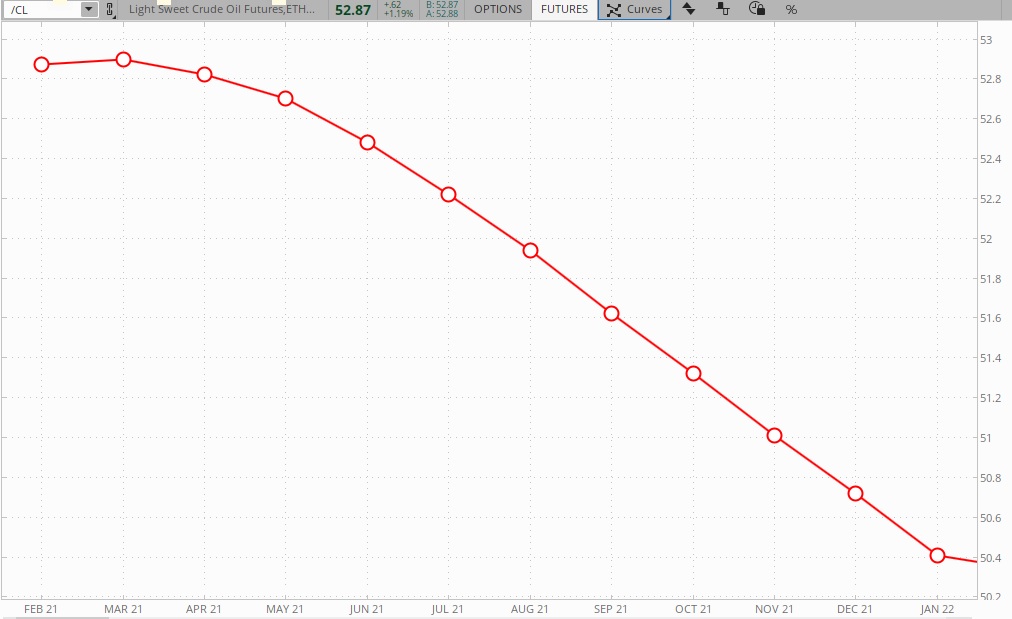

That means that a small step up in demand could push inventory levels quickly lower. These dynamics are playing out for the oil futures market as the term structure is trading in backwardation moving into the spring and summer months. The image below shows the prices for each contact for the next year. The falling prices represent an anticipated shortage heading into the summer months.

XLE Option Activity

On Monday, the call option volume on XLE was over 25% higher than average with a put-to-call ratio of 0.148. Nearly 50% of the call volume was filled at the ask, which is an indication of traders buying at market. Sifting through the option activity, there are three trades that really stood out. Here’s a summary of the option activity:

- 35,000 19 FEB 21 $45 calls BOT in one print @ $1.05 against open interest of 30,990

- 35,000 19 Feb 21 $48 calls sold in one print @ $0.44 against open interest of 12,486

- 38,130 30 JUN 21 $47 calls BOT in two prints @ $2.26 to $2.28 against open interest of 483

- 38,130 30 JUN 21 $50 calls sold in two prints @ $1.53 to $1.55 against open interest of 1,336

- 5,000 22 JAN 22 $44.50 calls BOT in one print @ $0.33 against open interest of 105

The above activity on XLE is some of the biggest and most numerous I’ve seen over the past year. The activity reflects a bullish near-term expectation with the long call vertical for February. However, it also reflects a bullish expectation heading into the summer months with the Jun long call vertical. Also, it reflects bullish expectations heading into 2022 with the January expiration.

Taking the short strike of the February call vertical on XLE gives a near-term price expectation of $48 or higher. Looking into June, the expectations is for $50 or higher.

Conclusion

While it may appear unthinkable, XLE appears ready to continue its bullish ascent into 2021, or at least the market is currently reflecting that possibility. With lower production, lower costs and a potential increase in demand heading into summer, that possibility may become the reality.

Learn how to deal with uncertain markets by learning about the Vomma Zone. Not a subscriber? Become a TheoTrade member.

2 Comments

the Goat

January 13, 2021“ The falling prices represent an anticipated shortage heading into the summer months.”

Wait, what? Doesn’t an anticipated shortage typically lead to higher prices? Lost me on that one. What am I missing?

Brandon Chapman

January 15, 2021The important thing to remember is that the forward prices don't represent future price expectations but rather the net cost of carry for commodities. If the net cost of carry is positive, then the market will be in backwardation, which reflects an implied future shortage. If you were looking at a cash settled product, like VIX futures, then the future price would reflect expectations.