Buybacks & Dividends Cut - Stocks Aren’t A Great Bet

Earnings Estimates Are Now Realistic 2020 EPS estimates have fallen so much that they are now realistic. Bad news is based on 2020 estimates, the stock market is expensive. Specifically, the 2020 EPS estimate fell from $178.96 at the start of the year to $132.75. That means the current S&P 500 PE ratio is 21.94.…

Are the Sellers Back?

Sellers are very much coming back into this marketplace. However, there is a much larger take on the whole situation. It's important to slow down and take careful steps in this chaos, instead of rushing right into a burning fire. The short answer is, yes, there are plenty of underlyings and opportunities for retail traders,…

Active Investors Chased The Market Higher

Investors Got Too Positive On Wednesday It’s pretty obvious investors were euphoric on Wednesday to any observers of the market. Even if you are bullish like me, you know the market got ahead of itself. Nasdaq was almost positive year to date. Now it’s time for a pullback. We started the decline on Thursday with…

Unemployment Rate Might Be 23.8%

Jobless Claims Fall Again Some traders decided that the stock market always rallies on Thursday because it seems like the stock market likes high jobless claims in the near term. They believed that because stocks would have been on a long Thursday winning streak if it wasn’t for the Gilead news last Thursday. As you…

Apple, Amazon, Earnings and What they Mean for the Market

As of this video, Apple and Amazon's earnings reactions went in opposite directions but we're continuing to watch the ongoing reaction and how it plays into Friday's trades. In tonight's video, Corey updates the key SP500 level in play right now along with how major stocks - including AMZN and AAPL - are likely to…

Stocks Explode to New Bear Market Heights

Huge Rally To New Bear Market Highs It’s tough to quantify what we are seeing in markets. It’s a mixture of extreme euphoria and extreme pessimism. That makes no sense, but we are in unprecedented times. To further explain, almost everyone thinks the stock market is expensive, yet the action has been remarkably bullish. Many…

GDP Sinks & Fed Stays Dovish

Q1 GDP Growth Was Bad & Q2 Will Be Worse Q1 GDP report showed -4.8% growth which missed estimates for -3.7%. 2.25% of the decline actually came from healthcare because elective surgeries were delayed. This is the worst growth since the last recession as the chart below shows. The chart also includes Oxford Economics’ Q2…

A Market in Denial?

Lots of market activity today. The FOMC announcement was no surprise and had no impact on markets. Good news about an effective drug to treat covid-19 sent the market higher. Then after the close good earnings announcements from FB, MSFT, and TSLA sent markets even higher. The IWM ratio and QQQ vs IWM pairs trade…

Optimism About A Potential Reopening Of The Economy Can’t Be Contained

Stealth Rally In Stocks The stock market is forward looking. It has been rallying on the decline in new COVID-19 cases, stimulus, and the expected end to the shutdowns. This index has been helped in the past few weeks by the fact that the companies the least hurt/helped by this shutdown are huge components. We…

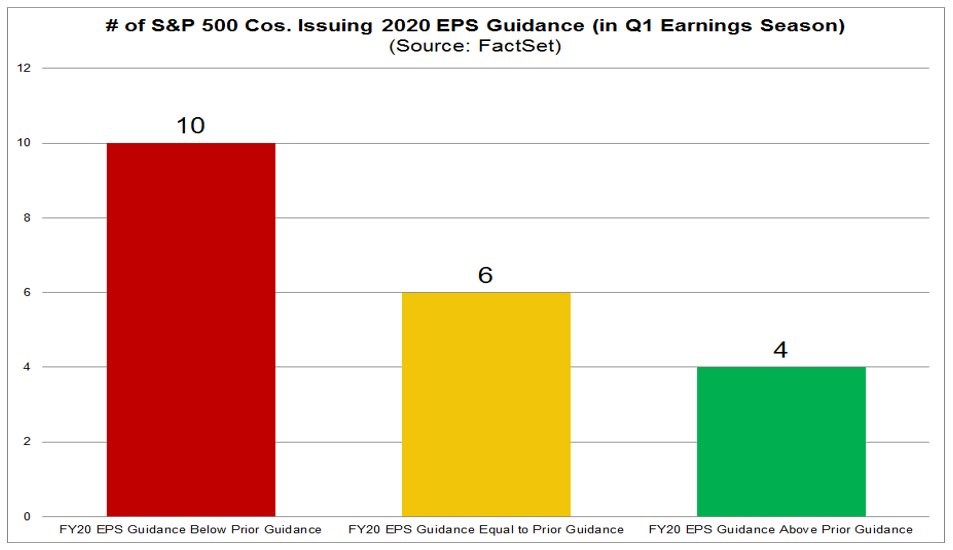

Any Guidance Is Good Guidance

Weak Earnings Guidance In a shock to no one on the planet, Q1 earnings season has been weak and guidance has been mostly non-existent. The situation is so unusually negative that when a company reports earnings and gives disappointing guidance, it’s a positive because at least there was guidance. We saw that play out with…

Recent Comments