Jackson Hole Speech - Stocks Gear Up

Slight Selloff As Market Awaits Jackson Hole Speech It seems like all the market cares about is Fed policy because it barely moved on Thursday even though there was a lot of economic data released, some of which I reviewed in a previous article. As I’ve discussed in previous articles, Powell is speaking at Jackson…

Markit PMI Consistent With Just 1.5% Q3 GDP Growth

Strong Leading Economic Indicators On an intermediate term basis, the Conference Board leading economic indicators report doesn’t look good, but that’s not the fault of the July monthly reading which was very strong. Specifically, it was up 0.5% monthly which beat estimates for 0.2% growth and met the high end of the consensus range. Plus,…

Hawkish Minutes Force Another Yield Curve Inversion

Hawkish Fed Minutes The Fed’s Minutes from its late July meeting were released on Wednesday. I think the Minutes were hawkish because the Fed was far from committing to more rate cuts even though as recently as this week, there was about a 50% chance of 3 more cuts by the end of the year.…

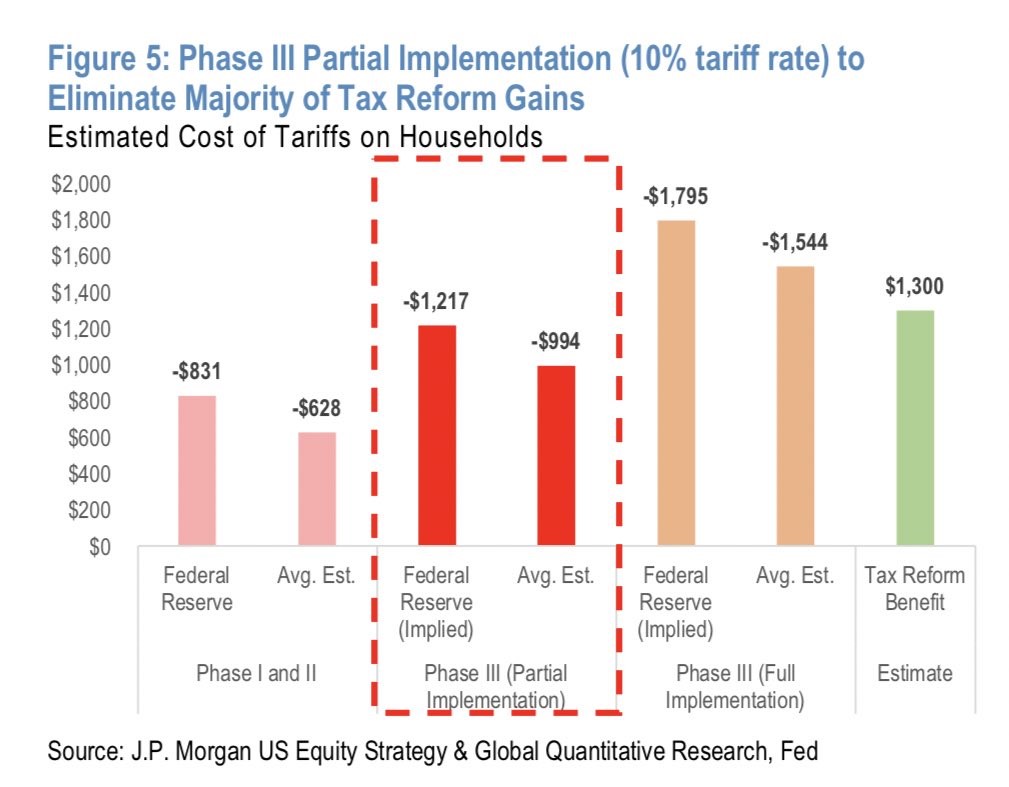

Tariffs To Hurt Consumers More Than The Tax Cuts Helped Them

Redbook Sales Growth Redbook same store sales growth in the week of August 17th was 4.9% which was a jump from 4.4%. This means August’s retail sales growth is tracking at a slightly lower, but still strong pace, as compared to July. This is prime shopping time for the back to school season. Each week’s data…

Trade Weighted Dollar Hits A Record High

Stock Market Ends 3 Day Winning Streak The stock market ended its 3 day winning streak as the S&P 500 fell 0.79% on Tuesday. In the past few corrections we have seen a sharp downturn, a smaller sharp upturn, then a retest of the low, and then a gradual rally until the market hits new…

Recessionary Warning - The Yield Curve Is The Only One

Yield Curve Only Indicator Showing Recession Before you get scared of the yield curve predicting a recession, look at the other indicators. If it wasn’t for the trade war, it’s possible the manufacturing sector wouldn’t be contracting. Without the trade war, it would be clear to most there’s little risk of a U.S. recession in…

Overblown Recession Fears As Stocks Continue To Recover

Stocks Reverse Recession Worries The only economic report that came out on Monday was quarterly e-commerce retail sales. It showed similar results to the July retail sales report. The category is on fire as quarterly growth improved from 3.6% to 4.2% in Q2. Yearly growth was 13.3%; e-commerce grew 0.2% to 10.7% of total retail…

Recession Fears Spike (Probably Too Much)

Recessionary Fears Catapult Higher Every stock market correction prices in some recession fears. It’s normal to expect an uptick in expectations for a recession after declines. The larger the decline, the more fear ramps up. A prime example was late last year when stocks fell 20%. This latest correction is different because the 10-2 year…

Volatile Week Ends With Stocks Gains

Stocks End The Week On A Positive Note The S&P 500 was up 1.44% on Friday, but it still closed down 1.03% for the week. The chart below shows the volatile action and the reversals throughout the week. The 2.93% decline on Wednesday sunk stocks for the week. The S&P 500 is down 4.53% from…

Manufacturing Sector - Now Contracting

Model Of ISM Manufacturing PMI Based on the rate of change of the recent manufacturing data, it’s clear manufacturing is falling into a contractionary phase. This won’t be one or 2 weak readings. It will be a manufacturing recession like 2015-2016. However, that call won’t generate alpha because it is the consensus at this point.…

Recent Comments